TIDMDNLM

RNS Number : 7486J

Dunelm Group plc

14 September 2016

14 September 2016

Dunelm Group plc ("Dunelm")

Preliminary Results for the 52 weeks to 2 July 2016

Delivering on our plans and increasing sales, profits and

dividends

Dunelm Group plc, the UK's leading homewares retailer, today

announces its preliminary results for the 52 weeks to 2 July

2016.

Financial summary

The comparative period represented 53 weeks; therefore, to aid

comparability, results for the 52 week period to 27 June 2015 are

also presented.

52 weeks 53 week 52 weeks Year on

ended 2 ended ended 27 year change

July 2016 4 July June 2015 (52 weeks)

2015

---------------------- ----------- ---------- ----------- -------------

Total revenues GBP880.9m GBP835.8m GBP822.7m 7.1%

---------------------- ----------- ---------- ----------- -------------

Like-for-like

growth +2.5% +5.8% -

---------------------- ----------- ---------- ----------- -------------

Gross margin 49.8% 49.2% 49.2% +60bps

---------------------- ----------- ---------- ----------- -------------

Operating profit GBP129.3m GBP122.5m GBP121.3m +6.6%

---------------------- ----------- ---------- ----------- -------------

Profit before

tax GBP128.9m GBP122.6m GBP121.4m +6.2%

---------------------- ----------- ---------- ----------- -------------

Basic EPS 50.5p 47.5p 47.0p +7.4%

---------------------- ----------- ---------- ----------- -------------

Fully diluted

EPS 50.3p 47.3p 46.8p +7.5%

---------------------- ----------- ---------- ----------- -------------

Ordinary dividends 25.1p 21.5p +16.7%

---------------------- ----------- ---------- ----------- -------------

Special distribution 31.5p 70.0p

---------------------- ----------- ---------- ----------- -------------

Total distribution 56.6p 91.5p

---------------------- ----------- ---------- ----------- -------------

Free cash flow(1) GBP110.4m GBP87.0m +26.9%

---------------------- ----------- ---------- ----------- -------------

(1) defined as net cash from operating activities less cash

utilised in investing activities

Highlights

-- Another strong year, maintaining our record of growing sales

and profit every year since IPO in 2006

-- Continued delivery across all three areas of the growth

strategy:

o In-store like-for-like growth of 1.0% (52 week basis);

o 23.2% growth in home delivery sales (52 week basis), now

accounting for 7.0% of total revenue (FY15: 6.1%);

o Six new openings in the year (including two relocations),

increasing footprint to 152 superstores; nine new stores

contractually committed.

-- Progress on eight key initiatives to support the growth

strategy and to build a world class operating model in a low cost

environment:

o New warehouse opened in Stoke, doubling capacity and providing

cost reduction opportunities

o Improved productivity within stores to reinvest into helping

customers, improving service, driving sales and to mitigate the

cost of introducing the National Living Wage

o Reduction in stock holding by GBP16.5m (12.4%) through

improved retail disciplines

-- Strong free cashflow, up 26.9% to GBP110.4m

-- Special distribution during the period of 31.5p per share

(GBP63.8m)

-- Recommended final dividend of 19.1p per share (FY15: 16.0p),

increasing the full year dividend to 25.1p (FY15: 21.5p), an

increase of 16.7% for the full year

John Browett, Chief Executive, commented:

"The business has performed well over the year. Shoppers tell us

that they genuinely appreciate the unrivalled depth and value of

the Dunelm homewares offer. This has meant we have further cemented

our leading position through market share gains, driving sales and

profits growth, and increasing returns to shareholders, including a

16.7% increase in total ordinary dividends and a special

distribution of 31.5p per share.

"My first year as Chief Executive has been extremely busy and

we're working hard on initiatives across the business. Not least,

we are investing in our stores to make them much easier to shop,

whilst making sure our vast range of product maintains the value

for money proposition which lies at the very heart of the Dunelm

offer.

"We remain particularly focused on extending the Dunelm offer to

more customers and have opened six new superstores in the year.

This will be ramped up in the current year with nine planned

openings, three of which are in the London area where we are

excited by the clear opportunity for growth.

"We continue to outperform the homewares market, and despite

potential challenges to the economy over the coming months and the

dampening effect on footfall of recent hot weather, we believe that

Dunelm's competitive position can come into its own, and are

confident of continuing to deliver our growth ambitions."

There will be a presentation for analysts at 9.30am this morning

at UBS, 100 Liverpool Street, London EC2M 2RH. If you have not

already registered for attendance then please contact Isabelle

Grainger at MHP Communications on isabelle.grainger@mhpc.com.

A conference call will be held for those who are unable to

attend. Please preregister using the link below and allow plenty of

time to dial in

https://cossprereg.btci.com/prereg/key.process?key=PQQF9LKGJ

For further information please contact:

Dunelm Group plc 0116 2644439

John Browett, Chief Executive

Keith Down, Chief Financial Officer

MHP Communications 020 3128 8100

John Olsen / Simon Hockridge / Gina dunelm@mhpc.com

Bell

For photography, please contact MHP Communications

Notes to Editors

Dunelm is market leader in the GBP11.6bn UK homewares market.

The Group currently operates 157 stores, of which 152 are

out-of-town superstores and five are located on high streets. There

is also an online store, to be found at www.dunelm.com.

Dunelm's "Simply Value for Money" customer proposition offers

industry-leading choice of quality products at keen prices, with

high levels of availability and supported by friendly service. Core

ranges include many exclusive designs and premium brands such as

Dorma, and are supported by a frequently changing series of special

buys. The superstore format provides an average of 30,000 sq. ft.

of selling space with over 26,000 products across a broad spectrum

of categories, extending from the Group's home textiles heritage

(bedding, curtains, cushions, quilts and pillows) to a complete

homewares offer including kitchenware and dining, lighting, wall

art, furniture and rugs. Dunelm is one of the few national

retailers to offer an authoritative selection of curtain fabrics on

the roll, and owns a specialist UK facility dedicated to producing

made-to-measure curtains.

Dunelm was founded in 1979 as a market stall business, selling

ready-made curtains. The first shop was opened in Leicester in 1984

and over the following years the business developed into a

successful chain of high street shops before expanding into broader

homewares categories following the opening of the first Dunelm

superstore in 1991.

Dunelm has been listed on the London Stock Exchange since

October 2006 (DNLM.L) and has a current market capitalisation of

approximately GBP1.8bn.

