TIDMDPLM

RNS Number : 2550Y

Diploma PLC

16 May 2016

DIPLOMA PLC

12 CHARTERHOUSE SQUARE, LONDON EC1M 6AX

TELEPHONE: +44 (0)20 7549 5700

FACSIMILE: +44 (0)20 7549 5715

FOR IMMEDIATE RELEASE

16 May 2016

ANNOUNCEMENT OF HALF YEAR RESULTS

FOR THE SIX MONTHSED 31 MARCH 2016

"Continued progress with a strong contribution from

acquisitions"

Unaudited Unaudited

Six months Six months

ended ended

31 March 31 March

2016 2015

GBPm GBPm

Revenue 179.1 163.2 +10%

Adjusted operating

profit(1) 30.8 29.6 +4%

Adjusted operating

margin(1) 17.2% 18.1%

Adjusted profit

before tax(1),(2) 30.4 29.3 +4%

Profit before tax 25.6 26.0 -2%

Profit after tax 18.5 18.7 -1%

Free cash flow(3) 23.0 12.4 +85%

Pence Pence

Adjusted earnings

per share(1),(2) 19.5 18.6 +5%

Basic earnings per

share 16.0 16.2 -1%

Interim dividend

per share 6.2 5.8 +7%

(1) Before acquisition related charges.

(2) Before fair value remeasurements.

(3) Before cash payments on acquisitions

and dividends.

Financial Highlights

* Revenue increased by 10%; businesses acquired

contributed 9% and underlying revenue increased by

2%.

* Adjusted operating margin reduced to 17.2% reflecting

continuing transactional currency effects in

Healthcare and initial dilution from acquired

businesses.

* Adjusted profit before tax increased by 4% to

GBP30.4m; adjusted EPS increased by 5% to 19.5p,

helped by slightly lower tax rate.

* Free cash flow increased by 85% to GBP23.0m,

benefitting from lower investment in working capital

and GBP2.3m from sale of legacy properties.

* Acquisition expenditure of ca. GBP30m in first half

(over GBP80m since January 2014).

* Strong financial position; net debt of GBP17.8m at

the end of March 2016 with significant resources

available.

* Interim dividend increased by 7% to 6.2p per share

reflecting confidence in Group's growth prospects.

Operational Highlights

-- Life Sciences revenues increased by 1% on a reported basis;

underlying revenues increased by 6% despite significant budget

pressures in the principal Healthcare markets.

-- Seals revenues increased by 22% on a reported basis,

benefitting from acquisitions of Kubo, Swan Seals and WCIS

completed during the past year; underlying revenues remained

unchanged against a strong comparative.

-- Controls revenues increased by 2% on a reported basis,

benefitting from the acquisitions of Cablecraft and Ascome;

underlying revenues decreased by 1% reflecting ongoing weakness in

UK Industrial markets.

-- Acquisitions of WCIS in Australia, Cablecraft in the UK and

Ascome in France extends the scope of the Seals and Controls

businesses respectively, opening up attractive new growth

opportunities.

Commenting on the results for the period, Bruce Thompson,

Diploma's Chief Executive said:

"The Group has delivered further robust growth in the first half

of the year, despite the weaker macro-economic backdrop and the

adverse impact of foreign exchange, with acquired businesses adding

9% to Group revenues.

These results reinforce the resilience of the Group's proven

business model which aims to deliver "GDP plus" organic revenue

growth, with value-creating acquisitions accelerating the growth to

the target double-digit level. Last year was a record year for

acquisitions and we have continued this momentum into the first

half of this year with acquisition spend of ca. GBP30m.

With challenging trading conditions likely to persist through

the second half of the year, we will continue to take advantage of

our strong financial position to target further acquisition

opportunities to support future growth and deliver shareholder

value."

Note:

1. Diploma PLC uses alternative performance measures as key

financial indicators to assess the underlying performance of the

Group. These include adjusted operating profit, adjusted profit

before tax, adjusted earnings per share, free cash flow and ROATCE.

All references in this Announcement to "underlying" revenues or

operating profits refer to reported results on a constant currency

basis and before any contribution from acquired businesses. The

narrative in this Announcement is based on these alternative

measures and an explanation is set out in note 2 to the

consolidated financial statements in this Announcement.

2. Certain statements contained in this Announcement constitute forward-looking statements. Such forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of Diploma PLC, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such statements. Such risks, uncertainties and other factors include, among others, exchange rates, general economic conditions and the business environment.

There will be a presentation of the results to analysts and

investors at 9.00am this morning at Pewterers' Hall, Oat Lane, City

of London, EC2V 7DE. This presentation will be made available as a

webcast from 2.00pm GMT via www.diplomaplc.com

For further information

please contact:

+44 (0)20 7549

Diploma PLC - 5700

Bruce Thompson, Chief Executive

Officer

Nigel Lingwood, Group Finance

Director

+44 (0)20 7353

Tulchan Communications - 4200

David Allchurch

Martin Robinson

NOTE TO EDITORS:

Diploma PLC is an international group of businesses supplying

specialised technical products and services to the Life Sciences,

Seals and Controls industries.

Diploma's businesses are focussed on supplying essential

products and services which are funded by the customers' operating

rather than their capital budgets, providing recurring income and

stable revenue growth.

Our businesses then design their individual business models to

closely meet the requirements of their customers, offering a blend

of high quality customer service, deep technical support and value

adding activities. By supplying essential solutions, not just

products, we build strong long term relationships with our

customers and suppliers, which support attractive and sustainable

margins.

Finally we encourage an entrepreneurial culture in our

businesses through our decentralised management structure. We want

our managers to feel that they have the freedom to run their own

businesses, while being able to draw on the support and resources

of a larger group. These essential values ensure that decisions are

made close to the customer and that the businesses are agile and

responsive to changes in the market and the competitive

environment.

The Group employs ca. 1,500 employees and its principal

operating businesses are located in the UK, Northern Europe, North

America and Australia.

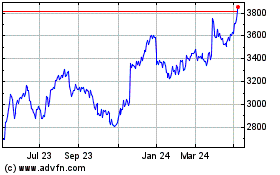

Over the last five years, the Group has grown adjusted earnings

per share at an average of ca. 20% p.a. through a combination of

organic growth and acquisitions. Diploma is a member of the FTSE

250 with a market capitalisation of ca. GBP850m.

Further information on Diploma PLC can be found at

www.diplomaplc.com

HALF YEAR REVIEW TO 31 MARCH 2016

The Group's revenues for the six months ended 31 March 2016

increased by 10% over the prior year comparable period, having

benefited from the good contributions made from businesses acquired

during the past year. The acquired businesses have contributed 9%

to Group revenues, but currency movements have reduced revenues by

1%, despite the weakening of UK sterling since the beginning of the

calendar year. On an underlying basis, after adjusting for

acquisitions and for currency effects on translation, Group

revenues increased by 2%.

