Dollar Extends Slide As U.S. Economy Grows Less Than Expected

July 29 2016 - 5:29AM

RTTF2

The U.S. dollar continued to be lower against its key

counterparts in European deals on Friday, as the U.S. economy

expanded less than estimates in the second quarter.

The initial estimate released by the Commerce Department showed

that gross domestic product climbed by 1.2 percent in the second

quarter following a downwardly revised 0.8 percent increase in the

first quarter.

Economists had expected GDP to jump by 2.6 percent compared to

the 1.1 percent growth that had been reported for the previous

quarter.

Slowing growth could be a concern to Federal Reserve officials

who had acknowledged "diminishing near-term downside risks" in the

Fed statement and plan to raise rates this year.

Traders now await the University of Michigan's final consumer

sentiment index for July, which is expected to be revised upward to

90.6 from the preliminary reading of 89.5.

The greenback has been falling in the Asian session, extending

its post-FOMC losses, as the Fed statement appeared to reduce a

possible interest rate increase occurring in September.

Thursday, the dollar shed 0.2 percent against the euro, 0.5

percent against the franc and 0.10 percent against the pound as the

Fed gave little clues about a near-term rate hike.

The greenback declined to a 2-week low of 1.1139 against the

euro, compared to 1.1075 hit late New York Thursday. The greenback

is seen finding support around the 1.125 zone.

Flash estimate from Eurostat showed that Eurozone consumer

prices increased for the second straight month in July.

Consumer prices climbed 0.2 percent year-on-year, following a

0.1 percent rise in June. Prices were expected to rise again by 0.1

percent.

The greenback depreciated to 0.9721 against the Swiss franc, its

lowest since July 5. This marks a 0.9 percent decline from

Thursday's closing value of 0.9809. On the downside, 0.96 is likely

seen as the next support level for the greenback-franc pair.

Survey results by the think tank KOF showed that its economic

barometer unexpectedly rose for a second straight month in July to

its highest level in four months, signaling sustained favorable

prospects.

The KOF Economic Barometer rose to 102.7 from 102.6 in June,

which was revised from 102.4. Economists were looking for a lower

score of 101.4.

The greenback fell back to 102.88 against the Japanese yen,

hovering near its Asian session's 2-week decline of 102.71. This

may be compared to a 2-day high of 105.61 hit at 11:30 pm ET.

Continuation of the greenback's downtrend may see it challenging

support around the 100.00 mark.

The Bank of Japan raised the target for exchange-traded fund

purchases, while holding its interest rate.

The bank will increase the purchases of exchange-traded funds so

that their outstanding amount will rise at an annual pace of about

JPY 6 trillion.

The greenback was trading lower at 1.3219 against the pound, off

its early high of 1.3148. If the greenback continues decline, it

may test support around the 1.33 region.

Data from the Bank of England showed that U.K. mortgage

approvals declined to a one-year low in June.

The number of mortgages approved in June fell to 64,766 in June

from 66,722 in May. This was the lowest since May 2015, when

approvals totaled 64,174. It was forecast to drop to 65,500 in

June.

The greenback slipped to a 2-day low of 0.7563 against the

aussie and a 2-week low of 0.7173 against the kiwi, reversing from

its previous highs of 0.7493 and 0.7068, respectively. Extension of

the greenback's downtrend may see it challenging support around

0.765 against the aussie and 0.73 against the kiwi.

Retreating from a high of 1.3186 hit at 4:00 am ET, the

greenback edged down to 1.3120 against the loonie. The greenback is

poised to test support around the 1.30 mark.

Looking ahead, Chicago manufacturing survey results and

University of Michigan's final consumer sentiment for July are to

be released shortly.

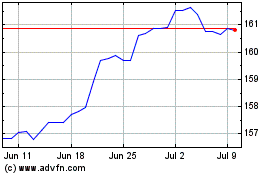

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024