TIDMDNE

RNS Number : 4988S

Dunedin Enterprise Inv Trust PLC

18 March 2016

18 March 2016

For release 18 March 2016

Dunedin Enterprise Investment Trust PLC ("the Company")

Year ended 31 December 2015

Dunedin Enterprise Investment Trust PLC, the private equity

investment trust which specialises in investing in mid-market

buyouts, announces its results for the year ended 31 December

2015.

Financial Highlights:

-- Net asset value total return flat in the year to 31 December 2015

-- Realisations of GBP3.3m in the year

-- New investment of GBP14.5m in the year

-- Proposals put to shareholders for managed wind-down

-- Realisation of CitySprint post year end at 2.75 times cost

-- New investment post year end of GBP7.0m in Alpha

-- Interim dividend of 16p per share for the year ended 31 December 2016

Comparative Total Return Performance

FTSE

Small

Cap

(ex Inv

Year to 31 December Net Asset Share Cos)

2015 value(*1) price Index

--------------------- ----------- ------- ---------

One year 0.0% -7.5% 13.0%

Three years 0.0% -16.4% 58.2%

Five years 12.0% 23.0% 82.9%

Ten years 39.6% -6.4% 75.7%

(*1) - taken from 31 October 2005 for ten years

For further information please contact:

Graeme Murray Corinna Osborne / Emily Weston

Dunedin LLP Equity Dynamics

0131 225 6699 07825 326 440 / 07825326442

0131 718 2310 corinna@equitydynamics.co.uk

07813 138367 emily@equitydynamics.co.uk

Chairman's Statement

In the year to 31 December 2015 your Company's net asset value

per share was largely unchanged at 505.8p. After allowing for last

year's final dividend of 4.7p, the total return to shareholders was

0.0%, while the share price total return was -7.5%. This represents

another period of disappointing performance.

On 8 February 2016 we announced the successful realisation of

our largest investment, CitySprint, the same-day delivery business,

for 2.75x our original investment. Further details of this

transaction appear below. At the same time we announced that the

Board had decided that it would be in the interests of shareholders

for your Company to be wound down in an orderly process over time.

This decision was taken after consulting the largest shareholders

and our professional advisers. A separate circular will be posted

to shareholders with the Annual Report containing further

information on these proposals, on which shareholders will be asked

to vote.

Following this combined announcement, the share price reacted

positively, increasing by some 14% to 335p. The share price at 17

March 2016 stands at 331p, a discount of 35% to the net asset value

of 505.8p per share.

Portfolio

There was one new investment during the year. An investment of

GBP4.9m was made in Blackrock Programme Management which provides

independent expert witness and construction consulting services for

large, international projects. Follow-on investments were also made

into RED, Premier Hytemp and Steeper.

Trading performance of the portfolio has again been mixed.

Valuation uplifts were achieved by CitySprint, Hawksford, the

fiduciary services business, and Kee Safety, the provider of safety

equipment. Each of these businesses is trading well as a result of

growth, achieved both organically and by acquisition. As EV and

Premier Hytemp supply services to the oil industry, trading at both

has been significantly impacted by the reduction in the price of

oil. Both are actively reducing their cost base to align this more

closely to market conditions. Pyroguard has been impacted by

production difficulties during the year at its French site, which

have now been resolved.

Since the year end the Company has made a significant

realisation as well as a new investment.

On 18 February 2016 the Company achieved a partial realisation

of CitySprint through a sale to LDC. On completion Dunedin

Enterprise received proceeds totalling GBP26.1m of which GBP22.8m

is capital and GBP3.3m is loan interest. A total of GBP7.3m has

been rolled into a CitySprint "Newco" alongside LDC for a 5%

interest, resulting in net cash proceeds received of GBP18.8m by

Dunedin Enterprise. The overall return to Dunedin Enterprise at 18

February 2016 was 2.75 times the original investment of GBP9.8m

over five years.

On 5 February 2016 a new investment of GBP7.0m was made in Alpha

Financial Markets. Alpha is the leading global asset and wealth

management consulting firm. Founded in London in 2003, Alpha has

grown rapidly and is now the global market leader in providing

specialist consultancy services to blue chip asset managers and

their third party administrators.