In Life Sciences, underlying revenues increased by 6%, with

stronger capital equipment sales in certain businesses against weak

comparatives. Reported revenues in Life Sciences increased by 1%

due to the continuing impact of currency movements on translation

of the results of the Healthcare businesses. In Seals, reported

revenues were 22% ahead of last half year, reflecting the

contribution from the businesses acquired during the past year. On

an underlying basis, revenues were unchanged against the strong

prior year comparable. In Controls, reported revenues increased by

2%, helped by strong growth in the Specialty Fastener business and

with a good initial contribution from the recent Cablecraft

acquisition. The Interconnect and Fluid Controls businesses are

beginning to stabilise and on an underlying basis, Controls

revenues decreased by 1%.

Acquisitions remain an integral part of the Group's growth

strategy and the improving environment experienced last year has

continued into the first half of the current year. During the six

months ended 31 March 2016, the Group has invested GBP30.2m on

acquiring businesses, principally the acquisitions of WCIS in

October 2015 and Cablecraft in March 2016. Since January 2014, the

Group has invested over GBP80m in acquiring new businesses which in

aggregate will now be contributing over 20% to the Group's

annualised revenue.

As anticipated, operating margins reduced by 90bps to 17.2%,

compared with 18.1% in the prior year comparable period. This

reduction was driven principally by the impact on Healthcare

margins from further significant depreciation of the Canadian and

Australian dollars against the US dollar through 2015. Since

January 2016, there are signs that both the Canadian and Australian

currencies may have stabilised at more favourable levels; the

foreign exchange transactional impact on gross margins in the

second half of the year should therefore be modest compared with

the first half year.

Group operating margins have also been impacted by the initial

lower operating margins in businesses acquired since January 2014

and the investments made within these businesses. This impact has

been more than offset by operating leverage in the businesses and

Sector mix.

RESULTS AND DIVIDS

In the six months ended 31 March 2016, Group revenue increased

by 10% to GBP179.1m (2015: GBP163.2m). Adjusted operating profit

increased by 4% to GBP30.8m (2015: GBP29.6m) and adjusted operating

margins were 17.2% (2015: 18.1%). After adjusting for the

incremental contribution from acquisitions and for translational

currency effects, underlying revenues increased by 2%.

Adjusted profit before tax increased by 4% to GBP30.4m (2015:

GBP29.3m) and adjusted earnings per share increased by 5% to 19.5p

(2015: 18.6p), benefitting from a slightly lower tax rate. On a

reported basis, profit before tax was GBP25.6m (2015: GBP26.0m) and

basic earnings per share were 16.0p (2015: 16.2p).

The cash flow from operations in the period increased by 30% to

GBP31.8m (2015: GBP24.4m) after an investment in working capital of

GBP1.0m (2015: GBP6.8m). The Group's free cash flow for the period

increased by GBP10.6m to GBP23.0m (2015: GBP12.4m) due to the lower

investment in working capital and proceeds of GBP2.3m from the sale

of legacy properties. At 31 March 2016, the Group had net debt of

GBP17.8m.

The Group continues to follow a progressive dividend policy,

which targets dividend cover towards two times on an adjusted EPS

basis. The Directors have declared an increased interim dividend up

7% to 6.2p per share (2015: 5.8p), reflecting the Board's

confidence in the Group's growth prospects. The dividend will be

payable on 15 June 2016 to shareholders on the register on 27 May

2016.

OPERATING REVIEW

Life Sciences

The Life Sciences businesses are suppliers of consumables,

instrumentation and related services to the healthcare and

environmental industries.

Half Year

2016 2015

--------------------------- ---------- --------- -----

Revenue GBP52.5m GBP52.0m +1%

Adjusted operating profit GBP9.3m GBP10.3m -10%

Adjusted operating margin 17.7% 19.8%

--------------------------- ---------- --------- -----

On an underlying basis, after adjusting for currency and

acquisitions, Life Sciences revenues increased by 6% over the prior

year comparable period. Reported revenues increased by 1% due to

the continued weakness of the Canadian and Australian dollars,

which reduced revenues by 5% on translation.

Adjusted operating margins reduced by 210bps as gross margins in

the Healthcare businesses continued to be impacted on a

transactional basis by further depreciation of the Canadian and

Australian dollar relative to the US dollar, particularly in the

second half of 2015. Local management has continued to work closely

with suppliers and customers to obtain pricing support, but the

opportunity to mitigate the transactional foreign exchange impact

on gross margins through operating cost management is reducing.

The DHG group of Healthcare businesses, which account for ca.

85% of Life Sciences revenues, increased underlying revenues by 6%

in constant currency terms. In Canada, DHG revenues increased by 4%

despite the significant budget pressures throughout the Provincial

healthcare systems driven by the tough economic environment. Good

growth in revenues in the surgical products businesses, AMT and

Vantage, more than offset reduced revenues in the Somagen clinical

diagnostics business.

AMT continued to face pricing pressures in its core

electrosurgery business from the tender and evaluation processes

introduced by Provincial shared services organisations and

cross-Province group purchasing organisations. However, the

constrained growth in revenues from smoke evacuation products and

electrosurgical accessories has been offset by good growth in the

supply of specialised surgical instruments and devices used in

laparoscopic and other minimally invasive surgical procedures. In

particular, strong growth has been achieved with products sourced

from new suppliers which have been added in recent years and which

have extended AMT into new surgical product segments. Vantage

delivered good double digit growth across its consumable product

lines including argon plasma probes, reprocessor chemicals and

other GI endoscopy accessories, including specialist retrieval

devices. Results were also boosted by strong growth in revenues

across all of Vantage's core capital equipment product lines and in

new cost per procedure deals for endoscope placements; this strong

performance was against a weak prior year comparative which was

constrained last year by delayed budget approvals.

Somagen's core clinical diagnostics business continues to be

impacted by the freeze in capital spending in Quebec while the

Province completes both the creation of integrated Health Centres

under its "Bill 10" legislation and the Optilab reorganisation

program which is designed to achieve cost savings and efficiencies

within Quebec public medical laboratories. Growth has also been

impacted by the introduction of stricter patient testing criteria

in Alberta's colorectal screening program thus constraining the

number of patient tests. To counter these headwinds, Somagen has

generated good revenue growth from its successful a1c diabetes

testing program and has continued to invest in new product

introductions designed to extend Somagen's business into new growth

segments.

