DuPont Names Breen CEO, Removing Interim Tag--Update

November 09 2015 - 3:05PM

Dow Jones News

By Jacob Bunge And David Benoit

DuPont Co. named Edward Breen as its permanent chairman and

chief executive, appointing an outsider who investors expect will

bring major changes to the agriculture-and-chemicals

conglomerate.

The appointment also could signal a truce with activist investor

Trian Fund Management LP, whose top executives in a meeting last

month with DuPont's board conveyed support for Mr. Breen taking

over, according to people familiar with the matter.

Mr. Breen, a DuPont board member and former CEO of Tyco

International PLC who took over as DuPont's interim CEO last month

after Ellen Kullman's sudden retirement , is expected to forge

ahead with plans to reduce costs as DuPont contends with deep

challenges in its main markets--and potentially to pursue deals

that could transform the 213-year-old maker of Pioneer corn seeds

and Kevlar fibers.

"Clearly, there's major change on the horizon," said Thomas

Weary, chief investment officer at Lau Associates LLC, a suburban

Wilmington, Del.-based firm that oversees about $500 million on

behalf of investors, including members of the DuPont family.

Mr. Breen became a DuPont director in February as Ms. Kullman

defended against Trian's proxy fight to gain seats on DuPont's

board. Ms. Kullman during her tenure had started a series of cost

cuts and sold or spun off two DuPont divisions to focus on

higher-profit operations increasingly centered on food and

agriculture. But Trian had pushed the company to go farther,

including potentially splitting itself in two.

Last month's meeting was the first Trian has had with DuPont's

whole board since Trian started engaging with the company in June

2013, the people familiar with the matter said. At the meeting,

Trian Chief Executive Nelson Peltz and Chief Investment Officer Ed

Garden pressed Mr. Breen and DuPont's other directors to respond to

what Trian considers poor performance by the company, and outlined

several strategic options they believe would create more long-term

value, the people said.

Dennis Carey, a vice chairman at executive-recruiting firm

Korn/Ferry International, said Mr. Breen's appointment is an

opportunity for DuPont to reset relations with Trian, if not pursue

all of the investment firm's ideas. "He will befriend Nelson

[Peltz] in a way that's consistent with good corporate governance,"

said Mr. Carey, a longtime acquaintance of Mr. Breen.

Mr. Weary of Lau Associates said Mr. Breen's track record of

overhauling Tyco--he twice broke up its businesses through

spinoffs--and the potential for consolidation in the agriculture

industry boost the odds that DuPont will separate out its

seed-and-pesticide business, its biggest source of profit and

revenue. "This may be the end of DuPont as you know it," he

said.

Mr. Breen, through a DuPont spokesman, declined to comment.

"He's spending his time and attention right now on internal

meetings with teams focused on improving our business performance,

cost structure, and evaluating strategic opportunities," the

spokesman said. In the past, Mr. Breen has defended DuPont's

structure and stressed that Tyco required "extreme measures."

Last month, though, Mr. Breen said he was discussing possible

deals with executives at rival agriculture companies, many of which

are considering mergers amid a three-year decline in crop prices

that has pushed seed and pesticide prices down. DuPont is holding

early-stage discussions with Dow Chemical Co. and Syngenta AG, The

Wall Street Journal reported last week.

Mr. Breen, who also has been CEO of General Instrument Corp.,

had been widely seen as a contender to stay on as DuPont's leader.

But his selection marks the first time the top executive position

has gone to someone from outside DuPont, which traces its roots to

gunpowder mills built by founder Éleuthère Irénée du Pont de

Nemours near Wilmington. Previous DuPont CEOs either arose from the

founding family or were promoted from within, including Ms.

Kullman, who had decades of experience working across the company's

divisions.

Rusty Robinson, president of Robinson Investment Group, said he

expects Mr. Breen to consider splitting up DuPont's businesses to

improve their competitive footing across DuPont's various

industries. As part of that, "you could see lower profit margin

companies of DuPont spun off and sold to private equity or venture

capital companies," said Mr. Robinson, whose Brentwood, Tenn., firm

owns about 57,000 DuPont shares.

DuPont's stock climbed 0.5% in Monday trading to $66.44, against

a broad decline in U.S. stocks. The shares have risen about 30%

since Ms. Kullman announced her resignation in early October.

Mr. Breen remains chairman at Tyco, which on Monday declined to

discuss any potential plans to replace him. Mr. Breen is keeping

his board seat at Comcast Corp., where he is lead independent

director, a Comcast spokesman said.

Joann S. Lublin contributed to this article

Write to Jacob Bunge at jacob.bunge@wsj.com and David Benoit at

david.benoit@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 14:50 ET (19:50 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

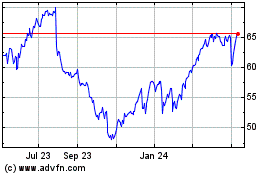

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

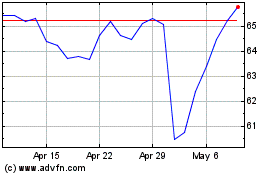

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024