Dividends

In the year to 31 December 2015 income received by the Company

fell as a result of there being no significant realisations. It is

therefore proposed not to pay a final dividend for the year ended

31 December 2015. However, following the partial realisation of

CitySprint in February 2016, which generated a receipt of GBP3.3m

of income, it is proposed that an interim dividend for the year

ended 31 December 2016 of 16p per share be paid on 18 May 2016.

Share Buy-back

As reported at the half year, a share buy-back was undertaken

for 1.1% of the Company's share capital. The share buy-back cost

GBP0.7m and was undertaken at 309.8p, a 39% discount to the latest

announced net asset value per share, following weakness in the

share price as a result of the Company's removal from the FTSE

All-Share Index due to a reduction in its market capitalisation.

This required shareholders who were index tracker funds to dispose

of their shares. Cantor, the Company's broker, was able to place

the majority of these shares in the market with the Company

undertaking a share buy-back for the balance.

Board changes

As already set out in the Interim Report, I am pleased that

Angela Lane has joined the Board. She was appointed to the Board on

1 June 2015. Angela has worked in private equity for a number of

years and her skills and experience will be of great benefit to the

Board.

Liz Airey, having been a member of the Board since 1 January

2005, will retire from the Board at the AGM in May 2016. In

addition to being a Director of the Company, Liz Airey has also

chaired the Audit Committee since 2009 and has been the Senior

Independent Director since 2012. I should like to thank her, on

behalf of shareholders, for her very substantial contribution to

the Company over the years. We have been fortunate to have had

access to her expertise and wish her well for the future.

Angela Lane will chair the Audit Committee with effect from 17

March 2016. Federico Marescotti will take over the duties of Senior

Independent Director with effect from the AGM in May 2016.

Outlook

Proposals regarding a managed wind-down of the Company will be

posted to shareholders with the Annual Report and voted upon at a

General Meeting following the Annual General Meeting.

Subject to the shareholder vote, your Company will begin a new

phase with the winding down of its activities and the realisation

of its assets over time, aiming to maximise value for

shareholders.

The June vote on the UK's membership of the EU is likely to lead

to a period of uncertainty. However, the environment continues to

be favourable for realising good private equity assets and

particularly those which offer the potential for strong profit

growth. The investment portfolio is relatively mature and a number

of our investee companies offer interesting prospects for

realisation.

Duncan Budge

Chairman

17 March 2016

Manager's Review

In the year to 31 December 2015 the net asset value per share

has declined from 510.6p to 505.8p. After taking account of a final

dividend for 2014 of 4.7p (paid in 2015), the movement in the year

equates to a total return of 0.0%.

The Trust's net asset value decreased from GBP106.6m to

GBP104.4m over the year. This movement is stated following a share

buyback of GBP0.7m and dividend payments totalling GBP1.0m.

This movement in net assets can be explained as follows:

GBPm

------------------------------------------ ------

Net asset value at 1 January 2014 106.6

Unrealised value increases 15.6

Unrealised value decreases (12.3)

Realised loss over opening valuation (*1) (2.3)

Share buy-back (0.7)

Dividends paid to shareholders (1.0)

Other revenue and capital movements (1.5)

------------------------------------------ ------

Net asset value at 31 December 2015 104.4

------------------------------------------ ------

*(1) - there were drawdowns totalling GBP2.3m made during the

year by Dunedin managed funds for management fees and operating

expenses.

Share Buy-back

In June 2015 Dunedin Enterprise no longer qualified for

inclusion in the FTSE All-Share Index due to a reduction in the

market capitalisation of the Company. This resulted in a number of

tracker funds being required to dispose of their shareholding

within a short period of time, resulting in downward pressure on

the share price. The majority of these shares were placed with the

assistance of the Company's brokers. The balance of shares

remaining (GBP0.7m) were bought back by the Company at a price of

309.8p, a discount of 39% to the net asset value as at 31 December

2014.