CHAIRMAN'S STATEMENT

I am pleased to report another year of good progress for Dunelm.

On a consistent 52-week basis, we grew our total sales by 7.1%,

driven by the opening of six new stores, 1% growth in our

like-for-like store sales and 23.2% growth in our home delivery

sales. We converted this revenue growth into 6.2% growth (5.1%

growth on a 53-week basis) in pre-tax profits and 7.5% growth (6.3%

growth on a 53-week basis) in earnings per share, notwithstanding

our sustained investment in the business.

This profit growth, coupled with strong cash flow, allows us to

propose a 19.4% increase in the final dividend, which would

increase the full year dividend by 16.7%. In addition, we paid a

special dividend of 31.5 pence per share during the year, bringing

the total dividend proposed for the year to 56.6 pence per share,

some GBP115m in shareholder distributions. In view of the scale of

the special dividends in recent years, the Board has refined our

dividend policy to provide a slightly higher ordinary dividend

pay-out ratio, the details of which are included in the Chief

Financial Officer's report.

Dunelm has become the UK's leading homewares retailer by

offering customers an unrivalled proposition through our national

network of 152 superstores and website, providing an extensive

choice of good quality, great value products, backed up by the

knowledge and expertise of nearly 9,000 colleagues. Let me thank

all our colleagues for their tremendous contribution to our

continuing success. We really appreciate their hard work and

dedication.

Our Chief Executive, John Browett, describes in the following

report the key initiatives which our teams are implementing to

further strengthen our business and support future growth. These

initiatives, which represent a considerable investment in the

business, include exciting new store designs, investment in our

online shop and its supporting infrastructure, and improved supply

chain and warehousing which will improve product availability and

efficiency. In addition, we shall continue to invest in our people

with increased training and talent development programmes. In

short, we aim to give our customers even more reasons to shop at

Dunelm and to make Dunelm a better place for our colleagues to

work.

We have successfully navigated a year of considerable change in

our Board, with John Browett formally taking the CEO reins in

January 2016, Keith Down becoming our new CFO in December 2015 and

two new Non-Executive Directors, William Reeve and Peter Ruis,

joining our Board. John has also strengthened our Executive team

with a number of new appointments, which are central to delivering

our plans. We are pleased to have brought in strong new leadership

whilst maintaining Dunelm's distinct business principles and

culture, which have sustained our growth since the business was

founded by Bill and Jean Adderley in 1979. We are proud of our

culture which is exemplified by our Deputy Chairman, Will

Adderley.

The competitive landscape in retail continues to change at a

fast pace with the growth of new competition, especially online.

Our operating model has allowed us to gain market share in times of

uncertainty, and post-Brexit, we are confident the same

opportunities exist now. We have ambitious plans to continue to

grow our business and we intend to grasp the opportunities to

further strengthen our competitive position. We remain confident in

the Dunelm proposition and look forward to reporting further

progress.

Andy Harrison

Chairman

14 September 2016

CHIEF EXECUTIVE'S REVIEW

One of the great things about Dunelm is that we are able to

offer tremendous value for money for our customers and an

unrivalled range whilst remaining a low cost retailer. In the last

year we have continued to strengthen our offer and expand our store

base, allowing us to further increase market share and enhance our

market leading position. We are confident that our ambitious plans

will bring further improvements for customers and underpin our

prospects, even if the market proves to be difficult.

Customers love what we do: our wide product ranges are suitable

for all budgets and tastes. Our prices are always competitive or

market leading. We have fantastic colleagues in our stores, in the

supply chain and our support centre who give great service. We have

high on-shelf availability in-store and online. Indeed, our offer

is unmatched by our competitors.

Our low cost model is a critical part of making our business

work for customers. Our store costs are low because we have built a

network of stores that work for customers but have been rented on

sensible terms. We have modern IT systems that are cost effective

and easy to upgrade. By running a defined contribution pension

scheme we have clear costs and no legacy liabilities. We always

endeavour to run a lean operation so we can invest more in lower

prices and better products.

Last year, we continued to improve the shopping trip for our

customers. We have improved our ranges, have become more

competitive on price, made our stores easier to shop and launched a

vastly improved website. I think almost all our customers have

noticed the work we have done to clear the aisles, put the product

back into logical places and run our promotions much more tightly

and effectively. These may seem like small things, but through

customer feedback we know they make a major difference.

The improvements in the customer offer are paid for by running

our business more effectively. We continue to work on developing

our IT platform to provide more efficient processes as well as a

better customer experience in-store and online. Our internal "Keep

it Simple" programme looks at activity in our head office to ensure

that we are eliminating unnecessary work or improving broken

processes. Last year, we invested heavily in our logistics

infrastructure to enable better customer service at lower costs in

the future. The store teams have also made great progress in

simplifying their operation to free up hours to serve

customers.

In the year ahead it may be that the economy proves to be

difficult. However, even if there are short term problems, life

continues and for a business like Dunelm this is almost sure to

bring new opportunities. Our 'Simply Value for Money' proposition

becomes even more appealing if consumers feel under financial

pressure. In addition, our business is not significantly reliant on

big-ticket purchases; our average basket size remains around

GBP30.

Dunelm is a strong business due to the level of profit and cash

flow generated, combined with its low leverage, even including our

lease liabilities. None of that changes because of Brexit. Indeed,

in uncertain times our strengths become even more of an advantage.

It should mean that we can expand faster and offer even more to our

customers.

At the end of my first year, I'd like to express what a

tremendous privilege it is to work with all of our colleagues at

Dunelm and I want to thank them for all their effort, enthusiasm

and dedication to making Dunelm a great place to shop and work. It

is hard to get everything right every day, but it is both

pleasurable and rewarding to find a company which is always trying

to do the right thing.

Growth Strategy

When we reported our half year results in February, we

reiterated our commitment to our three-part growth strategy;

growing like-for-like sales, rolling out new stores and growing our

home delivery channel. We also identified eight key initiatives

that I believe will enable us to achieve this and will be the key

method by which we improve our business substantially for our

customers and shareholders over the medium term.

Online

Whilst we continue to work towards increasing our store estate

to 200 stores, we still believe in a multi-channel world for

homewares and continue to see online as a critical part of our

shopping trip.

We are working on making our website easier to access; for

example allowing customers to browse and order in-store. We want to

make the range and relevant content broader and provide an improved

site experience. We also want to provide greater convenience

through an increase in collection points, times and

availability.