The Australian Healthcare sector has experienced similar

economic and budget pressures to Canada, but even against this

background, the BGS and DSL businesses have increased revenues by

13% in local currency terms. BGS continued to grow surgical product

revenues strongly, with smoke evacuation programmes in existing and

new accounts continuing to provide the main driver for growth.

There was also a steady sales performance in electrosurgical

grounding pads, laparoscopic electrodes and the enzymatic products

acquired from Chemzyme. In the DSL clinical diagnostic products

business, the solid growth in revenues has been driven by capital

equipment sales, in particular of capillary electrophoresis

instruments used in testing for multiple myelomas and diabetes.

Consumable product sales were broadly flat, reflecting softer prior

year capital equipment sales from which consumable product demand

is derived.

The TPD business was acquired at the beginning of the prior

financial year and is an established supplier to the Biotechnology,

Clinical Laboratory and Medical markets in Ireland and the UK. TPD

has performed very well since acquisition, posting double digit

revenue growth in its first full year with the Group and continuing

this strong growth into the new financial year. In January 2016,

TPD consolidated and relocated its operations into an adjacent

leased building, which had been refurbished and fitted out to meet

TPD's requirements at a total cost of GBP0.6m. This new facility

consolidates a number of fragmented, less efficient operations into

a single facility and provides significant capacity to support

DHG's growth ambitions in Europe.

The a1-group of Environmental businesses in Europe, which

account for ca. 15% of Sector revenues, saw revenues increase by 3%

in UK sterling terms. The a1-envirosciences business revenues

increased by 18% in Euro terms with strong sales of high end

elemental and trace analysers supplied to petrochemical industry

customers and environmental laboratories; sales of containment

enclosures for the safe weighing of hazardous materials also

delivered strong growth. In the a1-CBISS business, revenues

decreased by 8% in UK sterling terms with stable revenues from long

term service contracts, but reductions in revenues from continuous

emissions monitoring systems (CEMS) and gas detection products. The

sector remains buoyant with new Biomass and Energy from Waste (EFW)

plants an important part of the UK's energy portfolio, but

competition is increasing in new sites controlled by major EPC

contractors. a1-CBISS is responding by focusing on replacement

systems and owner-operator sites where its specialist knowledge and

customised software solutions give competitive advantage.

Seals

The Seals businesses are suppliers of seals, gaskets, filters,

cylinders, components and kits for heavy mobile machinery and

industrial equipment.

Half Year

2016 2015

--------------------------- --------- ---------- -----

Revenue GBP79.2m GBP64.8m +22%

Adjusted operating profit GBP13.4m GBP12.0m +12%

Adjusted operating margin 16.9% 18.5%

--------------------------- --------- ---------- -----

Reported revenues increased by 22% over the prior comparable

period. The Seals acquisitions completed during last year (Kubo and

Swan Seals) along with an initial contribution from the WCIS

acquisition (completed in October 2015), added 20% to Sector

revenues. Currency movements (principally the stronger US dollar

relative to UK sterling) contributed a further 2% to Sector

revenues; on an underlying basis, after adjusting for currency and

acquisitions, revenues were unchanged.

Adjusted operating margins in the Seals businesses decreased by

160bps to 16.9%, as the proportion of acquired businesses with

lower initial operating margins increased to ca. 30% of Sector

revenues.

The North American Seals businesses, which account for ca. 60%

of Seals sector revenues, saw revenues decrease by 3% on a constant

currency basis against strong prior year comparatives.

The HFPG Aftermarket businesses saw revenues decrease by 4%,

with the core Hercules Bulldog seals and gaskets revenues broadly

flat against strong comparatives, but with a substantial reduction

in HKX attachment kit revenues in a depressed market for new

excavators.

In the domestic US market, Hercules Bulldog revenues were

broadly flat, but with a modest recovery in the repair sector in

the second quarter. Specific growth initiatives are also gaining

traction, including the participation in buying portals to sell

seal kits to large rental fleets and contractors and the addition

of new product lines including lifting slings and aftermarket

cylinders for skid-steer equipment. Webstore revenues also continue

to increase and in the first half accounted for ca. 20% of domestic

US Aftermarket seal sales. Sales to smaller specialist

sub-distributors increased in the first half, but this growth was

offset by reduced sales to larger distribution customers who were

actively looking to reduce inventories.

In Canada, Hercules revenues increased by 2% in local currency

terms with improved market conditions in Canadian manufacturing,

offsetting the decline in resource markets. Growth however slowed

in the second quarter as orders reduced from hydraulic cylinder

manufacturing customers. Revenues from international markets

outside North America reduced by 1% with growth in Mexico and Asia

Pacific markets more than offset by reductions in resource

dependent markets in South and Central America.

The HKX attachment kit business experienced a significant

reduction in revenues reflecting the depressed market for new

excavators in the US and Canada. The increased percentage of

factory installed kits continues to impede HKX's standard kit

sales, but HKX continues to respond by marketing lower cost entry

level kits which are upgradeable to provide a more complete range

of capabilities.

The HFPG Industrial OEM businesses in North America (RT Dygert,

All Seals and J Royal) saw revenues reduce by 1% against a

background of generally slow industrial markets, still indirectly

impacted by the weak Oil & Gas sector and with slowing growth

in the Aerospace and Medical sectors. Sales to cylinder

manufacturers reduced as their businesses were impacted by loss of

business to offshore suppliers and sales to catalogue distributors

reduced reflecting again the weaker industrial markets.

The businesses responded by reinforcing their strong position

with their core industrial equipment customers, ensuring high

levels of customer service in support of existing projects, as well

as offering more specialised material and product specifications to

secure new projects with higher added-value. In particular, the

businesses looked for opportunities to deploy higher specification,

regulatory-compliant compounds for the Pharmaceutical, Water and

Food equipment industries and for fuel dispensing applications.

The EMEA Seals businesses, which now account for ca. 40% of

Sector revenues, increased revenues by 4% on an underlying basis,

after adjusting for currency effects and acquisitions.

The FPE Seals business has continued to make progress in

developing a more substantial, broader-based Aftermarket Seals

business in the EMEA region. From the beginning of the year, it has

been fully operational from its new facility in Darlington in the

UK, which now serves as the core operational hub for the further

expansion of FPE Seals across the region. FPE Seals has also taken

full responsibility for the sale of Bulldog branded seal and gasket

products in international markets outside the Americas. FPE Seals

revenues reduced in the half year due to the impact of delayed

product shipments from the Bulldog operation following its

relocation to Tampa in September 2015; however, back orders have

been substantially reduced going into the second half of the

year.