Portfolio Composition

(MORE TO FOLLOW) Dow Jones Newswires

March 18, 2016 03:00 ET (07:00 GMT)

Dunedin Enterprise makes investments in unquoted companies

through Dunedin either directly or via its managed funds. In the

past the Company has made commitments to funds managed by third

parties. The last such commitment was made in 2009 and, following

the policy change in November 2011, no further commitments will be

made to funds managed by third parties.

The investment portfolio can be analysed as shown in the table

below.

Valuation Additions Valuation

at 1 January in Disposals Realised Unrealised at 31 December

2015 year in year movement movement 2015

GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm

-------------------- ------------- --------- --------- --------- ---------- ---------------

Dunedin managed 84.0 10.3 (1.8) (2.3) 2.9 93.1

Third party managed 13.2 4.2 (1.5) - 0.4 16.3

-------------------- ------------- --------- --------- --------- ---------- ---------------

97.2 14.5 (3.3) (2.3) 3.3 109.4

-------------------- ------------- --------- --------- --------- ---------- ---------------

New Investment Activity

A total of GBP14.5m was invested in the year to 31 December

2015. Of this total, GBP10.3m was invested in Dunedin managed funds

and GBP4.2m was drawn down by European third party funds.

In March 2015 an investment of GBP4.9m was made in Blackrock

Programme Management ("Blackrock PM"). Blackrock PM is a

professional services firm that provides independent expert witness

and construction consulting services for large, international

construction projects. The company is headquartered in London and

is widely recognised as a market leader, employing individual

directors who are experts in their field. Blackrock PM has worked

on an extensive range of projects around the globe including

airports, roads, railways, power stations, process plants,

manufacturing facilities, health and educational facilities and

commercial buildings.

During the year three follow-on investments were made. A further

investment of GBP2.5m was made in RED, the IT staffing business, to

assist with working capital and a re-setting of bank covenants.

There was a follow-on investment of GBP0.3m made in Premier Hytemp,

the provider of components to the oil and gas industry. Premier

Hytemp's products are utilised in oil exploration. This area of the

oil sector has been hit particularly hard by the reduction in the

price of oil and the company required additional funding to support

ongoing working capital requirements. Your Manager is working

closely with the management of Premier to ensure that the cost base

of the company matches expected future revenues.

A further GBP0.3m was invested in Steeper, the provider of

prosthetic, orthotic and assistive technology products and

services, to assist with a factory improvement programme. The

company, which operates from factories in Leeds, was subsequently

hit by the recent flooding in the north west of England causing

significant damage to the operating capabilities of the business.

The company is currently re-evaluating its strategic options but in

the meantime is being assisted by insurance payments covering both

damage to property and plant & machinery as well as business

interruption.

Following the year end, in February 2016 an investment of

GBP7.0m was made in Alpha Financial Markets ("Alpha"). Founded in

London in 2003, Alpha has grown rapidly and is now the global

market leader in providing specialist consultancy services to blue

chip asset and wealth managers and their third party

administrators. Alpha has over 200 consultants deployed across six

major financial centres (London, Paris, New York, Boston, The Hague

& Luxembourg), working on behalf of more than 130 top asset and

wealth management clients. Alpha currently advises three quarters

of the top 50 global asset managers.

Within the European funds, GBP2.7m was drawn down by Realza

Capital and GBP1.5m by Innova/5.

Realza made two new investments in the year. In March 2015 an

investment of GBP1.4m was made in Litalsa, a provider of packaging

finishes. Realza also invested GBP1.3m in Cualin Quality, a leading

producer of premium tomatoes.

Innova made one new investment in the year. In December 2015 an

investment of GBP1.2m was made in Pekaes S.A. Pekaes is one of the

leading integrated logistics operators in Poland. Its services are

delivered through a fully outsourced fleet.

Realisations

During the year a total of GBP3.3m was generated from portfolio

realisations. GBP1.7m was realised from Enrich following the

successful outcome of the court case against the vendor of the

business.

A total of GBP1.0m was returned from Innova/5. This was

primarily the result of a successful IPO of the internet portal

service provider Wirtualna Polska on the Polish stock exchange with

a partial realisation of the stock on flotation. A further

distribution of GBP0.4m was made by Realza as a result of strong

cash generation by GTT, the provider of management services to

local public entities in Spain.