We have also made progress in multiple other areas. The

integration of our one-man fulfilment process into our Stoke

distribution centre is a significant step towards broader

fulfilment options. We have grown our email database to over two

million customers, an increase of 18%. We have an online Made to

Measure service, and are building a more comprehensive solution,

due to be launched later this year.

Over the coming year, we are looking to extend our range through

a new DSV (drop shipped vendor) service. We are also rolling out

tablet devices and associated chip and pin payment options in-store

and are working towards a full Click and Collect service.

London

As part of our challenge to find 50 new stores to reach our 200

target, we recognise that London and the South East will provide a

significant proportion of this opportunity.

Encouragingly, we have legally committed to nine new stores in

the coming year, of which three are within the M25; an excellent

result given that we have only eight stores currently in this

area.

We are also focussing on improving the capability of our

colleagues in the region and will be looking to increase our online

participation in London, aided by the increased store presence.

Store Operations

We have reviewed all activities carried out in-store and found

several opportunities to help our colleagues work more effectively.

As a result, we have reduced hours worked on certain tasks in the

business, partially to mitigate the cost of introducing the

National Living Wage, but more importantly to reinvest back into

helping customers, improving service and driving sales.

We see this as a continual process, with several rounds of

improvements that will allow us to continue to reinvest in wages

and service.

Store Format

Our customers love our stores, but they do tell us that we could

make them easier to shop, particularly in terms of navigation and

making our displays more attractive.

We are trialling several new category merchandising initiatives,

and are particularly pleased with the work that we have done around

rugs, lighting and the till area. We will continue to roll these

out across the estate in the coming year.

We also continue to improve the store format design as we open

new stores. Our recent openings in Nottingham and Sheffield in

particular reflect a lighter, more open environment with lower

shelving and easier navigation. We are aiming to refit around 15

stores in FY17 in this new format, as well as using the format in

our new store openings.

Made to Measure

Made to Measure is a service that differentiates us from most of

our competitors. We manufacture the majority of our curtains

ourselves and offer great value for money.

We are trialling new operations in-store and developing a

greater understanding of how investment in service, presentation

and range can enhance our offer. We are looking to improve our

manufacturing performance by creating more efficiency in our

processes. We are also working on a new IT system to manage

customer orders and make things easier for customers.

Furniture

Dunelm continues to develop its furniture offer across all

channels. We are working hard to deliver new ranges, with better

quality and greater choice. We are trialling new formats in-store

using room-sets and new ways to display products. We are also

working on an improved service model and our new POS system will

help our colleagues to sell our entire range in-store.

Supply Chain

We have successfully opened our new warehouse in Stoke, which

doubles our capacity and provides a purpose built platform for

reducing costs over time. We are correspondingly reducing our third

party storage requirements which are costly and inefficient.

We are near the end of the process of moving our one-man

delivery operation into Stoke, which is a precursor to moving to a

click and collect offer. This will enhance the attractiveness of

our online offer by providing greater choice and ease to

customers.

We will look to further integrate our e-commerce and

direct-to-store distribution over time. This will enable improved

availability, productivity and a cleaner end of season

clearance.

Stock Management

To meet customer expectations, we rely on having full ranges

available in-store which previously resulted in a high stock

holding. We are working towards reducing the amount of stock that

we hold whilst improving availability. This will make us more

efficient and enable us to reinvest in the customer offer.

We have reduced our stock holding by GBP16.5m (12.4%) during the

course of the year by focussing on sensible retail disciplines such

as reducing minimum order quantities, reducing pack sizes and

through the better use of order replenishment systems. In-store we

have focused on better stock management, both on shelf and back of

house, by enhancing stock control processes.

Although we believe we can reduce stock levels further in time,

we consider this to be business as usual and stock management will

therefore no longer form one of our strategic initiatives in

FY17.

Product

Great product is the lifeblood of our business. We have started

work on a new strategic initiative (replacing stock management) to

further improve our product ranges. We see major opportunities in

product design, innovation and sourcing.

The work on product should enable us to grow by appealing to a

broader set of customers across more categories. Our sourcing work

should also improve our value for money proposition.

Enablers

While our key initiatives are the focus for improving the

business for customers, there are several initiatives we are

working on to make the business more effective. This work ranges

from 'Keep it Simple' changes in the Store Support Centre and

Contact Centre, to developing our IT systems to support the key

initiatives and customer offer. We could also talk at length about

the use of better customer insight, service and sales training in

stores and investment in skills and training across the

company.

At Dunelm we are always looking for opportunities and working on

making our business better for customers and a more fulfilling

place to work. The agenda is always ambitious.

Outlook

Whatever the market brings us, our strategy remains unchanged.

Indeed, we may be able to achieve more in a difficult economy. We

can't forecast what will happen to the broader market but we know

we will be busy improving our company, through our self-help

initiatives and also by continuing to roll-out and reinvest in our

stores.

As we have seen in previous years, hot weather can have a

dampening effect on footfall, so the start to the new financial

year has inevitably seen some impact here. However, the weather is

outside of our control and our job is to trade through such

periods.

Encouragingly, we believe that we continue to outperform the

homewares market as a whole and therefore are confident of

continuing to deliver on our growth ambitions, including new store

openings which should number at least nine this year. We have the

key infrastructure in place, the right team, a great heritage and a

continued focus on product and people.

John Browett

Chief Executive

14 September 2016

CHIEF FINANCIAL OFFICER'S REVIEW

The year ended 2 July 2016 was a 52 week accounting period but

the comparative year ended 4 July 2015 was a 53 week accounting

period. The additional 53rd week last year contributed GBP13.1m of

revenue and GBP1.2m of operating profit. Unless otherwise stated,

reference to 2015 or the comparative year relates to this 53 week

period.

Revenue

Group revenue for FY16 was GBP880.9m (FY15: GBP835.8m), an

increase of 5.4% for the full financial year and 7.1% on a 52 week

basis. Like-for-like ('LFL') sales grew by 2.5% on a 52 week basis

as a result of growth in both in-store LFL sales (+1.0%) and Home

Delivery sales (+23.2%). Over the financial year as a whole, Home

Delivery sales represented 7.0% of total business (FY15: 6.1%).

Our store expansion programme continued with six new openings in

the year (of which two were relocations). We also closed our high

street store in Coalville leaving a portfolio of 152 superstores

and five stores in high street locations.

