Dollar Strengthens On Improving U.S. Consumer Price Inflation

January 18 2017 - 4:35AM

RTTF2

The U.S. dollar climbed against its major rivals in the European

session on Wednesday, after data showed that the nation's consumer

price inflation improved in December, backing hopes for Fed rate

hikes this year.

Data from the Labor Department showed that U.S. consumer prices

increased in line with economist estimates in the month of

December.

The Labor Department said its consumer price index rose by 0.3

percent in December after edging up by 0.2 percent in November.

Excluding food and energy prices, the core consumer price index

crept up by 0.2 percent for the second consecutive month. The

uptick in core prices also matched economist estimates.

Investors await the NAHB housing market index for January due at

10:00 am ET and the Federal Reserve's Beige Book report later in

the day for more clues about the health of the economy.

Minneapolis Federal Reserve Bank President Kashkari is set to

speak at Minneapolis Urban League at 10:00 am ET, while Federal

Reserve Chair Janet Yellen will speak in San Francisco at 3:00 pm

ET.

The currency has been trading in a positive territory in the

Asian session.

The greenback bounced off to 1.0046 against the Swiss franc,

from a low of 1.0011 hit at 5:45 pm ET. The greenback is likely to

challenge resistance around the 1.03 zone.

The greenback, having fallen to 112.57 against the yen at 5:00

pm ET, reversed direction and was trading higher at 113.45.

Continuation of the greenback's uptrend may see it challenging

resistance around the 115.00 area.

The greenback reversed from an early session's low of 1.2417

against the pound and was trading up at 1.2283. The next possible

resistance for the greenback is seen around the 1.21 mark.

Data from the Office for National Statistics showed that the

U.K. unemployment rate remained stable in three months to November

and people claiming unemployment benefits declined

unexpectedly.

The unemployment rate came in at 4.8 percent, the lowest since

September 2005 and matched economists' expectations.

The greenback edged up to 1.0655 against the euro, following a

decline to 1.0715 at 5:00 pm ET. The greenback is seen finding

resistance around the 1.05 region.

Final data from Eurostat showed that Eurozone inflation climbed

as initially estimated in December.

Inflation rose to 1.1 percent in December from 0.6 percent in

November.

The greenback bounced off to 1.3121 against the loonie, 0.7543

against the aussie and 0.7180 against the kiwi, from its early lows

of 1.3038, 0.7567 and 0.7216, respectively. If the greenback

extends rise, 1.33, 0.74 and 0.70 are likely seen as its next

resistance levels against the loonie, the aussie and the kiwi,

respectively.

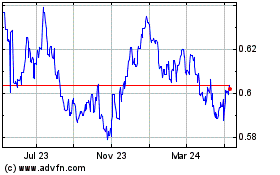

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

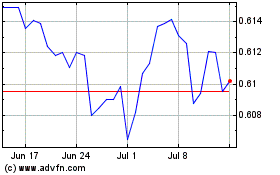

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024