Following the year end, in February 2016, the investment in

CitySprint was partially realised. On completion Dunedin Enterprise

received proceeds totalling GBP26.1m of which GBP22.8m is capital

and GBP3.3m is loan interest. A total of GBP7.3m has been rolled

into a CitySprint Newco alongside LDC, resulting in net cash

proceeds received of GBP18.8m by Dunedin Enterprise. Dunedin

Enterprise retains a 5% interest in the Newco. The overall return

to Dunedin Enterprise at 18 February 2016 was 2.75 times the

original investment of GBP9.8m over five years.

Cash and commitments

As at 31 December 2015 the Company had cash and near cash

balances of GBP0.6m all of which are denominated in Sterling. The

Company has a revolving credit facility with Lloyds of GBP20m of

which GBP4.7m was drawn at the year end. The net cash position of

the Company at the year end was therefore overdrawn by GBP4.1m.

During the year the availability of the GBP20m facility from Lloyds

was extended to 31 May 2018.

Following the sale of CitySprint and after taking account of the

investment in Alpha, other follow-on investments and operating

expenses, the Company has net cash of GBP4.6m.

At 31 December 2015 the Company had undrawn commitments

totalling GBP50.2m. Following the investment activity in 2016 noted

above, as at the date of this report the Company had undrawn

commitments to Dunedin managed funds of GBP35.7m and a further

EUR6.0m (GBP4.4m) of undrawn commitments to the two remaining

European funds. It is expected that GBP21m of the total outstanding

commitments will ultimately be drawn over the remaining life of the

funds.

Unrealised movements in valuations

In the year to 31 December 2015 there were valuation uplifts

generated from the following investments: CitySprint (GBP7.2m),

Hawksford (GBP4.2m) and Kee Safety (GBP2.1m).

The valuation of CitySprint has been based upon the value of the

transaction completed in February 2016.

The maintainable earnings of Hawksford have increased by 6%

during the year and net external debt has been reduced by GBP3.4m.

The EBITDA multiple applied to the valuation has been increased

from 7x to 8.5x to reflect recent transactions in the sector, where

multiples of 9x - 10x have been paid.

The maintainable earnings of Kee Safety have increased by 25%

during the year, generated from both organic growth and the bolt-on

acquisition of five companies based in the UK, Ireland Holland and

the US. The acquisitions have resulted in an increase in net bank

debt of GBP5.4m.

The most significant valuation reductions in the year to 31

December 2015 were at EV (GBP4.9m), Premier Hytemp (GBP2.7m) and

Pyroguard (GBP1.5m).

The maintainable earnings of both EV and Premier Hytemp have

been impacted by the reduced oil price and the consequent reduced

level of demand and lower margins. Premier Hytemp supplies the oil

exploration sector whilst EV primarily supplies the production side

of the oil industry. Both companies have taken actions to

significantly reduce their cost base in light of the prevailing

market conditions. EV has been valued on an earnings basis whilst

Premier Hytemp is valued on a discounted net assets basis.

The maintainable earnings of Pyroguard have decreased by 19%

during the year. The company has experienced production

difficulties at its French operation which resulted in

reworking/wastage costs and product discounting. The production

problems in France have now been resolved.

The majority of portfolio companies are budgeting an increase in

maintainable earnings during 2016.

A provision of GBP1.4m has also been established during the year

for carried interest arising in the Equity Harvest Fund. This 2002

limited partnership fund has a hurdle rate of 7% which was achieved

during the year following a period of valuation growth of its

investment portfolio.

Included within portfolio company valuations is accrued interest

of GBP11.6m (GBP9.1m), of which GBP3.2m relates to CitySprint.

Valuations and Gearing

The average earnings multiple applied in the valuation of the

Dunedin managed portfolio was 8.4x EBITDA (2014: 7.6x), or 9.8x

EBITA (2014: 9.3x). These multiples continue to be applied to

maintainable profits.

The basis for the valuation of Weldex has been changed from an

earnings to an assets basis. In deriving a valuation for Weldex the

assets of the company have been valued at book value. An assets

basis of valuation is commonly used to value plant hire

businesses.