Gross Margin

Gross margin increased by 60 basis points to 49.8% (FY15:

49.2%). Gross margin in FY15 was impacted by a high level of

markdown needed to clear excess stocks (particularly furniture). In

FY16, however, we improved our product life cycle management, stock

turn and absolute stock levels. We also benefitted from cost

reductions due to increasing scale and a small increase in direct

sourcing to 21%.

Operating Costs

Operating costs in FY16 grew by 7.1% compared with the prior

year, an increase of GBP20.5m, or by 9.1% on a 52 week basis, an

increase of GBP25.7m. The main drivers of this increase were:

-- Store portfolio growth - six new store openings and two closures;

-- Multi-channel fulfilment - the value of business through this

channel rose by 23.2% compared with the previous year;

-- Warehousing infrastructure - we invested GBP3.0m in

transition costs associated with the opening of our new

Distribution Centre ('DC') in Stoke. This DC will significantly

increase our ability to deliver multi-channel fulfilment operations

and negates the need to operate additional third party storage

facilities;

-- Store labour - the increase in the National Living Wage has

been offset by productivity savings;

-- IT capability - recognising the importance of IT in our

business, we have again significantly increased the scale and

capability of our internal IT function. We have also seen the first

year of amortisation relating to our web re-platform;

-- Marketing - increased spend on digital marketing to replace

loss of natural search following web re-platform; and

-- Administration - we have invested in the Board and Executive

team to support the continued growth of the business.

Looking ahead, a number of these cost drivers will continue to

apply in the new financial year as we open new stores, look to

refit 15 stores into our new format, grow our home delivery

business further and continue to invest in IT and management to

support our key initiatives.

Operating Profit

Group operating profit for the financial year was GBP129.3m

(FY15: GBP122.5m), an increase of GBP6.8m (5.6%). On a 52 week

basis operating profit increased by GBP8.0m, an increase of 6.6%.

Operating profit margin was 14.7% (FY15: 14.7%). In the year the

business invested in operating costs (described above) to enhance

key infrastructure and capabilities to deliver future growth.

EBITDA

Earnings before interest, tax, depreciation and amortisation

were GBP154.3m (FY15: GBP144.2m, GBP142.6m on a 52 week basis).This

represents an increase of 7.0% on the previous financial year, or

8.2% on a 52 week basis. The EBITDA margin achieved was 17.5% of

sales (FY15: 17.3%). FY15 EBITDA margin on a 52 week basis was

17.3%.

Financial Items

The Group incurred a net financial expense of GBP0.4m in FY16

(FY15: GBP0.1m income). Interest and amortisation of costs arising

from the Group's revolving credit facility amounted to GBP1.6m

(FY15 GBP0.7m). These costs were partially offset by interest

earned on cash deposits GBP0.2m (FY15: GBP0.5m) and gains of

GBP1.0m (FY15: GBP0.3m) resulting from foreign exchange differences

on the translation of dollar denominated assets and

liabilities.

As at 2 July 2016 the Group held $90.5m (FY15: $91.5m) in US

dollar forward contracts representing approximately 61% of the

anticipated US dollar spend over the next financial year. Surplus

US dollar cash deposits amounted to $1.6m (FY15: $3.2m).

Profit before Tax

After accounting for interest and foreign exchange impacts,

profit before tax for the financial year amounted to GBP128.9m

(FY15: GBP122.6m), an increase of 5.1%. On a comparable 52 week

basis this represents an increase of 6.2% over FY15.

Taxation

The tax charge for the year was 20.6% of profit before tax,

compared with 21.6% in the prior year. This reflects the reduction

in the headline rate of corporation tax from 20.75% in FY15 to

20.0% this year. The tax charge is expected to trend approximately

75-80 bps above the headline rate of corporation tax going forward,

principally due to depreciation charged on non-qualifying capital

expenditure.

Profit after Tax and EPS

Profit after tax was GBP102.3m (FY15: GBP96.1m), an increase of

6.5%.

Basic earnings per share (EPS) for the 52 weeks ended 2 July

2016 was 50.5p (FY15: 47.5p), an increase of 6.3%. Fully diluted

EPS increased by 6.3% to 50.3p (FY15: 47.3p). This is a rise of

7.5% on a comparable 52 week basis (FY15 52 week: 46.8p).

Operating Cash Flow

Dunelm continues to deliver strong cash returns. In FY16 the

Group generated GBP148.2m (FY15: GBP118.2m) of net cash from

operating activities, an increase of 25.4%.

Year-end working capital decreased by GBP18.3m compared with the

previous year-end. This reflects our drive to improve product life

cycle management and increase stock turn. At the end of the year

the Group had GBP16.5m lower inventories than the prior year

despite the investment in new stores. Trade and Other Payables due

within one year increased by GBP7.4m primarily as a result of an

increase in the capital creditor as a result of the completion of

our new DC in Stoke at the end of the year.

Capital Expenditure

Gross capital expenditure in the financial year was GBP42.5m

compared with GBP31.5m in FY15. Significant investments were made

in the opening of our second distribution centre in Stoke

(GBP11.9m), IT infrastructure (GBP7.2m) and in acquiring the

Fogarty brand (GBP4.8m). In addition we invested GBP18.0m in the

continued growth and development of the store portfolio with the

addition of six new superstores and seven major refits.

We expect higher capital expenditure in the next financial year

of approximately GBP50m to support the business' growth strategy.

We expect to open more new stores (requiring an average investment

of GBP1.2m per store), we plan to carry out a number of major store

refits (approximately GBP20m in total), and will continue to invest

in IT systems development (estimated at GBP6m) and supply chain

improvements (estimated at GBP5m). We will also consider freehold

store acquisitions on an opportunistic basis, with FY17 having

already seen the purchase of a freehold property in Shoreham for

GBP5.5m.

Banking Agreements and Net Debt

The Group has in place a GBP150m syndicated Revolving Credit

Facility ('RCF') which matures in 2020. The terms of the RCF are

consistent with normal practice and include covenants in respect of

leverage (net debt to be no greater than 2.5× EBITDA) and fixed

charge cover (EBITDA to be no less than 1.5× fixed charges), both

of which were met comfortably as at 2 July 2016.

In addition the Group maintains GBP20m of uncommitted overdraft

facilities with two syndicate partner banks.

