The following reflects the income and share data used in the

basic and diluted earnings per share computations:

(Unaudited) (Unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

28 June 29 June 28 December

2015 2014 2014

GBP000 GBP000 GBP000

Profit for the period 25,446 19,698 42,738

Adjusted for - non-controlling

interests - 200 200

------------ ------------ ------------

Profit attributable to

owners of the parent 25,446 19,898 42,938

------------ ------------ ------------

(Unaudited) (Unaudited)

At At At

28 June 29 June 28 December

2015 2014 2014

No. No. No.

Reconciliation of basic

and diluted weighted average

number of shares:

Basic weighted average

number of shares (excluding

treasury shares) 165,823,987 165,084,656 165,471,079

Dilutive potential ordinary

shares:

Share options 1,328,336 586,001 547,979

Reversionary interests 394,136 243,094 582,848

------------ ------------ ------------

Diluted weighted average

number of shares 167,546,459 165,913,751 166,601,906

------------ ------------ ------------

(Unaudited) (Unaudited)

26 weeks 26 weeks 52 weeks

Ended Ended ended

28 June 29 June 28 December

2015 2014 2014

Basic earnings per share

(pence) 15.3 12.0 25.9

------------ ------------ ------------

Diluted earnings per share

(pence) 15.2 12.0 25.8

------------ ------------ ------------

There have been no other transactions involving ordinary shares

or potential ordinary shares between the reporting date and the

date of completion of these interim financial statements.

In addition, the performance conditions for share options

granted over 262,070 (29 June 2014: 3,143,856; 28 December 2014:

1,087,596) shares have not been met in the current financial period

and therefore the dilutive effect of the number of shares that

would have been issued at the period end have not been included in

the diluted earnings per share calculation.

Underlying earnings per share

The Group presents as non-underlying items below the income

statement, those material items of income and expense which,

because of the nature and expected infrequency of the events giving

rise to them, merit separate presentation to allow shareholders to

understand better the elements of financial performance in the

year, so as to facilitate comparison with prior periods and to

assess better the trends in financial performance.

To this end, basic and diluted earnings from continuing

operations per share is also presented on this basis and using the

weighted average number of shares for both basic and diluted

amounts as per the table above. The amounts for earnings per share

from continuing operations on an underlying basis are as

follows:

(Unaudited) (Unaudited)

26 weeks 26 weeks 52 weeks

ended ended Ended

28 June 29 June 28 December

2015 2014 2014

Underlying basic earnings

per share (pence) 15.3 11.6 26.6

------------ ------------ ------------

Underlying diluted earnings

per share (pence) 15.2 11.5 26.4

------------ ------------ ------------

Underlying profit and attributable to equity holders of the

parent is derived as follows:

(Unaudited) (Unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

28 June 29 June 28 December

2015 2014 2014

GBP000 GBP000 GBP000

Profit for the period 25,446 19,698 42,738

Adjusted for - non-controlling

interests - 200 200

------------ ------------ ------------

Profit attributable to owners

of the parent 25,446 19,898 42,938

Amounts excluded from underlying

profit - attributable to

equity holders of the parent - (821) 1,026

Amounts included in operating

profit - 453 1,426

Other gains and losses - (1,276) (1,147)

Discount unwind - 356 722

Taxation impact - 62 25

Prior year adjustment - impact - (416) -

on deferred tax asset

Attributable to owners of

the parent 25,446 19,077 43,964

------------ ------------ ------------

10. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment additions in the period

During the 26 weeks ended 28 June 2015, the Group acquired

assets with a cost of GBP2.6m (29 June 2014: GBP1.8m; 28 December

2014: GBP4.4m).

Capital commitments

At 28 June 2015, the Group had capital commitments of GBPnil (29

June 2014 and 28 December 2014: GBPnil).

11. INTEREST-BEARING LOANS AND BORROWINGS

Bank revolving facility

On 31 January 2014, the Group increased the existing revolving

credit facility with Barclays Bank plc to a GBP45,000,000 facility

(being a GBP30,000,000 revolving credit facility and GBP15,000,000

term loan) in order to repay the Employee Benefit Trust loan. On 31

January 2015, the term loan was repaid by the Group. Interest

charged on the term loan was 1.10% per annum above LIBOR. Interest

charged on the revolving credit facility is 1.35% per annum above

LIBOR in addition to a 0.5% utilisation fee. The facility expires

on 10 August 2017. Arrangement fees of GBP298,000 (29 June 2014:

GBP372,000; 28 December 2014: GBP372,000) directly incurred in

relation to the facility are included in the carrying value of the

facility and are being amortised over the term of the facility; at

28 June 2015, amortisation of GBP207,000 (29 June 2014: GBP134,000;

28 December 2014: GBP208,000) had been recognised against the

carrying value of the facility. The facility is secured by an

unlimited cross-guarantee between the Company, Domino's Pizza UK

& Ireland Limited, DPG Holdings Limited, DP Realty Limited, DP

Pizza Limited and DP Group Developments Limited.

Bank overdraft facility

On 5 October 2012, the Company obtained an overdraft facility

from Barclays Bank plc for a maximum limit of GBP5,000,000 for

working capital purposes. The interest is charged at 1.25% per

annum above LIBOR. At 28 June 2015, there was GBPnil drawdown on

the facility (29 June 2014 and 28 December 2014: GBPnil).

Other loans

Other loans include loans entered into to acquire assets which

are then leased onto franchisees under finance lease arrangements.

The Group has an asset finance facility of GBP5,000,000 (29 June

2014 and 28 December 2014: GBP5,000,000) with a term of 5 years.

The balance drawn down on this facility and held within 'other

loans' as at 28 June 2015 is GBP2,599,000 (29 June 2014:

GBP2,455,000; 28 December 2014: GBP2,278,000). The loans are

repayable in equal instalments over a period of up to five years.

The loans are secured by a limited guarantee and indemnity by the

Company and Domino's Pizza UK & Ireland Limited (limited to an

annual sum of GBP300,000) and a mortgage charge over the assets

financed. The interest rate on these loans is fixed at an average

of 5.7% (29 June 2014: 5.8%; 28 December 2014: 5.5%).

12. SHARE-BASED PAYMENTS

The expense recognised for share-based payments in respect of

employee services received during the 26 weeks to 28 June 2015 is

GBP664,000 (29 June 2014: GBP538,000; 28 December 2014:

GBP899,000). This all arises on equity settled share-based payment

transactions.

13. RELATED PARTY TRANSACTIONS

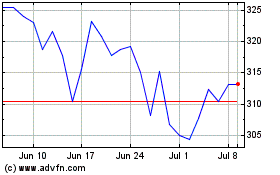

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Apr 2023 to Apr 2024