(MORE TO FOLLOW) Dow Jones Newswires

March 18, 2016 03:00 ET (07:00 GMT)

Within the Dunedin managed portfolio, the weighted average

gearing of the companies was 2.3x EBITDA (2014: 2.2x) or 2.6x EBITA

(2014: 2.7x). Analysing the portfolio gearing in more detail, the

percentage of investment value represented by different gearing

levels was as follows:

Less than 1 x EBITDA 14%

Between 1 and 2 x EBITDA 58%

Between 2 and 3 x EBITDA 15%

More than 3 x EBITDA 13%

Of the total acquisition debt in the Dunedin managed portfolio

companies the scheduled repayments are spread as follows:

Less than one year 25%

Between one and two years 33%

Between two and three years 9%

More than 3 years 33%

Fund Analysis

The table below analyses the investment portfolio by investment

fund vehicle.

%

------------------------

Direct 9

Dunedin Buyout Fund II 55

Dunedin Buyout Fund III 17

Equity Harvest Fund 4

Third Party managed 15

------------------------

Portfolio Analysis

Detailed below is an analysis of the investment portfolio by

geographic location as at 31 December 2015.

%

---------------

UK 85

Rest of Europe 15

---------------

Sector Analysis

The investment portfolio of the Company is broadly diversified.

At 31 December 2015 the largest sector exposure of 43% remains to

the Support Services sector, a diverse sector in itself.

%

------------------------------------

Automotive 2

Construction and building materials 6

Consumer products & services 4

Financial services 15

Healthcare 4

Industrials 24

Support services 43

Technology 2

------------------------------------

Valuation Method

%

---------------------

Earnings - provision 22

Earnings - uplift 43

Assets basis 11

Exit value 24

---------------------

Year of Investment

In the vintage year table below, value is allocated to the year

in which either Dunedin Enterprise or the third party manager first

invested in each portfolio company.

%

----------

<1 year 7

1-3 years 18

3-5 years 10

>5 years 65

----------

Dunedin LLP

17 March 2016

Ten Largest Investments

(both held directly and via Dunedin managed funds) by value at

31 December 2015

Approx. Percentage

percentage Cost Directors' of net

of

of equity investment valuation assets

Company name % GBP'000 GBP'000 %

-------------- ----------- ----------- ----------- -----------

CitySprint 11.9 9,838 26,137 25.0

Hawksford 17.8 5,637 13,030 12.5

Realza 8.9 8,781 9,714 9.3

Weldex 15.1 9,505 9,611 9.2

Kee Safety 7.2 6,275 9,473 9.1

C.G.I. 41.7 9,450 6,543 6.3

Formaplex 17.7 1,732 6,467 6.2

Innova/5 3.9 6,941 6,330 6.1

Blackrock PM 7.8 4,902 5,803 5.6

U-POL 5.2 5,657 5,276 5.1

68,718 98,384 94.4

-------------- ----------- ----------- ----------- -----------

Consolidated Income Statement

2015 2014

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment income 196 - 196 1,711 - 1,711

Gains/(losses) on investments - 853 853 - (1,218) (1,218)

------------------------------ ------- ------- ------- ------- ------- -------

Total income 196 853 1,049 1,711 (1,218) 493

Expenses

Investment management

fee (95) (285) (380) (104) (311) (415)

Management performance

fee - - - 7 22 29

Other expenses (599) - (599) (633) - (633)

------------------------------ ------- ------- ------- ------- ------- -------

Profit/(loss) before

finance costs and tax (498) 568 70 981 (1,507) (526)

Finance costs (130) (388) (518) (138) (413) (551)

------------------------------ ------- ------- ------- ------- ------- -------

Profit/(loss) before

tax (628) 180 (448) 843 (1,920) (1,077)

Taxation - - - 137 162 299

------------------------------ ------- ------- ------- ------- ------- -------

Profit for the year (628) 180 (448) 980 (1,758) (778)

------------------------------ ------- ------- ------- ------- ------- -------

Basic return per ordinary

share

(basic & diluted) (3.0)p 0.8p (2.2)p 4.6p (8.3)p (3.7)p

The total column of this statement represents the Income

Statement of the Group, prepared in accordance with International

Financial Reporting Standards as adopted by the EU. The

supplementary revenue and capital columns are both prepared under

guidance published by the Association of Investment Companies. All

items in the above statement derive from continuing operations.

