Dollar Mostly Lower After Data Disappoints

January 15 2016 - 9:26AM

RTTF2

The dollar is losing ground against the Euro and the Japanese

Yen Friday afternoon, but is up against the British pound.

Investors were inundated with U.S. economic data this morning,

after a trading week that had been extremely light on data. Once

they were able to sift through the numerous reports, what they

discovered was a number of disappointing results.

Retail sales in the U.S. saw a modest decrease in the month of

December, according to a report released by the Commerce Department

on Friday. The report said retail sales edged down by 0.1 percent

in December following an upwardly revised 0.4 percent increase in

November.

Economists had expected sales to come in unchanged compared to

the 0.2 percent uptick originally reported for the previous

month.

With utilities output showing another substantial decrease, the

Federal Reserve released a report on Friday showing that U.S.

industrial production fell by more than expected in the month of

December. The report said industrial production dropped by 0.4

percent in December after slumping by a revised 0.9 percent in

November.

Economists had expected production to dip by 0.2 percent

compared to the 0.6 percent decrease originally reported for the

previous month.

Reflecting steep drops in prices for food and energy, the Labor

Department released a report on Friday showing that U.S. producer

prices fell by slightly more than expected in December. The Labor

Department said its producer price index for final demand dipped by

0.2 in December after rising by 0.3 percent in November. Economists

had expected prices to edge down by 0.1 percent.

Manufacturers in New York State saw a sharp deterioration in

business conditions in January, results of a key regional survey

showed Friday. Results were well below what economists were

predicting and marked the lowest levels in about 7 years. The

figures also showed a multi-year low in optimism.

The Federal Reserve Bank of New York said that its Empire State

index came in at negative 19.37 for January. This was down sharply

from the reading of negative 6.21 in December. Economists had

expected January's figure to improve slightly to negative 4.

Reflecting more positive expectations for future economic

growth, the University of Michigan released a report on Friday

showing that U.S. consumer sentiment has improved for the fourth

straight month in January.

The preliminary report said the consumer sentiment index climbed

to 93.3 in January from the final December reading of 92.6.

Economists had expected the index to inch up to 93.0.

Business inventories in the U.S. unexpectedly saw a modest

decrease in the month of November, according to a report released

by the Commerce Department on Friday. The report said business

inventories dipped by 0.2 percent in November after edging down by

a revised 0.1 percent in October.

Economists had expected inventories to come in unchanged,

matching the reading originally reported for the previous

month.

The dollar dropped to over a 2-week low of $1.0984 against the

Euro Friday, but has bounced back to around $1.0935 this

afternoon.

The euro area trade surplus hit a nine-month high in November as

exports increased amid fall in imports, Eurostat reported Friday.

The trade surplus rose to a seasonally adjusted EUR 22.7 billion

from EUR 19.8 billion in October. This was the highest since

February, when it totaled EUR 23.1 billion. Also, it stayed above

the expected level of EUR 21 billion.

Demand and availability for unsecured lending increased notably

in the fourth quarter, the latest Credit Conditions Survey from the

Bank of England showed Friday.

Banks reported a significant increase in demand for unsecured

lending in the fourth quarter. It was expected to increase again in

the first quarter.

Demand for buy-to-let lending increased significantly in the

fourth quarter, the bank said.

Meanwhile, demand for credit card lending fell notably at the

end of the year, but lenders expected this to reverse in the first

quarter.

Further, lenders said the availability of unsecured credit to

households especially personal loans increased in the fourth

quarter.

The buck has climbed to over a 5-year high of $1.4261 against

the pound sterling this afternoon, from around $1.4430 this

morning.

U.K. construction output dropped unexpectedly in November,

figures from the Office for National Statistics revealed Friday.

Construction output fell 0.5 percent month-on-month in November,

reversing a 0.2 percent rise in October. Economists had forecast a

0.5 percent rise for November.

The greenback has dropped to a 5-month low of Y116.501 against

the Japanese Yen Friday, from around Y117.800 this morning. The Yen

is benefitting from its safe haven status on an extremely weak day

for global equity markets.

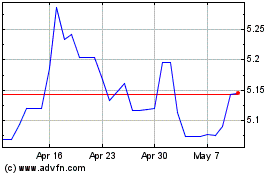

US Dollar vs BRL (FX:USDBRL)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs BRL (FX:USDBRL)

Forex Chart

From Apr 2023 to Apr 2024