Diploma PLC Trading Statement (7560I)

March 30 2015 - 2:00AM

UK Regulatory

TIDMDPLM

RNS Number : 7560I

Diploma PLC

30 March 2015

DIPLOMA PLC

12 CHARTERHOUSE SQUARE, LONDON EC1M 6AX

TELEPHONE: +44 (0)20 7549 5700

FACSIMILE: +44 (0)20 7549 5715

FOR IMMEDIATE RELEASE

30 March 2015

DIPLOMA PLC

TRADING UPDATE

Diploma PLC, the international group of businesses supplying

specialised technical products and services, is today issuing a

trading update for the six months ending 31 March 2015, ahead of

going into its close period.

Trading Summary

The businesses acquired during the past year have made a good

contribution to the Group's overall results and revenues for the

six months ending 31 March 2015 are expected to be ca. 9% ahead of

the comparable period. The acquired businesses have contributed ca.

9% to Group revenues, but currency volatility has continued to

impact the Group's results, reducing revenues by ca. 2%. On an

underlying basis, after adjusting for the impact of currencies and

acquisitions, revenues are expected to increase by ca. 2%.

The main driver to revenue growth has been from the Seals

businesses where revenues have benefited both from acquisitions

completed last year and from strong demand, particularly in the

North American Seals businesses. In Life Sciences, the recent

acquisition of the TPD business has contributed to a strong

increase in headline revenues. Underlying growth has been flat as

the Canadian Healthcare businesses have faced tougher markets, with

hospitals increasing their focus on controlling costs as they

approach the end of their budgetary fiscal year. In Controls,

underlying revenues have reduced against the strong prior year

comparative, reflecting lower activity in the Motorsport and

Aerospace fastener sectors and softer European industrial

markets.

Currency movements have continued to impact the Group's results

on both a translational and transactional basis. Further

depreciation against UK sterling, relative to last year, of the

Euro and the Canadian and Australian dollars, more than offset the

impact from the appreciation of the US dollar. The transactional

impact from currency depreciation on the Life Sciences businesses

has contributed to a slightly lower Group operating margin, as

anticipated.

Financial Position

After spending ca. GBP34m on completing the acquisitions of TPD

(Life Sciences) in October 2014 and Kubo (Seals) in early March

2015, the Group expects to have net debt of ca. GBP18m at 31 March

2015, compared with cash balances of GBP21.3m at 30 September

2014.

The Board will provide a further update on trading prospects for

the year when the Group's Half Year's results are announced on

Monday, 11 May 2015.

Note: A copy of this Statement, together with further

information about Diploma PLC, may be viewed on its website at

www.diplomaplc.com

+44 (0)20 7549

Diploma PLC - 5700

Bruce Thompson, Chief Executive

Officer

Nigel Lingwood, Group Finance

Director

+44 (0)20 7353

Tulchan Communications - 4200

David Allchurch

Martin Robinson

NOTE TO EDITORS:

Diploma PLC is an international group of businesses supplying

specialised technical products and services to the Life Sciences,

Seals and Controls industries.

Diploma's businesses are focussed on supplying essential

products and services which are funded by the customers' operating

rather than their capital budgets, providing recurring income and

stable revenue growth.

Our businesses design their individual business models to

closely meet the requirements of their customers, offering a blend

of high quality customer service, deep technical support and value

adding activities. By supplying essential solutions, not just

products, we build strong long term relationships with our

customers and suppliers, which support attractive and sustainable

margins.

Finally we encourage an entrepreneurial culture in our

businesses through our decentralised management structure. We want

our managers to feel that they have the freedom to run their own

businesses, while being able to draw on the support and resources

of a larger group. These essential values ensure that decisions are

made close to the customer and that the businesses are agile and

responsive to changes in the market and the competitive

environment.

The Group employs ca. 1,300 employees and its principal

operating businesses are located in the UK, Germany, US, Canada and

Australia.

Over the last five years, the Group has grown adjusted earnings

per share at an average of 20% p.a. through a combination of

organic growth and acquisitions. Diploma is a member of the FTSE

250 with a market capitalisation of ca. GBP900m.

Further information on Diploma PLC, together with a copy of this

Announcement, is available at www.diplomaplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTPGUWGWUPAGQM

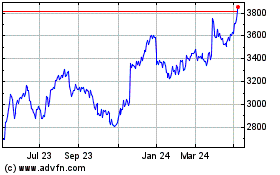

Diploma (LSE:DPLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

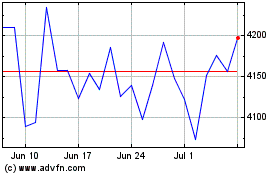

Diploma (LSE:DPLM)

Historical Stock Chart

From Apr 2023 to Apr 2024