All income is attributable to the equity shareholders of Dunedin

Enterprise Investment Trust PLC.

Consolidated Statement of Changes in Equity

for the year ended 31 December 2015

Year ended 31 December 2015

Capital Capital Capital Special Total

Share redemption Reserve reserve Distributable Revenue retained Total

capital reserve realised - Reserve account earnings equity

GBP'000 GBP'000 GBP'000 unrealised GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 31 December

2014 5,217 2,709 47,552 (3,436) 47,600 6,914 98,630 106,556

Profit/(loss)

for the year - - (8,213) 8,393 - (628) (448) (448)

Purchase

and

cancellation

of shares (56) 56 (700) - - - (700) (700)

Dividends

paid - - - - - (981) (981) (981)

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 31 December

2015 5,161 2,765 38,639 4,957 47,600 5,305 96,501 104,427

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

Year ended 31 December 2014

Capital Capital Capital Special Total

Share redemption Reserve reserve Distributable Revenue retained Total

capital reserve realised - Reserve account earnings equity

GBP'000 GBP'000 GBP'000 unrealised GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 31 December

2013 5,492 2,434 62,832 (11,649) 47,600 9,558 108,341 116,267

Profit/(loss)

for the year - - (9,971) 8,213 - 980 (778) (778)

Purchase

and

cancellation

of shares (275) 275 (5,309) - - - (5,309) (5,309)

Dividends

paid - - - - - (3,624) (3,624) (3,624)

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 31 December

2014 5,217 2,709 47,552 (3,436) 47,600 6,914 98,630 106,556

(MORE TO FOLLOW) Dow Jones Newswires

March 18, 2016 03:00 ET (07:00 GMT)

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

Consolidated Balance Sheet

As at 31 December 2015

31 December 31 December

2015 2014

GBP'000 GBP'000

-------------------------------- ------------ ------------

Non-current assets

Investments held at fair value 109,374 98,371

Current assets

Other receivables 167 269

Cash and cash equivalents 573 8,726

-------------------------------- ------------ ------------

740 8,995

Total assets 110,114 107,366

Current liabilities

Other liabilities (987) (810)

Loan facility (4,700) -

Net assets 104,427 106,556

-------------------------------- ------------ ------------

Capital and reserves

Share capital 5,161 5,217

Capital redemption reserve 2,765 2,709

Capital reserve - realised 38,639 47,552

Capital reserve - unrealised 4,957 (3,436)

Special distributable reserve 47,600 47,600

Revenue reserve 5,305 6,914

-------------------------------- ------------ ------------

Total equity 104,427 106,556

-------------------------------- ------------ ------------

Net asset value per ordinary

share (basic and diluted) 505.8p 510.6p

Consolidated Cash Flow Statement

for the year ended 31 December 2015

31 December 31 December

2015 2014

GBP'000 GBP'000

-------------------------------------- ------------ ------------

Operating activities

Profit / (loss) before tax (448) (1,077)

Gains / (losses) on investments (853) 1,218

Interest paid 518 551

Decrease in debtors 102 324

Increase in creditors 4,877 140

Other non cash movements - 199

-------------------------------------- ------------ ------------

Net cash inflow from operating

activities 4,196 1,355

Taxation

Tax recovered - 116

Servicing of finance

Interest paid (518) (551)

Investing activities

Purchase of investments (14,513) (16,025)

Purchase of 'AAA' rated money

market funds (6,707) (13,395)

Sale of investments 3,286 6,108

Sale of 'AAA' rated money market

funds 7,840 16,629

-------------------------------------- ------------ ------------

Net cash inflow / (outflow) from

investing activities (10,094) (6,683)

Financing activities

Purchase of ordinary shares (700) (5,309)

Dividends paid (981) (3,624)

-------------------------------------- ------------ ------------

Net cash (outflow) from financing

activities (1,681) (8,933)