Kentek continued to respond well to challenging economic

conditions in its core markets of Russia and Finland, with

pressures on the region's economy caused by lower global demand in

the Oil & Gas and Mining sectors and from the negative impact

of US and EU sanctions on Russia. Despite these challenges and

further devaluation of the Russian Rouble, Kentek delivered strong

double digit growth in revenues in Euro terms. In Finland, the new

General Manager has given additional structure and impetus to the

sales efforts and in Russia, Kentek has seen good increases in

revenues from its newer sales offices as they establish their

presence across the region. Kentek has also benefited from

increased investment by the Russian government in the agricultural

and general manufacturing sectors and has also won a number of

tenders with key mining customers. During the period, Kentek

introduced a new own-branded filter range which is now gaining

traction.

M Seals delivered solid revenue growth in the half year in its

core markets of Denmark and Sweden. The first quarter performance

was held back by delayed orders from a number of key customers, but

orders started to be released in the second quarter against several

new projects with these customers. The growth in these core

markets, was offset by reduced revenues from the M Seals operations

in the UK, which have traditionally supplied to customers in the

Oil & Gas sector. M Seals has responded by increasing sales

efforts to specialised Industrial OEMs in other sectors.

Since its acquisition in March 2015, Kubo has faced a period of

contraction in its core industrial market in Switzerland, following

the decoupling of the Swiss Franc from the Euro in early 2015.

Against the background of these challenging market conditions, Kubo

has made progress in taking market share from competitors and on a

like-for-like basis, including pre-acquisition revenues, Kubo

revenues have remained broadly unchanged. Investment is being made

in a new seal machining centre which will be installed in May 2016

and will enable Kubo to respond quickly to urgent customer

requirements for specialised seals as well as replacing externally

sourced products. Kubo has also benefited from its prior year

investment in a custom gasket cutting machine in its Austrian

operations; this has delivered improved responsiveness and service

for maintenance and repair customers in process industries.

In October 2015, the Group completed the acquisition of WCIS, a

supplier of gaskets, seals and associated products and services

with operations in Australia and New Caledonia. WCIS has core

capabilities in soft and metallic gaskets and mechanical seals,

used in complex and arduous applications. WCIS is an important

extension of the Group's EMEA Seals activities into the Australasia

region. Since its acquisition, WCIS core customers in the Mining

and Energy sectors have faced difficult market conditions and this

has held back revenues as expected. However, progress has been made

in broadening sales and marketing activities in Australia and

reinforcing relationships with the key customer of WCIS in New

Caledonia.

Controls

The Controls businesses are suppliers of specialised wiring,

connectors, fasteners and control devices for technically demanding

applications.

Half Year

2016 2015

--------------------------- ---------- --------- -----

Revenue GBP47.4m GBP46.4m +2%

Adjusted operating profit GBP8.1m GBP7.3m +11%

Adjusted operating margin 17.1% 15.7%

--------------------------- ---------- --------- -----

Reported revenues increased by 2% against the prior year

comparable period. The acquisitions of Cablecraft and Ascome in

this half year added 3% to Sector revenues and currency effects on

translation were minimal. On an underlying basis, after adjusting

for these acquisitions, underlying revenues decreased by 1%.

Adjusted operating margins have increased by 140bps to 17.1%.

Gross margins have strengthened in the IS-Group and Specialty

Fasteners businesses, while operating costs as a percentage of

revenue have remained broadly stable across these businesses. The

operating margins of the newly acquired Cablecraft business have

also contributed to the improvement in the Sector average.

The Interconnect businesses account for ca. 75% of Sector

revenues. These businesses supply high performance wiring, harness

components, connectors and fasteners, used in technically demanding

applications, often in harsh environments. In the half year,

Interconnect revenues increased by 3% in UK sterling terms; after

adjusting for the Cablecraft and Ascome acquisitions and for

currency effects, underlying revenues decreased by 1%.

The IS-Group UK businesses saw revenues reduce by 9% in UK

sterling terms. Defence & Aerospace and Industrial markets in

the UK continued to be challenging, with the most significant

reductions being in sales to other distributors, both in the UK and

particularly in Continental European markets. Energy revenues also

showed a significant reduction against the prior year, partially

driven by the cut-backs in the Oil & Gas industry which have

impacted sales of harness components to sub-sea cable manufacturers

and other Oil & Gas related markets. In response to these

challenging conditions, sales resources have been realigned and

further business development programmes introduced; these

initiatives have produced a modestly improving trend in the second

quarter that has continued into April. In the US, Motorsport sales

were particularly buoyant and compensated for a small reduction in

Industrial sales.

In Germany, IS-Sommer and Filcon reported a 4% increase in

revenues in local Euro terms. IS-Sommer's sales in Industrial

markets showed modest growth, benefiting from a relatively stable

economic environment and strong business fundamentals. IS-Sommer

also delivered good revenue growth in the Aerospace and Defence

markets which compensated for a weaker performance in Motorsport.

In the Energy sector, IS-Sommer's principal involvement is in the

supply of products used in the repair and maintenance of the low

and medium-voltage Electricity network; these sales have held up

well, as 2016 is an assessment year for the German power network

which typically triggers a cyclical round of investments.

Filcon delivered a strong performance in the half year, driven

by increased sales to the Motorsport and Space industries.

Increased activity is also being seen in the Defence and Military

Aerospace sector, where there is growing pressure on Germany to

upgrade its military capabilities. The increased sales activity has

not yet translated into orders, but prospects for the second half

are more encouraging. In February 2016, Filcon completed the

acquisition of Ascome, a small distributor of specialist connectors

into the Defence and Industrial markets in France. This acquisition

gives critical mass to Filcon's operations in France, provides

credible access to the Defence sector and gives access to new

products and suppliers.

The Specialty Fasteners business (Clarendon and SFC) increased

revenues by 12% over the prior year comparable period. Last year,

Clarendon's deliveries to its key aircraft seating customer were

held back by programme changes, as well as from the implementation

by Clarendon of a new lineside supply project which initially

revealed surplus inventory at the customer. In this half year,

revenues increased strongly as the customer increased production

and deliveries of new inventory were resumed. Clarendon also had

success increasing sales to other aircraft seating and cabin

interiors manufacturers and sub-contractors across Europe.

Motorsport revenues returned to more normal levels after the

reduced development spend in the prior year and SFC continued to

grow sales of fastening solutions to a range of Industrial and

Defence customers.

In March 2016, the Group completed the acquisition of

Cablecraft, a leading supplier of cable accessory products which

are used to identify, connect, secure and protect electrical

cables; own-branded and manufactured products account for ca. 80%

of revenues. The Cablecraft business supplies to wholesalers,

distributors and end-users in a range of industries including

Electrical contracting, Control panels, Rail & signalling and

Energy & Utilities. The acquisition of Cablecraft broadens the

product range of the Controls businesses and the industrial markets

that it serves open up opportunities for cross-selling.