Net debt at 2 July 2016 was GBP79.3m (0.51x historical EBITDA)

compared with GBP73.6m in FY15 (0.51× historical EBITDA). Daily

average net debt in FY16 was approximately GBP50.0m. This compares

with an average of GBP75.4m in FY15 from the date of the special

distribution (20 March 2015) following the inception of our

RCF.

Capital and Dividend Policy

During FY15, the Board adopted a new policy on capital

structure, targeting an average net debt level (excluding lease

obligations and short-term fluctuations in working capital) of

between 0.25× and 0.75× historical EBITDA. This policy provides the

flexibility to continue to invest in the Group's growth strategy

and to take advantage of investment opportunities as and when they

arise, for example freehold property acquisitions. At the year end,

net debt/EBITDA was 0.51× (FY15: 0.51× ).

The Board's policy on dividends in FY15 was that ordinary

dividend cover (by which we mean the Group's earnings per share

divided by the total amount paid to shareholders by way of ordinary

dividend) should be between 2 and 2.5x in the full year in respect

of which the dividend is paid. The Board has decided to move the

targeted range of dividend cover to a range of 1.75 and 2.25x,

reflecting the strong cash generation in the business and the

Board's confidence in the growth prospects of the business.

The Board will consider further special distributions in the

future if average net debt over a period consistently falls below

the minimum target of 0.25× EBITDA, subject to known and

anticipated investment plans at the time.

The Group's full capital and dividend policy is available on our

website at www.dunelm.com.

Dividend and Special Dividend Paid

Reflecting the capital and dividend policy, an interim dividend

of 6.0p per share was paid in March 2016 (FY15: 5.5p). It is

proposed to pay a final dividend of 19.1 per share (FY16: 16.0p),

subject to shareholder approval. The total dividend of 25.1p

represents an increase of 16.7% over the previous year, giving a

dividend cover of 2.0× (FY15: 2.2×). The final dividend will be

paid on 25 November 2016 to shareholders on the register at the

close of business on 4 November 2016.

During the year, the Group returned excess capital of GBP63.8m

(31.5p per share) to shareholders in the form of a special

dividend.

In total the Group returned GBP108.4m to shareholders by way of

dividend in the year, the equivalent of 53.5p per share.

Distributable Reserves

During the current financial year, the Group undertook a capital

restructuring exercise which facilitated the payment of dividends

from subsidiary undertakings to Dunelm Group plc of GBP359m.

Consequently the parent company has retained earnings of GBP242.8m

as at 2 July 2016.

Share Buy-back

During the year, the Group invested GBP7.8m to buy 841,359

shares to hold in treasury in line with its policy to purchase

shares in the market to satisfy the future exercise of options

granted under incentive plans and other share schemes. At the

year-end, 846,455 shares were held in treasury, equivalent to

approximately 42% of options outstanding. Over time, we expect to

increase our holding in treasury to be equivalent to approximately

60% of outstanding options.

Since the year end GBP4.2m has been invested to purchase an

additional 500,000 shares into treasury.

Tax Policy

The Group has a straight forward and transparent tax policy. The

aim is to comply with all relevant tax legislation and pay all

taxes due, in full and on time as well as actively managing tax

affairs and only to engage in tax planning where this is aligned

with commercial and economic activity and does not lead to an

abusive result. We would normally expect our corporation tax charge

to be higher than the statutory tax rate. HMRC has recently renewed

the Group's low-risk tax status. Further details of the Group's tax

policy are available on our website, www.dunelm.com.

During the year, total tax contributions paid to HMRC during the

year in the form of corporation tax, property taxes, PAYE and NIC's

and VAT were GBP140.8m (FY15: GBP122.7m).

Treasury Management

The Group Board has established an overall Treasury Policy,

day-to-day management of which is delegated to me as Chief

Financial Officer. The policy aims to ensure the following:

-- Effective management of all clearing bank operations

-- Access to appropriate levels of funding and liquidity

-- Effective monitoring and management of all banking covenants

-- Optimal investment of surplus cash within an approved risk/return profile

-- Appropriate management of foreign exchange exposures and cash flows

Key Performance Indicators

In addition to the traditional financial measures of sales and

profits, the Directors review business performance each month using

a range of other KPIs. These include measures shown below:

Sales growth

2016 * 7.1%

------------------------------------------- ----------

2015 * 12.7%

2014 7.8%

------------------------------------------- ----------

Like for like store sales growth

2016 * 1.0%

------------------------------------------- ----------

2015 * 3.4%

2014 -0.2%

------------------------------------------- ----------

Home delivery sales growth

2016 * 23.2%

------------------------------------------- ----------

2015 * 55.0%

2014 68.6%

------------------------------------------- ----------

Gross margin change

2016 * 60bps

------------------------------------------- ----------

2015 * -30bps

2014 80bps

------------------------------------------- ----------

Operating margin

2016 14.7%

------------------------------------------- ----------

2015 * 14.7%

2014 15.9%

------------------------------------------- ----------

Earnings per share (diluted)

2016 50.3p

------------------------------------------- ----------

2015 * 46.8p

2014 43.7p

------------------------------------------- ----------

Dividend per share

2016 25.1p

------------------------------------------- ----------

2015 21.5p

2014 20.0p

------------------------------------------- ----------

Total distributions per share

2016 56.6p

------------------------------------------- ----------

2015 91.5p

2014 20.0p

------------------------------------------- ----------

EBITDA

2016 GBP154.3m

------------------------------------------- ----------

2015 * GBP142.6m

2014 GBP137.3m

------------------------------------------- ----------

New store openings

2016 6

------------------------------------------- ----------

2015 12

2014 12

------------------------------------------- ----------

* 2015 is treated as a 52 week period for

these measures, rather than 53 weeks

Keith Down

Chief Financial Officer

14 September 2016

CONSOLIDATED INCOME STATEMENT

For the 52 weeks ended 2 July 2016

Note 2016 2015

52 weeks 53 weeks

GBP'm GBP'm

----------- -----------

Revenue 1 880.9 835.8

Cost of sales (442.4) (424.6)

--------------------------------------- ----- ----------- -----------

Gross profit 438.5 411.2

Operating costs 3 (309.2) (288.7)

--------------------------------------- ----- ----------- -----------

Operating profit 2 129.3 122.5

Financial income 5 1.2 0.8

Financial expenses 5 (1.6) (0.7)

