Domino's Pizza Group PLC Half Yearly Report -5-

July 28 2015 - 2:00AM

UK Regulatory

(unaudited) 2,586 23,981 425 (1) 561 - 39,004 66,556 - 66,556

Profit for

the period - - - - - - 23,040 23,040 - 23,040

Other

comprehensive

income -

exchange

differences - - - - 11 - - 11 - 11

Total

comprehensive

income for

the period - - - - 11 - 23,040 23,051 - 23,051

Proceeds

from share

issues 6 1,616 - - - - - 1,622 - 1,622

Purchase

of own shares - - - (2,237) - - - (2,237) - (2,237)

Vesting of

LTIP grants - - - - - - (2,769) (2,769) - (2,769)

Tax on employee

share options - - - - - - (257) (257) - (257)

Share options

and LTIP

charge - - - - - - 361 361 - 361

Equity dividends

paid - - - - - - (12,929) (12,929) - (12,929)

At 28 December

2014 2,592 25,597 425 (2,238) 572 - 46,450 73,398 - 73,398

----------------- ----------------- -------------- ----------- -------- ---------------- ---------------- ------------------ ------------------- ------------ -------------------

Profit for

the period - - - - - - 25,446 25,446 - 25,446

Other

comprehensive

expense -

exchange

differences - - - - (994) - - (994) - (994)

Total

comprehensive

income for

the period - - - - (994) - 25,446 24,452 - 24,452

Proceeds

from share

issue 12 3,183 - - - - - 3,195 - 3,195

Share

transaction

charges - - - - - - (9) (9) - (9)

Share option

and LTIP

charge - - - - - - 664 664 - 664

Tax on employee

share options - - - - - - 352 352 - 352

Equity dividends

paid - - - - - - (16,039) (16,039) - (16,039)

At 28 June

2015

(unaudited) 2,604 28,780 425 (2,238) (422) - 56,864 86,013 - 86,013

GROUP CASHFLOW STATEMENT

(Unaudited) (Unaudited)

26 weeks 26 weeks 52 weeks

ended ended ended

28 June 29 June 28 December

2015 2014 2014

(Restated) (Restated)

Cash flows from operating activities GBP000 GBP000 GBP000

Profit before taxation 32,014 24,965 53,797

Net finance costs 98 589 1,375

Share of post tax profits of

associates (868) (389) (1,047)

Amortisation and depreciation 3,027 2,693 5,824

Impairment 47 741 1,036

Loss / (profit) on disposal of

non-current assets 36 194 (1,147)

Release of contingent consideration - (1,082) -

Share option and LTIP charge 664 538 899

(Increase)/decrease in inventories (641) (344) (616)

Decrease /(increase) in receivables 2,144 2,263 (1,626)

(Decrease)/increase in payables (5,275) 3,140 11,447

Increase/(decrease) in deferred

income 140 (301) (339)

Decrease in provisions (546) (1,384) (1,100)

------------ ------------ ------------

Cash generated from operations 30,840 31,623 68,503

UK corporation tax paid (5,273) (2,672) (7,499)

Overseas corporation tax paid (28) (298) (612)

------------ ------------ ------------

Net cash generated by operating

activities 25,539 28,653 60,392

------------ ------------ ------------

Cash flows from investing activities

Interest received 81 496 186

Dividends received from associates 62 - 45

Decrease in loans to associates

and joint ventures 245 264 582

Decrease in loans to franchisees 1,305 1,745 3,275

Payments to acquire finance lease

assets (697) (953) (741)

Receipts from repayment of franchisee

finance leases 580 490 1,121

Purchase of property, plant and

equipment (2,342) (1,774) (4,412)

Deferred consideration for Domino's

Leasing Limited (631) (615) (1,208)

Purchase of other non-current

assets (2,555) (1,123) (2,532)

Receipts from the sale of non-current

assets - (265) 1,059

Settlement of deferred consideration - - (132)

Net cash used by investing activities (3,952) (1,735) (2,757)

------------ ------------ ------------

Cash inflow before financing 21,587 26,918 57,635

Cash flow from financing activities

Interest paid (183) (671) (807)

Issue of ordinary share capital 3,195 409 2,038

Purchase of own shares - - (2,243)

Payments under LTIP schemes (7) (140) (2,914)

New bank loans and facilities

draw down 3,765 2,685 31,912

Repayment of borrowings (15,595) (2,576) (56,253)

Equity dividends paid (16,039) (14,551) (27,480)

------------ ------------ ------------

Net cash used by financing activities (24,864) (14,844) (55,747)

------------ ------------ ------------

Net increase in cash and cash

equivalents (3,277) 12,074 1,888

Cash and cash equivalents at

beginning of period 33,743 31,597 31,597

Foreign exchange (loss) / gain

on cash and cash equivalents (332) (60) 258

------------ ------------ ------------

Cash and cash equivalents at

end of period 30,134 43,611 33,743

------------ ------------ ------------

NOTES TO THE GROUP INTERIM REPORT

1. GENERAL INFORMATION

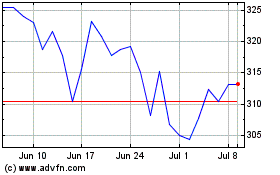

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Apr 2023 to Apr 2024