The Hawco Group of Fluid Controls businesses accounts for ca.

25% of Controls sector revenues and supply temperature, pressure

and fluid control products, with a high proportion of its products

being supplied to the Food and Beverage industry. Hawco Group

revenues were flat in UK sterling terms against the prior year

comparable period.

Hawco continues to face challenging market conditions in its

core Refrigeration equipment and Industrial OEM markets in the UK

and is responding by adding new product lines and extending into

export markets, including Turkey and Germany. Hawco saw an upturn

in sales to air conditioning and refrigeration contractors,

serviced increasingly through the company's web-site and through

independent trade counter partners; sourcing and fulfilment

contracts are also being established with major contracting

groups.

Abbeychart continued to achieve growth in revenues in its core

coffee segment, where the company is offering a broad portfolio of

essential parts to service the broad range of espresso type

machines being installed in an increasing number of outlets, as

customers reposition themselves from vending companies to coffee

specialists. In the water segment, revenues reduced as plumbed

water dispensers continue to lose share against individual bottled

water. To offset this decline, Abbeychart has focussed growth

initiatives in the craft brewing and export markets.

FINANCE

Free cash flow

The Group generated strong free cash flow of GBP23.0m (2015:

GBP12.4m) during the half year, maintaining tight control over

working capital in response to the more difficult trading

environment and helped by an incremental GBP2.3m of proceeds from

the sale of surplus legacy properties.

Operating cash flow increased by 30% to GBP31.8m (2015:

GBP24.4m), benefitting from a much lower investment in working

capital of GBP1.0m, compared with an investment of GBP6.8m in the

comparable period. A small seasonal increase in receivables and

inventories was largely offset by increased payables at the period

end. However despite this lower cash outflow into working capital,

the Group's metric of working capital to revenue was 18.0%,

compared with 17.0% at 30 September 2015, when working capital is

generally at its lowest point. Further reductions in working

capital, relative to trailing revenues, will be targeted in the

second half of the year which should bring this metric back to the

longer term average of ca. 17%.

Tax payments in the first half of the year increased to GBP8.7m

(2015: GBP7.3m), including GBP0.3m of tax payments relating to

pre-acquisition tax liabilities of those businesses acquired during

the period. On an underlying basis, the cash tax rate increased to

ca. 27% (2015: ca. 25%) reflecting a much lower benefit in the UK

from tax relief on the exercise of outstanding LTIP awards in 2015.

The Company's contribution to the Diploma Employee Benefit Trust in

connection with outstanding LTIP awards reduced to GBP0.3m compared

with GBP1.7m in the comparable period.

Capital expenditure of GBP1.6m (2015: GBP1.7m) included GBP0.5m

in Life Sciences on completing the refurbishment of the TPD

leasehold facility in Ireland which has now provided TPD with their

own independent and lower cost facility; a further GBP0.4m was

spent on acquiring field equipment in support of customer contracts

at hospitals and GBP0.2m was incurred on upgrading office and IT

facilities in the Canadian Healthcare businesses. In Seals, a new

seal cutting machine was acquired by FPE Seals for their Darlington

facility for GBP0.2m and GBP0.3m was invested on new warehouse

machinery in WCIS, Australia and on IT infrastructure in the US

seals businesses.

In addition to this expenditure, an initial amount of GBP0.2m

was spent on financing the construction of a new warehouse and

office facilities for J Royal, a Seals business based in North

Carolina in the United States. This facility is due to be completed

in January 2017 at a cost of ca. GBP2.0m and it is intended that

this facility will then be sold and leased back to J Royal. A

similar project was completed last year in the UK for FPE Seals, of

which GBP1.1m had been spent on construction in the comparable

period.

Net debt

At 31 March 2016, the Group had net debt of GBP17.8m, comprising

borrowings of GBP40.0m offset by cash balances of GBP22.2m,

compared with net cash of GBP3.0m at 30 September 2015. The

reduction in net cash funds of GBP20.8m was after spending GBP30.2m

(2015: GBP35.0m) on acquisitions and GBP14.4m (2015: GBP13.3m) on

dividends paid to ordinary and minority shareholders.

Acquisition expenditure of GBP30.2m comprised GBP29.5m on

acquiring new businesses and GBP0.7m on deferred consideration, as

described further in notes 10 and 11 to the financial

statements.

These acquisitions were funded out of existing cash resources

and from the utilisation of the Group's existing committed

revolving bank facility. In March 2016, the Group exercised its

accordion option again to increase this bank facility from GBP40m

to a maximum of GBP50m to assist with funding the acquisition of

Cablecraft.

On the basis of current financial projections and after

considering sensitivities, the Directors are confident that the

Group has sufficient resources to fund its operations for the

foreseeable future. The condensed set of consolidated financial

statements has therefore been prepared on a going concern

basis.

Exchange rates

A significant proportion of the Group's revenues (ca. 75%) are

derived from businesses located outside the UK, principally in the

US, Canada, Australia and Northern Europe. During the first quarter

of the financial year, UK sterling was stronger against most of the

major currencies in which the Group operates (other than the US

dollar) compared with last year. This more than offset the impact

from the weakening of UK sterling since January 2016. As a result,

the impact on the Group of translating the results of the Group's

overseas businesses into UK sterling has been to reduce Group

revenues by GBP1.3m and Group adjusted operating profit by GBP0.2m,

compared with the same period last year.

As previously reported, a large proportion of the Healthcare

businesses, which account for ca. 25% of Group revenues, are

impacted by exchange rate movements in the Canadian and Australian

dollars, relative to the currencies in which these businesses

purchase their products, primarily US dollars and Euros. The

substantial depreciation in the exchange rate of these two

currencies which began in late 2013, continued throughout the past

two years before peaking in mid January 2016. The ability of these

businesses to mitigate this transactional impact on gross margins

through a combination of foreign currency hedges, supplier cost

reductions and tight control over operating costs becomes more

limited over time. Accordingly in the period ended 31 March 2016,

there was ca. 400bps reduction in the gross margins of the

Healthcare businesses, compared with the comparable period arising

from further currency depreciation.

Transactional currency exposures in the rest of the Group's

businesses have generally been mitigated by currency hedging

contracts and therefore have not materially impacted the reported

results in this period.

RISKS AND UNCERTAINTIES

The principal risks and uncertainties which may have the largest

impact on performance in the second half of the year are the same

as those described in detail in pages 35-37 of the 2015 Annual

Report & Accounts. In summary these are:

-- Strategic risks - a downturn in major markets, loss of key

suppliers and/or major customers and supplier strategy change;

-- Operational risks - product liability and loss of key personnel; and

-- Financial risks - foreign currency risk and inventory obsolescence.