--------------------------------------- ----- ----------- -----------

Profit before taxation 128.9 122.6

Taxation 6 (26.6) (26.5)

---------------------------------------

Profit for the period attributable

to owners of the parent 102.3 96.1

--------------------------------------- ----- ----------- -----------

Earnings per Ordinary Share - basic 8 50.5p 47.5p

Earnings per Ordinary Share - diluted 8 50.3p 47.3p

--------------------------------------- ----- ----------- -----------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the 52 weeks ended 2 July 2016

2016 2015

52 weeks 53 weeks

GBP'm GBP'm

----------- -----------

Profit for the period 102.3 96.1

Other comprehensive income/(expense):

Items that may be subsequently reclassified

to profit or loss:

Movement in fair value of cash flow

hedges 10.3 1.0

Transfers of cash flow hedges to

inventory (2.9) 1.7

Deferred tax on hedging movements (1.3) (0.6)

Other comprehensive income for the

period, net of tax 6.1 2.1

--------------------------------------------------- ----------- -----------

Total comprehensive income for the

period attributable to owners of

the parent 108.4 98.2

--------------------------------------------------- ----------- -----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 2 July 2016

Note 2 July 4 July

2016 2015

GBP'm GBP'm

Non-current assets

Intangible assets 9 18.6 13.1

Property, plant and equipment 10 168.9 158.9

Deferred tax assets 0.6 1.9

Derivative financial instruments 0.8 -

Total non-current assets 188.9 173.9

------------------------------------- ----- -------- --------

Current assets

Inventories 116.6 133.1

Trade and other receivables 19.2 18.0

Derivative financial instruments 6.8 -

Cash and cash equivalents 14.9 16.2

Total current assets 157.5 167.3

------------------------------------- ----- -------- --------

Total assets 346.4 341.2

------------------------------------- ----- -------- --------

Current liabilities

Trade and other payables (95.4) (88.0)

Liability for current tax (12.8) (12.5)

Derivative financial instruments - (0.3)

Total current liabilities (108.2) (100.8)

------------------------------------- ----- -------- --------

Non-current liabilities

Bank loans (94.2) (89.8)

Trade and other payables (41.4) (42.4)

Deferred tax liabilities (0.8) -

Provisions (2.0) (3.1)

Derivative financial instruments (0.2) -

Total non-current liabilities (138.6) (135.3)

------------------------------------- ----- -------- --------

Total liabilities (246.8) (236.1)

------------------------------------- ----- -------- --------

Net assets 99.6 105.1

------------------------------------- ----- -------- --------

Equity

Issued share capital 2.0 2.0

Share premium account 1.6 1.6

Capital redemption reserve 43.2 43.2

Hedging reserve 5.9 (0.2)

Retained earnings 46.9 58.5

Total equity attributable to equity

holders of the Parent 99.6 105.1

------------------------------------- ----- -------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the 52 weeks ended 2 July 2016

Note 2016 2015

52 weeks 53 weeks

GBP'm GBP'm

Profit before taxation 128.9 122.6

Adjustment for net financing costs 0.4 (0.1)

----------- -----------

Operating profit 129.3 122.5

Depreciation and amortisation 2 25.3 21.5

Impairment charge on non-current

assets 10 - 0.1

(Profit)/loss on disposal of non-current

assets 2 (0.3) 0.1

----------- -----------

Operating cash flows before movements

in working capital 154.3 144.2

Decrease/(increase) in inventories 16.5 (17.6)

(Increase)/decrease in receivables (1.2) 1.5

Increase in payables 3.0 16.2

----------- -----------

Net movement in working capital 18.3 0.1

Share-based payments expense 1.4 0.3

----------- -----------

174.0 144.6

Interest received 5 0.1 0.5

Tax paid (25.9) (26.9)

----------- -----------

Net cash generated from operating

activities 148.2 118.2

Cash flows from investing activities

Proceeds on disposal of property,

plant and equipment 10 2.0 -

Acquisition of property, plant and

equipment 10 (29.6) (25.3)

Acquisition of intangible assets 9 (10.2) (5.9)

------------------------------------------- ----- ----------- -----------

Net cash used in investing activities (37.8) (31.2)

Cash flows from financing activities

Proceeds from re-issue of treasury

shares 1.3 0.8

Purchase of treasury shares (7.8) -

Drawdowns on revolving credit facility 39.0 127.0

Repayments of revolving credit facility (35.0) (36.0)

Loan transaction costs - (1.3)

Interest paid 5 (1.6) (0.1)

Ordinary dividends paid 7 (44.6) (41.5)

Special dividends / distributions

to shareholders 7 (63.8) (141.7)

------------------------------------------- ----- ----------- -----------

Net cash flows used in financing

activities (112.5) (92.8)

------------------------------------------- ----- ----------- -----------

Net decrease in cash and cash equivalents (2.1) (5.8)

Foreign exchange revaluations 0.8 0.3

Cash and cash equivalents at the

beginning of the period 16.2 21.7

Cash and cash equivalents at the

end of the period 14.9 16.2

------------------------------------------- ----- ----------- -----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the 52 weeks ended 2 July 2016

Issued Share Capital

share premium redemption Hedging Retained Total

Note capital account reserve reserve earnings equity

GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm

--------------------------- ----- --------- --------- ------------ --------- ---------- --------

As at 28 June 2014 2.0 1.6 43.2 (2.3) 145.2 189.7

Profit for the period - - - - 96.1 96.1

Fair value gains of

cash flow hedges - - - 1.0 - 1.0

Loss on cash flow hedges

transferred to inventory - - - 1.7 - 1.7

Deferred tax on hedging

movements - - - (0.6) - (0.6)

--------------------------- ----- --------- --------- ------------ --------- ---------- --------

Total comprehensive

income for the period - - - 2.1 96.1 98.2

Issue of treasury shares - - - - 0.8 0.8

Share based payments - - - - 0.3 0.3

Deferred tax on share

based payments - - - - (0.8) (0.8)

Current tax on share

options exercised 6 - - - - 0.1 0.1

Ordinary dividends

paid 7 - - - - (41.5) (41.5)

Special distributions

to shareholders 7 - - - - (141.7) (141.7)

--------------------------- ----- --------- --------- ------------ --------- ---------- --------

Total transactions with

owners, recorded directly

in equity - - - - (182.8) (182.8)

---------------------------------- --------- --------- ------------ --------- ---------- --------

