Dollar Advances As Strong ADP Private Payrolls Data Raises Fed Rate Hike Hopes

November 30 2016 - 4:37AM

RTTF2

The U.S. dollar climbed against its most major counterparts in

the European session on Wednesday, after data showed that U.S.

private sector employment increased much more than expected in

November, adding to hopes for the Fed to hike rate in December.

Data from payroll processor ADP showed that private sector

employment jumped by 216,000 jobs in November following a

downwardly revised increase of 119,000 jobs in October.

Economists had expected employment to climb by about 160,000

jobs compared to the addition of 147,000 jobs originally reported

for the previous month.

The Commerce Department report showed a bigger than expected

increase in U.S. personal income in October, while personal

spending rose less than anticipated.

The Commerce Department said personal income climbed by 0.6

percent in October after rising by an upwardly revised 0.4 percent

in September.

Economists had expected income to rise by about 0.4 percent.

Investors now focus on the all-important nonfarm payrolls on

Friday for more indications about the health of the economy as well

as path of rate hike. The economy is expected to have added 170,000

jobs in November, with a jobless rate of 4.9 percent.

Optimism over OPEC meeting in Vienna is bolstering global stocks

as well as oil prices. An OPEC delegate reportedly said that the

cartel have finalized a plan to cut output by around 1.2 million

barrels per day to rein in oversupply.

The currency has been trading in a positive territory against

most major rivals in the Asian session, on the back of strong

revision to U.S. GDP data in the third quarter.

Reversing an early 2-day low of 1.0107 against the Swiss franc,

the greenback climbed to 1.0172. Continuation of the greenback's

uptrend may see it challenging resistance around the 1.04

region.

Data from the investment bank UBS showed that Swiss consumption

indicator improved on domestic tourism in October.

The consumption indicator rose to 1.49 points in October from

1.47 in September.

The greenback reached as high as 1.0610 against the euro,

following a 2-day low of 1.0666 hit at 6:15 am ET. Further gains

may take the greenback to a resistance around the 1.05 level.

Flash data from Eurostat showed that Eurozone inflation

accelerated as expected in November on food prices.

Inflation rose to 0.6 percent in November from 0.5 percent in

October.

The greenback spiked up to a 5-day high of 113.62 against the

Japanese yen, off its early low of 112.06. The greenback is seen

finding resistance near the 115.00 mark.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan's housing starts increased at a faster

pace in October.

Housing starts climbed 13.7 percent year-on-year in October,

following a 10 percent rise in September. Economists had forecast

growth to rise to 11 percent.

The greenback climbed to 0.7104 against the kiwi, after having

fallen to near a 3-week low of 0.7170 at 3:15 am ET. On the upside,

the greenback is likely to locate resistance near the 0.69

region.

The greenback rallied to 0.7421 against the aussie, its

strongest since November 25. Continuation of the greenback's

uptrend may see it challenging resistance around the 0.72

level.

On the flip side, the greenback fell back to 1.2485 against the

pound, from a high of 1.2419 hit at 5:30 am ET. The greenback is

likely to target support around the 1.26 mark.

The greenback remained lower against the loonie, after falling

to a 3-week low of 1.3357 at 6:35 am ET. The pair closed Tuesday's

trading at 1.3432.

Looking ahead, U.S. pending home sales data for October is due

shortly.

At 11:00 am ET, German Bundesbank President Jens Weidmann is

expected to speak at the Axica Conference Center, in Berlin.

At 11:45 am ET, Federal Reserve Governor Jerome Powell will

deliver a speech titled "The View from the Fed" at the Brookings

Institution, in Washington DC.

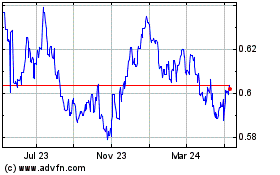

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

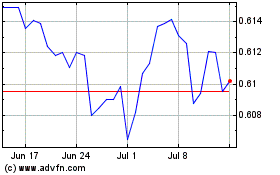

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024