Draghi Says ECB To Do What It Must To Raise Inflation Quickly

November 20 2015 - 1:59AM

RTTF2

Policymakers are set to review the factors that are acting as a

drag on euro area inflation and will use all available tools to

bring price growth to target if there are downside risks to the

outlook, European Central Bank President Mario Draghi said

Friday.

"If we decide that the current trajectory of our policy is not

sufficient to achieve that objective, we will do what we must to

raise inflation as quickly as possible," Draghi said in a speech in

Frankfurt.

Draghi had revealed in October that policymakers discussed

interest rate cuts. The accounts of the October 22 rate-setting

session, released Thursday, confirmed that policymakers are set to

review all available tools in December that will help to achieve

the ECB's price stability goal of bringing inflation 'below, but

close to 2 percent'.

On December 3, the bank is widely expected to raise the size of

its monthly asset purchases to EUR 80 billion from EUR 60 billion

and also extend the EUR 1.1 trillion programme beyond its September

2016 deadline. A reduction of the already-negative deposit rate is

also possible.

"We consider the APP [asset purchase programme] to be a powerful

and flexible instrument, as it can be adjusted in terms of size,

composition or duration to achieve a more expansionary policy

stance," Draghi said.

"The level of the deposit facility rate can also empower the

transmission of APP, not least by increasing the velocity of

circulation of bank reserves."

Policymakers are not yet confident that the process of economic

repair in the euro area is complete. If the 19-nation needs more

monetary stimulus, the ECB will not hesitate to provide, he

added.

Regarding inflation, Draghi pointed out that the low level of

underlying inflation suggest relatively weak price pressures going

forward. "In making our assessment of the risks to price stability,

we will not ignore the fact that inflation has already been low for

some time," he said.

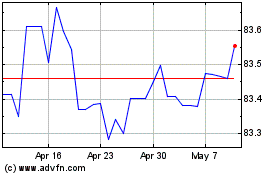

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

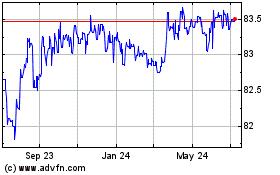

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024