Domino's Pizza Group plc (the "Company") is a public limited

company incorporated in the United Kingdom under the Companies Acts

(registration number 03853545). The Company is domiciled in the

United Kingdom and its registered address is Domino's Pizza Group

plc, 1 Thornbury, West Ashland, Milton Keynes, MK6 4BB. The

Company's ordinary shares are traded on the London Stock Exchange.

Further copies of the Interim Report and Annual Report and Accounts

may be obtained from the address above.

2. BASIS OF PREPARATION

This interim report has been prepared in accordance with IAS 34

'Interim Financial Reporting'. The financial information contained

in this interim report does not constitute statutory accounts as

defined by Section 435 of the Companies Act 2006.

The interim results for the 26 weeks ended 28 June 2015 and the

comparatives to 29 June 2014 are unaudited, but have been reviewed

by the auditors. A copy of their review report has been included at

the end of this report.

The financial information for the 52 weeks ended 28 December

2014 has been extracted from the Group financial statements for

that period. These published financial statements were reported on

by the auditors without qualification or an emphasis of matter

reference and did not include a statement under section 498(2) or

(3) of the Companies Act 2006 and have been delivered to the

Registrar of Companies.

In the Group's 2014 Annual Report sales and cost of sales for

the 52 weeks ended 29 December 2013 were re-presented for the

Switzerland segment to more accurately present the classification

of internal sales. The corresponding re-presentation for the 26

weeks ended 29 June 2014 has resulted in an adjustment between

revenue and cost of sales for GBP1,164,000 and does not have a

profit impact on either the operating results of the segment or the

Group as a whole (see note 4).

As at 29 June 2014 quarterly rent in advance received from

franchisees of GBP4,297,000 (28 December 2014: GBP4,548,000) has

been reclassified within current deferred income to better

represent the nature of the liability, having previously been

disclosed as part of trade and other payables.

As at 29 June 2014 some credit balances in respect of rent-free

periods received from landlords and payable to franchisees have

been restated resulting in an increase of GBP876,000 (28 December

2014: GBP1,039,000) in non-current deferred income and GBP198,000

(28 December 2014: GBP247,000) in current deferred income;

previously GBP876,000 (28 December 2014: GBP1,039,000) of these

amounts were netting within non-current trade and other receivables

and GBP198,000 (28 December 2014: GBP247,000) in current trade and

other receivables. These adjustments had no effect on the income

statement of the respective periods.

The interim financial information has been prepared on the going

concern basis. This is considered appropriate, given the

considerable financial resources of the Group including the current

position of the banking facilities, together with long-term

contracts with its master franchisor, its franchisees and its key

suppliers.

The interim financial information is presented in sterling and

all values are rounded to the nearest thousand pounds (GBP000),

except when otherwise indicated.

Changes in accounting policy

The consolidated accounts for the 52 weeks ended 28 December

2014 were prepared in accordance with IFRS as adopted by the EU.

The accounting policies applied by the Group are consistent with

those disclosed in the Group's Annual Report and Accounts for the

52 weeks ended 28 December 2014. There are no new standards and

interpretations effective for the first time in 2015 that have a

material impact on this interim report.

3. REVENUE

Revenue recognised in the income statement is analysed as

follows:

(Unaudited) (Unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

28 June 29 June 28 December

2015 2014 2014

(restated)

GBP000 GBP000 GBP000

Royalties, corporate store

sales and sales to franchisees 149,506 137,226 277,305

Rental income on leasehold

and freehold property 7,746 8,296 16,945

Finance lease income 76 62 128

------------ ------------ ------------

157,328 145,584 294,378

------------ ------------ ------------

4. SEGMENT INFORMATION

For management purposes, the Group is organised into four

geographical business units based on the territories governed by

the Master Franchise Agreements ("MFA"): the United Kingdom,

Ireland, Germany and Switzerland. These are considered to be the

Group's operating segments as the information provided to the

Executive Directors of the Board, who are considered to be the

chief operating decision makers, is based on these territories.

Revenue included in each includes all sales (royalties, Supply

Chain Centre sales, rental income and finance lease income) made to

franchise stores and sales by corporate stores located in that

segment. Segment results for the Ireland segment include both the

Republic of Ireland and Northern Ireland as both of these

territories are served by the same Supply Chain Centre.

Management monitors the operating results of its business units

separately for the purpose of making decisions about resource

allocation and performance assessment. Segment performance is

evaluated based on operating profit or loss. Group financing

(including finance costs and finance revenue) and income taxes are

managed on a group basis and are not allocated to operating

segments.

Unallocated assets include cash and cash equivalents and

taxation assets. Unallocated liabilities include the bank revolving

facility, bank loans, deferred consideration and taxation

liabilities.

Following the representation of sales and cost of sales in the

Group's Annual Report and Accounts for the 52 weeks ended 28

December 2014 for the Switzerland segment, a representation has now

been made for the 26 weeks ended 29 June 2014 for the Switzerland

segment to more accurately present the classification of internal

sales. This has resulted in an adjustment between revenue and cost

of sales for GBP1,164,000 and does not have a profit impact on

either the operating results of the segment or the Group as a

whole.

Operating Segments

(Unaudited) 26 weeks ended

28 June 2015

Switzerland Germany Ireland United Total

Kingdom

GBP000 GBP000 GBP000 GBP000 GBP000

Segment revenue

Sales to external

customers 5,541 2,852 10,495 138,440 157,328

------------ -------- -------- --------- --------

Results

Segment result (670) (1,800) 2,618 31,096 31,244

Non-underlying - - - - -

items

Share of profit

of associates - - - 868 868

------------ -------- -------- --------- --------

Group operating

profit (670) (1,800) 2,618 31,964 32,112

Net finance costs (98)

Profit before

taxation 32,014

--------

Assets

Segment assets 9,340 1,737 2,800 100,587 114,464

Equity accounted

investments - - - 7,558 7,558

Unallocated assets 37,873

Total assets 9,340 1,737 2,800 108,145 159,895

------------ -------- -------- --------- --------

Liabilities

Segment liabilities 1,699 4,744 1,224 47,622 55,289

Unallocated liabilities 18,593

------------ -------- -------- --------- --------

Total liabilities 1,699 4,744 1,224 47,622 73,882

------------ -------- -------- --------- --------

(Unaudited) 26 weeks ended

29 June 2014 (restated)

Switzerland Germany Ireland United Total

Kingdom

GBP000 GBP000 GBP000 GBP000 GBP000

Segment revenue

Sales to external

customers 4,723 3,239 10,716 126,906 145,584

------------ -------- -------- --------- --------

Results

Segment result (386) (4,714) 2,502 26,940 24,342

Non-underlying

items (208) - (245) (453)

Share of profit

of associates - - - 389 389

------------ -------- -------- --------- --------

Group operating

profit (386) (4,922) 2,502 27,084 24,278

Profit on sale

of non-current

assets 194

Other gains

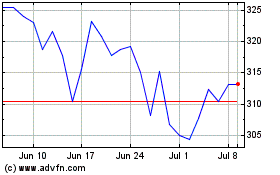

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Apr 2023 to Apr 2024