Dollar Extends Advance After Better-than-expected Personal Income Data

March 30 2015 - 10:33AM

RTTF2

The U.S. dollar extended its early rally against its most major

rivals in early New York deals on Monday, following the release of

better-than-expected personal income data in the month of

February.

According to a report released by the Commerce Department, the

personal income climbed by 0.4 percent in February, matching the

upwardly revised increase seen in January.

Economists had been expecting income to rise by 0.3 percent.

Meanwhile, the report also showed that personal spending inched

up by 0.1 percent in February after dipping by 0.2 percent in

January.

The currency was already supported by expectations that the

Federal Reserve is on course to increase rates later this year. In

a speech at San Francisco on Friday, Fed Chair Janet Yellen told

that she expects the Fed to start normalising monetary policy later

this year, even though inflation and wage growth have not picked

up.

In the Asian session, the greenback was higher, adding onto

Friday's gains. The greenback rose by 0.17 percent versus the pound

and 0.03 percent against the euro on Friday.

The greenback appreciated to a 10-day high of 1.4752 against the

pound and a weekly high of 124.04 against the yen, compared to

Friday's closing values of 1.4869 and 119.10, respectively. If the

greenback continues rise, it may find resistance around 1.47

against the pound and 120.5 against the yen.

The greenback that closed last week's deals at 1.0885 against

the euro edged up to 1.0812. On the upside, the greenback may

challenge resistance around the 1.05 mark.

Survey figures from the European Commission showed that Eurozone

economic sentiment rose for the fourth successive month to its

highest level in nearly four years.

The economic sentiment index climbed to 103.9 from 102.3 in

February, revised from 102.1.

The greenback reached as high as 0.9672 against the franc at

3:00 am ET, before holding steady in subsequent trading. The

greenback-franc pair finished last week's trading at 0.9606.

The greenback spiked up to near a 2-week high of 0.7639 against

the aussie, 10-day highs of 1.2677 against the loonie and 0.7505

against the NZ dollar, up from last week's closing quotes of

0.7745, 1.2612 and 0.7561,respectively. The greenback may possibly

challenge resistance around 0.76 against the aussie, 1.28 against

the loonie and 0.745 against the kiwi.

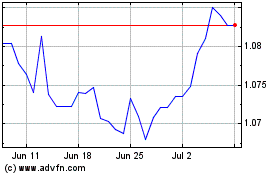

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

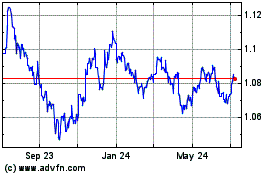

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024