The Directors consider that the principal risks and

uncertainties have not changed since the publication of the 2015

Annual Report & Accounts and that they remain relevant for the

second half of the financial year. In particular, since a large

proportion of the Group's revenue and profits are generated

overseas, movements in the foreign exchange rates of these

territories remain a principal risk to financial performance.

The Directors have also considered the potential impact on the

Group's businesses from a UK vote in June 2016 to leave the

European Community ("Brexit") and do not believe that this would

materially impact the Group's outlook or viability.

CURRENT TRADING AND OUTLOOK

The Group has delivered further robust growth in the first half

of the year, despite the weaker macro-economic backdrop and the

adverse impact of foreign exchange, with acquired businesses adding

9% to Group revenues.

These results reinforce the resilience of the Group's proven

business model which aims to deliver "GDP plus" organic revenue

growth, with value-creating acquisitions accelerating the growth to

the target double-digit level. Last year was a record year for

acquisitions and we have continued this momentum into the first

half of this year with acquisition spend of ca. GBP30m.

With challenging trading conditions likely to persist through

the second half of the year, we will continue to take advantage of

our strong financial position to target further acquisition

opportunities to support future growth and deliver shareholder

value.

BM Thompson

Chief Executive Officer

16 May 2016

Responsibility Statement of the Directors in respect of the Half

Year Report 2016

We confirm that to the best of our knowledge:

-- the condensed set of consolidated financial statements has

been prepared in accordance with IAS 34 "Interim Financial

Reporting" as adopted by the EU; and

-- the Half Year Report includes a fair review of the information required by:

a) DTR4.2.7R of the Disclosure and Transparency Rules, being an

indication of the important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of consolidated financial statements; and a

description of the principal risks and uncertainties for the

remaining six months of the year; and

b) DTR4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last Annual Report & Accounts that could do

so.

The Directors of Diploma PLC and their respective

responsibilities are listed in the Annual Report & Accounts for

2015 and on the Company's website at www.diplomaplc.com.

By Order of the Board

BM Thompson NP Lingwood

Chief Executive Officer Group Finance Director

16 May 2016 16 May 2016

Condensed Consolidated Income Statement

For the six months ended 31 March 2016

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2016 2015 2015

Note GBPm GBPm GBPm

------------------------------- -------- ---------- ---------- --------

Revenue 3 179.1 163.2 333.8

Cost of sales (114.4) (103.9) (212.8)

--------------------------------- ------- ---------- ---------- --------

Gross profit 64.7 59.3 121.0

Distribution costs (4.0) (3.5) (6.8)

Administration costs (34.7) (29.9) (61.3)

--------------------------------- ------- ---------- ---------- --------

Operating profit 3 26.0 25.9 52.9

Gain on sale of properties 3 0.3 - -

Financial (expense)/income,

net 4 (0.7) 0.1 (1.1)

Profit before tax 25.6 26.0 51.8

Tax expense 5 (7.1) (7.3) (14.4)

--------------------------------- ------- ---------- ---------- --------

Profit for the period 18.5 18.7 37.4

--------------------------------- ------- ---------- ---------- --------

Attributable to:

Shareholders of the Company 18.1 18.3 36.7

Minority interests 0.4 0.4 0.7

--------------------------------- ------- ---------- ---------- --------

18.5 18.7 37.4

------------------------------- ------- ---------- ---------- --------

Earnings per share

Basic and diluted earnings 6 16.0p 16.2p 32.5p

--------------------------------- ------- ---------- ---------- --------

Alternative Performance 31 March 31 March 30 Sept

Measures (note 2) 2016 2015 2015

Note GBPm GBPm GBPm

------------------------------- ---------- --------- --------- --------

Operating profit 26.0 25.9 52.9

Add: Acquisition related

charges 9 4.8 3.7 7.4

Adjusted operating profit 3 30.8 29.6 60.3

Deduct: Net interest expense 4 (0.4) (0.3) (0.7)

-------------------------------- ---- ---- --------- --------- --------

Adjusted profit before

tax 30.4 29.3 59.6

-------------------------------- ---- ---- --------- --------- --------

Adjusted earnings per share 6 19.5p 18.6p 38.2p

-------------------------------- ---- ---- --------- --------- --------

Condensed Consolidated Statement of Income and Other

Comprehensive Income

For the six months ended 31 March 2016

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2016 2015 2015

GBPm GBPm GBPm

----------------------------------------- ---------- ---------- ---------

Profit for the period 18.5 18.7 37.4

------------------------------------------ ---------- ---------- ---------

Items that will not be reclassified

to the Consolidated Income Statement

Actuarial losses in the defined

benefit pension scheme - - (1.9)

Deferred tax on items that will

not be reclassified - - 0.4

------------------------------------------ ---------- ---------- ---------

- - (1.5)

------------------------------------------ ---------- ---------- ---------

Items that may be reclassified

to the Consolidated Income Statement

Exchange rate gains/(losses)

on foreign currency net investments 13.6 (2.1) (8.2)

(Losses)/gains on fair value

of cash flow hedges (1.1) 1.6 1.5

Net changes to fair value

of cash flow hedges transferred

to the Consolidated Income

Statement - - (0.3)

Deferred tax on items that

may be reclassified 0.3 (0.4) (0.3)

------------------------------------------- ---------- ---------- ---------

12.8 (0.9) (7.3)

----------------------------------------- ---------- ---------- ---------

Total Comprehensive Income for

the period 31.3 17.8 28.6

------------------------------------------ ---------- ---------- ---------

Attributable to:

Shareholders of the Company 30.6 17.8 28.1

Minority interests 0.7 - 0.5

------------------------------------------- ---------- ---------- ---------

31.3 17.8 28.6

----------------------------------------- ---------- ---------- ---------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 31 March 2016

Share

Share Transl. Hedging Retained -holders' Minority Total

capital reserve reserve earnings equity interest equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- ---------- ---------- ---------- ----------- ----------- ----------- ---------

At 1 October 2014 5.7 7.5 0.3 170.9 184.4 2.9 187.3

Total comprehensive

income - (2.1) 1.2 18.7 17.8 - 17.8

Share-based payments - - - 0.4 0.4 - 0.4

Acquisition of

businesses - -- -- -- -- 3.2 3.2

Minority interest

put option - - - (3.2) (3.2) - (3.2)

Minority interest

acquired - - - 1.2 1.2 (1.2) -

Tax on items recognised

directly in equity - - - - - - -

Notional purchase

of own shares - - - (1.7) (1.7) - (1.7)

Dividends - - - (13.1) (13.1) (0.2) (13.3)