As at 4 July 2015 2.0 1.6 43.2 (0.2) 58.5 105.1

Profit for the period - - - - 102.3 102.3

Fair value gains of

cash flow hedges - - - 10.3 - 10.3

Gains on cash flow

hedges transferred

to inventory - - - (2.9) - (2.9)

Deferred tax on hedging

movements - - - (1.3) - (1.3)

--------------------------- ----- --------- --------- ------------ --------- ---------- --------

Total comprehensive

income for the period - - - 6.1 102.3 108.4

Purchase of treasury

shares - - - - (7.8) (7.8)

Issue of treasury shares - - - - 1.3 1.3

Share based payments - - - - 1.4 1.4

Deferred tax on share

based payments - - - - (0.6) (0.6)

Current tax on share

options exercised 6 - - - - 0.2 0.2

Ordinary dividends

paid 7 - - - - (44.6) (44.6)

Special dividends 7 - - - - (63.8) (63.8)

--------------------------- ----- --------- --------- ------------ --------- ---------- --------

Total transactions with

owners, recorded directly

in equity - - - - (113.9) (113.9)

--------- --------- ------------ --------- ---------- --------

As at 2 July 2016 2.0 1.6 43.2 5.9 46.9 99.6

--------------------------- ----- --------- --------- ------------ --------- ---------- --------

NOTES TO THE ANNUAL FINANCIAL STATEMENTS

For the 52 weeks ended 2 July 2016

1 Segmental reporting

The Group has one reportable segment, in accordance with IFRS 8

- Operating Segments, which is the retail of homewares in the

UK.

Customers access our offer across multiple channels and often

their journey involves more than one channel. Therefore internal

reporting focuses on the Group as a whole and does not identify

individual segments.

The Chief Operating Decision Maker is the Executive Board of

Directors of Dunelm Group plc. Internal management reports are

reviewed by them on a monthly basis. Performance of the segment is

assessed based on a number of financial and non-financial KPI's as

well as on profit before taxation.

Management believe that these measures are the most relevant in

evaluating the performance of the segment and for making resource

allocation decisions.

All material operations of the reportable segment are carried

out in the UK. The Group's revenue is driven by the consolidation

of individual small value transactions and as a result Group

revenue is not reliant on a major customer or group of

customers.

2 Operating profit

Operating profit is stated after charging/(crediting) the

following items:

2016 2015

52 53

weeks weeks

GBP'm GBP'm

--------------------------------- ----- ---- ---- ---- -------- --------

Cost of inventories

included in cost of

sales 439.9 421.3

Amortisation of intangible

assets 5.6 2.0

Depreciation of owned

property, plant and

equipment 19.7 19.5

Impairment charge on

non-current assets - 0.1

(Profit)/loss on disposal of property,

plant and equipment and intangible

assets (0.3) 0.1

Operating lease rentals 41.3 38.9

Net foreign exchange

gains (1.8) (0.3)

---------------------------------------------------------- -------- --------

3 Operating costs

2016 2015

52 53

weeks weeks

GBP'm GBP'm

Selling and distribution

costs 273.9 262.6

Administrative expenses 35.3 26.1

309.2 288.7

---------------------------------------------- -------- --------

4 Employee numbers and costs

The average monthly number of people employed by the Group

(including Directors) was:

2016 2016 2015 2015

52 52 53 53

weeks weeks weeks weeks

Number Full Number Full

of time of time

heads equivalents heads equivalents

Selling 8,035 4,757 7,757 4,425

Distribution 439 431 382 377

Administration 494 487 417 410

8,968 5,675 8,556 5,212

-------------------------- -------- ------------- -------- -------------

The aggregate remuneration of all employees including Directors

comprises:

2016 2015

52 53

weeks weeks

GBP'm GBP'm

------------------------------- ----- ---- ---- ---- -------- --------

Wages and salaries including

bonuses and termination benefits 120.0 109.5

Social security costs 7.0 6.5

Share-based payment

expense 1.4 0.3

Other pension costs 1.5 1.3

129.9 117.6

---------------------------------------------------- -------- --------

5 Financial income and expense

2016 2015

52 53

weeks weeks

GBP'm GBP'm

------------------------------ ---- ---- ---- ---- -------- --------

Finance income

Interest on bank deposits 0.1 0.5

Foreign exchange gains

(net) 1.1 0.3

1.2 0.8

-------------------------------------------------- -------- --------

Finance expenses

Interest on bank borrowings (1.3) (0.6)

Amortisation of issue

costs of bank loans (0.3) (0.1)

(1.6) (0.7)

-------------------------------------------------- -------- --------

Net finance (expense)/income (0.4) 0.1

------------------------------------------------------ -------- --------

6 Taxation

2016 2015

52 53

weeks weeks

GBP'm GBP'm

--------------------------- ---- ---- ---- ---- -------- --------

Current taxation

UK corporation tax charge

for the period 26.6 26.3

Adjustments in respect

of prior periods (0.2) (0.3)

26.4 26.0

----------------------------------------------- -------- --------

Deferred taxation

Origination of temporary

differences - 0.2

Adjustments in respect

of prior periods - 0.3

Impact of change in 0.2 -

tax rate

0.2 0.5

----------------------------------------------- -------- --------

Total tax expense 26.6 26.5

--------------------------------------------------- -------- --------

The tax charge is reconciled with the standard rate of UK

corporation tax as follows:

2016 2015

52 53

weeks weeks

GBP'm GBP'm

-------------------------------- ---- ---- ---- ---- -------- --------

Profit before taxation 128.9 122.6

UK corporation tax at standard

rate of 20.00% (2015: 20.75%) 25.8 25.4

Factors affecting the

charge in the period:

Non-deductible expenses 1.1 1.1

Loss on disposal of (0.3) -

non-qualifying assets

Adjustments in respect (0.2) -

of prior periods

Effect of change in 0.2 -

standard rate of corporation

tax

Tax charge 26.6 26.5

-------------------------------------------------------- -------- --------

The taxation charge for the period as a percentage of profit

before tax is 20.6% (2015: 21.6%).

A reduction in the UK corporation tax from 20% to 19% (effective

from1 April 2017) was substantively enacted on 26 March 2016, and a

further reduction to 18% (effective from 1 April 2020) was

substantively enacted on the same day.

Further changes were announced in the Chancellor's budget on 16

March 2016 reducing the UK corporation tax by a further 1% to 17%

from 1 April 2020. As this further change had not been enacted at

the balance sheet date the effect is not included in the financial

statements.