Effect of exchange rate fluctuations

on cash held (56) (62)

-------------------------------------- ------------ ------------

Net (decrease) in cash and cash

equivalents (8,153) (14,758)

-------------------------------------- ------------ ------------

Cash and cash equivalents at

the start of the year 8,726 23,484

Net (decrease) in cash and cash

equivalents (8,153) (14,758)

Cash and cash equivalents at

the end of the year 573 8,726

-------------------------------------- ------------ ------------

Statement of Directors' Responsibilities in respect of the

Annual Report and the Financial Statements

The Directors are responsible for preparing the Annual Report

and the Group and Parent Company financial statements in accordance

with applicable law and regulations.

Company law requires the Directors to prepare Group and Parent

Company financial statements for each financial year. Under that

law they are required to prepare the Group financial statements in

accordance with IFRSs as adopted by the EU and applicable law and

have elected to prepare the Parent Company financial statements on

the same basis.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Parent Company and of

their profit or loss for that period. In preparing each of the

Group and Parent Company financial statements, the Directors are

required to:

- select suitable accounting policies and then apply them

consistently;

- make judgments and estimates that are reasonable and

prudent;

- state whether they have been prepared in accordance with IFRSs

as adopted by the EU; and

- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and the Parent

Company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Parent

Company's transactions and disclose with reasonable accuracy at any

time the financial position of the Parent Company and enable them

to ensure that its financial statements comply with the Companies

Act 2006. They have general responsibility for taking such steps as

are reasonably open to them to safeguard the assets of the Group

and to prevent and detect fraud and other irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a Strategic Report, Directors' Report,

Directors' Remuneration Report and Corporate Governance Statement

that complies with that law and those regulations.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

Under the Disclosure and Transparency Rules the Directors

confirm that to the best of their knowledge:

- that the financial statements have been prepared in accordance

with the applicable accounting standards and give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Company; and

- that in the opinion of the Directors, the Annual Report and

Accounts taken as a whole, is fair, balanced and understandable and

it provides the information necessary to assess the Company's

performance, business model and strategy; and

- the Strategic Report and Directors' Report include a fair

review of the development and performance of the business and the

position of the issuer and the undertakings included in the

consolidation taken as a whole, together with a description of the

principal risks and uncertainties that they face.

On behalf of the Board

Duncan Budge

Chairman

17 March 2016

Notes to the Accounts

1. Preliminary Results

The financial information contained in this report does not

constitute the Company's statutory accounts for the years ended 31

December 2015 or 2014. The financial information for 2014 is

derived from the statutory accounts for 2014 which have been

delivered to the Registrar of Companies. The auditor has reported

on those accounts. Their report was (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498(2) or (3) of

the Companies Act 2006. The audit of the statutory accounts for the

year ended 31 December 2015 is not yet complete. These accounts

will be finalised on the basis of the financial information

presented by the Directors in this preliminary announcement and

will be delivered to the Registrar of Companies following the

Company's annual general meeting.

2. Dividends

Year to Year to

31 31

December December

2015 2014

GBP'000 GBP'000

Dividends paid in the year 981 3,624

An interim dividend for the year ended 31 December 2016 will be

paid on 18 May 2016 to shareholders on the register at close of

business on 29 April 2016. The ex-dividend date is 28 April

2016.

3. Earnings per share

Year to Year to

31 December 31 December

2015 2014

Revenue return per ordinary

share (p) (3.0) 4.6

Capital return per ordinary

share (p) 0.8 (8.3)

Earnings per ordinary share

(p) (2.2) (3.7)

Weighted average number

of shares 20,750,515 21,277,808

(MORE TO FOLLOW) Dow Jones Newswires

March 18, 2016 03:00 ET (07:00 GMT)

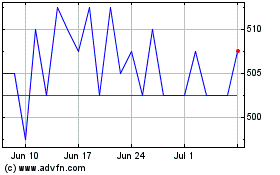

Dunedin Enterprise Inves... (LSE:DNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dunedin Enterprise Inves... (LSE:DNE)

Historical Stock Chart

From Apr 2023 to Apr 2024