-------------------------- ---------- ---------- ---------- ----------- ----------- ----------- ---------

At 31 March 2015

(unaudited) 5.7 5.4 1.5 173.2 185.8 4.7 190.5

Total comprehensive

income - (5.9) (0.3) 16.5 10.3 0.5 10.8

Share-based payments - - - 0.1 0.1 - 0.1

Tax on items recognised

directly in equity - - - - - - -

Notional purchase

of own shares - - - - - - -

Dividends - - - (6.6) (6.6) - (6.6)

-------------------------- ---------- ---------- ---------- ----------- ----------- ----------- ---------

At 30 September

2015 5.7 (0.5) 1.2 183.2 189.6 5.2 194.8

Total comprehensive

income - 13.3 (0.8) 18.1 30.6 0.7 31.3

Share-based payments - - - 0.2 0.2 - 0.2

Tax on items recognised

directly in equity - - - - - - -

Notional purchase

of own shares - - - (0.3) (0.3) - (0.3)

Dividends - - - (14.0) (14.0) (0.4) (14.4)

At 31 March 2016

(unaudited) 5.7 12.8 0.4 187.2 206.1 5.5 211.6

-------------------------- ---------- ---------- ---------- ----------- ----------- ----------- ---------

Condensed Consolidated Statement of Financial Position

As at 31 March 2016

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2016 2015 2015

Note GBPm GBPm GBPm

--------------------------------- ------ ---------- ---------- ---------

Non-current assets

Goodwill 9 109.2 91.3 89.3

Acquisition intangible

assets 9 58.4 43.1 40.2

Other intangible assets 1.1 0.8 1.2

Investment 0.7 0.7 0.7

Property, plant and equipment 22.9 22.7 22.8

Deferred tax assets 0.5 1.4 0.4

----------------------------------- ----- ---------- ---------- ---------

192.8 160.0 154.6

--------------------------------- ----- ---------- ---------- ---------

Current assets

Inventories 64.5 62.7 56.6

Asset in course of construction 3 0.2 1.1 -

Trade and other receivables 59.1 55.5 51.3

Cash and cash equivalents 8 22.2 18.6 23.0

----------------------------------- ----- ---------- ---------- ---------

146.0 137.9 130.9

--------------------------------- ----- ---------- ---------- ---------

Current liabilities

Trade and other payables (53.1) (48.7) (45.1)

Current tax liabilities (3.2) (4.3) (2.9)

Other liabilities 11 (2.3) (1.0) (2.5)

(58.6) (54.0) (50.5)

--------------------------------- ----- ---------- ---------- ---------

Net current assets 87.4 83.9 80.4

----------------------------------- ----- ---------- ---------- ---------

Total assets less current

liabilities 280.2 243.9 235.0

Non-current liabilities

Borrowings 8 (40.0) (33.5) (20.0)

Retirement benefit obligations (10.0) (8.1) (9.8)

Other liabilities 11 (8.3) (5.1) (4.1)

Deferred tax liabilities (10.3) (6.7) (6.3)

----------------------------------- ----- ---------- ---------- ---------

Net assets 211.6 190.5 194.8

----------------------------------- ----- ---------- ---------- ---------

Equity

Share capital 5.7 5.7 5.7

Translation reserve 12.8 5.4 (0.5)

Hedging reserve 0.4 1.5 1.2

Retained earnings 187.2 173.2 183.2

----------------------------------- ----- ---------- ---------- ---------

Total shareholders' equity 206.1 185.8 189.6

Minority interests 5.5 4.7 5.2

----------------------------------- ----- ---------- ---------- ---------

Total equity 211.6 190.5 194.8

----------------------------------- ----- ---------- ---------- ---------

Condensed Consolidated Cash Flow Statement

For the six months ended 31 March 2016

Unaudited Unaudited Audited

31 March 31 March 30 Sept

2016 2015 2015

Note GBPm GBPm GBPm

----------------------------------------- ---------- ---------- ---------

Operating profit 26.0 25.9 52.9

Acquisition related charges 7 4.8 3.7 7.4

Non-cash items 7 2.0 1.6 3.7

Increase in working capital 7 (1.0) (6.8) (1.9)

----------------------------------- ----- ---------- ---------- ---------

Cash flow from operating

activities 31.8 24.4 62.1

Interest paid, net (0.3) (0.2) (0.5)

Tax paid (8.7) (7.3) (15.4)

----------------------------------- ----- ---------- ---------- ---------

Net cash from operating

activities 22.8 16.9 46.2

----------------------------------- ----- ---------- ---------- ---------

Cash flow from investing

activities

Acquisition of businesses

(including expenses) 10 (29.5) (34.1) (36.6)

Deferred consideration paid 11 (0.7) (0.3) (0.6)

Purchase of property, plant

and equipment (1.5) (1.5) (4.0)

Assets in course of construction (0.2) (1.1) -

Purchase of other intangible

assets (0.1) (0.2) (0.3)

Proceeds from sale of property,

plant and equipment 2.3 - 0.1

----------------------------------- ----- ---------- ---------- ---------

Net cash used in investing

activities (29.7) (37.2) (41.4)

----------------------------------- ----- ---------- ---------- ---------

Cash flow from financing

activities

Acquisition of minority

interests 11 - (0.6) (0.6)

Dividends paid to shareholders 12 (14.0) (13.1) (19.7)

Dividends paid to minority

interests (0.4) (0.2) (0.2)

Purchase of own shares by

Employee Benefit Trust - (0.7) (0.7)

Notional purchase of own

shares on exercise of share

options (0.3) (1.0) (1.0)

Proceeds of borrowings,

net 8 20.0 33.5 20.0

Net cash generated/(used)

in financing activities 5.3 17.9 (2.2)

----------------------------------- ----- ---------- ---------- ---------

Net (decrease)/increase

in cash and cash equivalents 8 (1.6) (2.4) 2.6

Cash and cash equivalents

at beginning of period 23.0 21.3 21.3

Effect of exchange rates

on cash and cash equivalents 0.8 (0.3) (0.9)

----------------------------------- ----- ---------- ---------- ---------

Cash and cash equivalents

at end of period 22.2 18.6 23.0

------------------------------------------ ---------- ---------- ---------

Alternative Performance Measures 31 March 31 March 30 Sept

(note 2) 2016 2015 2015

GBPm GBPm GBPm

------------------------------- -------------------------------- --------- ---------------- ----------------

Net (decrease)/increase in

cash and cash equivalents (1.6) (2.4) 2.6

Add: Dividends paid to shareholders 14.0 13.1 19.7

Dividends paid to minority

interests 0.4 0.2 0.2

Acquisition of businesses

and minority interests 29.5 34.7 37.2

Deferred consideration

paid 0.7 0.3 0.6

Proceeds of borrowings,

Less: net (20.0) (33.5) (20.0)