7 Dividends and Special Distributions to Shareholders

The dividends set out in the table below relate to the 1p

Ordinary Shares.

2016 2015

52 53

weeks weeks

GBP'm GBP'm

-------------------------- ------ ----- ----- ---- -------- --------

Final for the period

ended 28 June 2014 - paid 15.0p - 30.4

Interim for the period

ended 4 July 2015 - paid 5.5p - 11.1

Final for the period - paid 16.0p 32.4 -

ended 4 July 2015

Interim for the period - paid 6.0p 12.2 -

ended 2 July 2016

Special dividend for - paid 31.5p 63.8 -

the period ended 2 July

2016

108.4 41.5

-------------------------------------------------- -------- --------

The Directors are proposing a final dividend of 19.1p per

Ordinary Share for the period ended 2 July 2016 which equates to

GBP38.6m. The dividend will be paid on 25 November 2016 to

shareholders on the register at the close of business on 4 November

2016.

In the prior year, the Group made a special distribution to

shareholders by way of a B/C share scheme. The amount paid to

shareholders on 10 March 2015 was 70p per share, which equated to

GBP141.7m.

8 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to equity holders of the company by the

weighted average number of Ordinary Shares in issue during the

period excluding ordinary shares purchased by the company and held

as treasury shares.

For diluted earnings per share, the weighted average number of

Ordinary Shares in issue is adjusted to assume conversion of all

dilutive potential Ordinary Shares. These represent share options

granted to employees where the exercise price is less than the

average market price of the Company's Ordinary Shares during the

period.

Weighted average numbers of shares:

2016 2015

52 53

weeks weeks

'000 '000

-------------------------- ---- ---- ---- ---- -------- --------

Weighted average number of

shares in issue during the

period 202,456 202,217

Impact of share options 795 982

Number of shares for

diluted earnings per

share 203,251 203,199

-------------------------------------------------- -------- --------

2016 2015

52 53

weeks weeks

GBP'm GBP'm

Profit for the period 102.3 96.1

Earnings per Ordinary

Share - basic 50.5p 47.5p

Earnings per Ordinary

Share - diluted 50.3p 47.3p

-------------------------------------------------- -------- --------

9 Intangible Assets

Software Rights Total

development to

and brands

licences

GBP'm GBP'm GBP'm

-------------------------- ------------- -------- ------

Cost

At 28 June 2014 14.1 5.0 19.1

Additions 5.8 - 5.8

At 4 July 2015 19.9 5.0 24.9

Additions 6.4 4.8 11.2

Disposals (0.1) - (0.1)

At 2 July 2016 26.2 9.8 36.0

----------------------------- ------------- -------- ------

Accumulated amortisation

At 28 June 2014 4.8 5.0 9.8

Charge for the financial

period 2.0 - 2.0

At 4 July 2015 6.8 5.0 11.8

Charge for the financial

period 5.3 0.3 5.6

At 2 July 2016 12.1 5.3 17.4

----------------------------- ------------- -------- ------

Net book value

At 28 June 2014 9.3 - 9.3

At 4 July 2015 13.1 - 13.1

At 2 July 2016 14.1 4.5 18.6

----------------------------- ------------- -------- ------

All additions were acquired and do not include any internal

development costs.

All amortisation is included within operating costs in the

income statement.

During the year, the Group acquired the rights to the Fogarty

brand which will be amortised over a 15 year period.

10 Property, plant and equipment

Land Leasehold Plant Fixtures Total

and improvements and and

buildings machinery fittings

GBP'm GBP'm GBP'm GBP'm GBP'm

-------------------------- ----------- -------------- ----------- ---------- ------

Cost

At 28 June 2014 80.0 101.9 3.6 66.2 251.7

Additions 4.3 11.8 0.4 9.2 25.7

Disposals - (0.2) - (0.9) (1.1)

At 4 July 2015 84.3 113.5 4.0 74.5 276.3

Additions - 21.8 0.6 8.9 31.3

Disposals (0.8) (3.6) - (3.0) (7.4)

At 2 July 2016 83.5 131.7 4.6 80.4 300.2

--------------------------- ----------- -------------- ----------- ---------- ------

Accumulated depreciation

At 28 June 2014 9.0 40.4 2.2 47.2 98.8

Charge for the financial

period 1.3 7.5 0.7 10.0 19.5

Disposals - (0.1) - (0.9) (1.0)

Impairment 0.1 - - - 0.1

At 4 July 2015 10.4 47.8 2.9 56.3 117.4

Charge for the financial

period 1.4 8.4 0.5 9.4 19.7

Disposals (0.4) (2.5) - (2.9) (5.8)

At 2 July 2016 11.4 53.7 3.4 62.8 131.3

--------------------------- ----------- -------------- ----------- ---------- ------

Net book value

At 28 June 2014 71.0 61.5 1.4 19.0 152.9

At 4 July 2015 73.9 65.7 1.1 18.2 158.9

At 2 July 2016 72.1 78.0 1.2 17.6 168.9

--------------------------- ----------- -------------- ----------- ---------- ------

All depreciation expense and impairment charge have been

included within operating costs in the income statement.

11 Basis of preparation

The annual report and financial statements for the period ended

2 July 2016 were approved by the Board of Directors on 14 September

2016 along with this preliminary announcement, but have not yet

been delivered to the Registrar of Companies.

The financial information contained in this preliminary

announcement does not constitute the Group's statutory accounts

within the meaning of Section 434 of the Companies Act 2006.

The auditor's report on the statutory accounts for the period

ended 2 July 2016 was unqualified and did not contain a statement

under section 498 of the Companies Act 2006.

The statutory accounts of Dunelm Group plc for the period ended

4 July 2015 have been delivered to the Registrar of Companies. The

auditor's report on the statutory accounts for the period ended 4

July 2015 was unqualified and did not contain a statement under

section 498 of the Companies Act 2006.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAKNDFLNKEFF

(END) Dow Jones Newswires

September 14, 2016 02:00 ET (06:00 GMT)

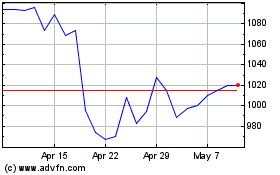

Dunelm (LSE:DNLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dunelm (LSE:DNLM)

Historical Stock Chart

From Apr 2023 to Apr 2024