Dollar Advances Ahead Of Jobs Data

March 06 2015 - 6:48AM

RTTF2

The U.S. dollar climbed against its major rivals in European

deals on Friday, as traders focus on the key U.S. jobs data for

February, due today, to assess whether the Federal Reserve is on

track toward a midyear liftoff of interest rates.

Economists expect the report to show an increase of about

230,000 jobs in February, down from 257,000 jobs in January and

pushing the unemployment rate down to 5.6 percent.

The U.S. private sector employment data reported earlier this

week was solid, in signs of steady recovery in labour market.

Focus on the jobs report was heightened as it is one of the most

important update on the labor market heading into the next Federal

Open Market Committee meeting on March 17-18.

Many economists expect the Fed could signal its openness to a

June rates lift-off by dropping a pledge to be "patient" in

considering a hike.

The greenback appreciated to 1.5162 against the Sterling, a

level unseen since February 5. Continuation of bullish trend may

lead greenback to a resistance around the 1.50 level. The pair was

worth 1.5237 at yesterday's close.

Britons' inflation expectations for a year fell to its lowest

level in more than 13 years and more people expect interest rates

to remain unchanged over the next 12 months, results of a quarterly

survey from the Bank of England showed.

Median expectations of inflation over the coming year were 1.9

percent, compared with 2.5 percent in November, the survey said. It

was the lowest since November 2001, when it was also 1.9

percent.

The greenback spiked up to 11-1/2-year high of 1.0962 against

the euro, compared to 1.1025 hit at yesterday's New York session

close. If the greenback extends gain, 1.084 is seen as its next

resistance level.

The Eurozone economy expanded as initially estimated in the

fourth quarter, second estimates from Eurostat showed.

Gross domestic product grew 0.3 percent sequentially, slightly

faster than the third quarter's 0.2 percent expansion.

The greenback appreciated to near 2-month high of 0.9777 against

the Swiss franc, up from Thursday's closing value of 0.9738. The

next possible resistance for the greenback-franc pair may be

located around the 1.00 mark.

The greenback climbed to 120.19 against the yen in Asian morning

deals and has been steady thereafter. Next key resistance for the

greenback is seen around the 122.00 region.

Looking ahead, U.S. jobs data for February, trade balance and

consumer credit - both for January and Canada trade data for

January are due in the New York session.

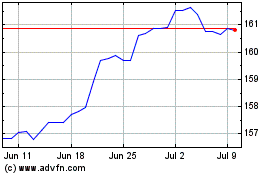

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024