------------------------------- ---------------------------------- --------- ---------------- ----------------

Free cash flow 23.0 12.4 40.3

------------------------------------------------------------------- --------- ---------------- ----------------

Cash and cash equivalents 22.2 18.6 23.0

Borrowings (40.0) (33.5) (20.0)

------------------------------------------------------------------- --------- ---------------- ----------------

Net (debt)/cash (17.8) (14.9) 3.0

------------------------------------------------------------------- --------- ---------------- ----------------

Notes to the Condensed Consolidated Financial Statements

For the six months ended 31 March 2016

1. BASIS OF PREPARATION AND PRINCIPAL ACCOUNTING POLICIES

Diploma PLC (the "Company") is a company registered and

domiciled in England and Wales. The condensed set of consolidated

financial statements (the "financial statements") for the six

months ended 31 March 2016 comprises the Company and its

subsidiaries (together referred to as the "Group").

The comparative figures for the financial year ended 30

September 2015 are not the Group's statutory accounts for that

financial year within the meaning of section 434 of the Companies

Act 2006. Those accounts have been reported on by the Company's

auditor and delivered to the Registrar of Companies. The report of

the auditor was (i) unqualified, (ii) did not include a reference

to any matters to which the auditors drew attention by way of

emphasis without qualifying their report, and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act 2006.

The figures for the six months ended 31 March 2015 were extracted

from the 2015 Half Year Report, which was unaudited.

The Group's audited consolidated financial statements for the

year ended 30 September 2015 are available on the Company's website

(www.diplomaplc.com) or upon request from the Company's registered

office at Diploma PLC, 12 Charterhouse Square, London, EC1M

6AX.

1.1 Statement of compliance

The financial statements included in this Half Year Announcement

for the six months ended 31 March 2016 have been prepared on a

going concern basis and in accordance with IAS 34, Interim

Financial Reporting as adopted by the European Union and the

Disclosure and Transparency Rules of the Financial Conduct

Authority. The financial statements do not include all of the

information required for full annual consolidated financial

statements and should be read in conjunction with the Group's

audited consolidated financial statements for the year ended 30

September 2015.

The Half Year financial statements were approved by the Board of

Directors on 16 May 2016; they have not been audited by the

Company's auditor.

1.2 Significant accounting policies

The accounting policies applied by the Group in this set of

financial statements are the same as those applied by the Group in

its audited consolidated financial statements for the year ended 30

September 2015, except for the amount included in the Half Year

Report in respect of taxation which has been calculated by applying

the Directors' best estimate of the annual rates of taxation to

taxable profits for the period. In the audited consolidated

financial statements for the full year, the taxation balances are

based on draft tax computations prepared for each business within

the Group. No new standards, amendments or interpretations have had

a material impact on the Group's reported results or financial

position.

1.3 Estimates and judgements

The preparation of these financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

The estimates and judgements made by management in applying the

Group's accounting policies and the key sources of uncertainty that

have the most significant effect on the amounts included within

these financial statements, were the same as those that applied to

the Group's audited consolidated financial statements for the year

ended 30 September 2015. These are set out on page 95 of the 2015

Annual Report & Accounts.

2. ALTERNATIVE PERFORMANCE MEASURES

The Group uses a number of alternative (non-Generally Accepted

Accounting Practice ("non-GAAP")) financial measures which are not

defined within IFRS. The Directors use these measures in order to

assess the underlying operational performance of the Group and as

such, these measures are important and should be considered

alongside the IFRS measures. The following non-GAAP measures are

referred to in this Half Year Announcement.

2.1 Adjusted operating profit

At the foot of the Condensed Consolidated Income Statement,

"adjusted operating profit" is defined as operating profit before

amortisation and impairment of acquisition intangible assets,

acquisition expenses, adjustments to deferred consideration

(collectively, "acquisition related charges"), the costs of a

material restructuring or rationalisation of operations and the

profit or loss relating to the sale of businesses or property. The

Directors believe that adjusted operating profit is an important

measure of the underlying operational performance of the Group.

2.2 Adjusted profit before tax

At the foot of the Condensed Consolidated Income Statement,

"adjusted profit before tax" is separately disclosed, being defined

as adjusted operating profit, after finance expenses (but before

fair value remeasurements under IAS 39 in respect of future

purchases of minority interests) and before tax. The Directors

believe that adjusted profit before tax is an important measure of

the underlying performance of the Group.

2.3 Adjusted earnings per share

"Adjusted earnings per share" ("EPS") is calculated as the total

of adjusted profit before tax, less income tax costs, but excluding

the tax impact on the items included in the calculation of adjusted

profit and the tax effects of goodwill in overseas jurisdictions,

less profit attributable to minority interests, divided by the

weighted average number of ordinary shares in issue during the

period. The Directors believe that adjusted EPS provides an

important measure of the underlying earning capacity of the

Group.

2.4 Free cash flow

At the foot of the Condensed Consolidated Cash Flow Statement,

"free cash flow" is reported, being defined as net cash flow from

operating activities, after net capital expenditure on fixed assets

and including proceeds received from business disposals, but before

expenditure on business combinations/investments and dividends paid

to both minority shareholders and the Company's shareholders. The

Directors believe that free cash flow gives an important measure of

the cash flow of the Group, available for future investment or

distribution to shareholders.

3. BUSINESS SECTOR ANALYSIS

Sector information is presented in this Half Year Announcement

in respect of the Group's business Sectors, which is the primary

basis of sector reporting. The business Sector reporting format

reflects the Group's management and internal reporting structure.

The geographic sector reporting represents results by origin. The

Group's financial results have not, historically, been subject to

significant seasonal trends. In the year ended 30 September 2015,

the Group earned 49% of its annual revenues and 49% of its annual

adjusted operating profits in the first six months of the year.

Adjusted operating

Revenue profit Operating profit

31 31 30 31 31 30 31 31 30

Mar Mar Sept Mar Mar Sept Mar Mar Sept

2016 2015 2015 2016 2015 2015 2016 2015 2015

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------- ------ ------ ------ ------- ------ ------ ------- ------ ------

By Sector

Life Sciences 52.5 52.0 103.1 9.3 10.3 21.0 7.9 8.6 17.9

Seals 79.2 64.8 139.6 13.4 12.0 24.8 10.9 10.4 21.2

Controls 47.4 46.4 91.1 8.1 7.3 14.5 7.2 6.9 13.8

---------------- ------ ------ ------ ------- ------ ------ ------- ------ ------

179.1 163.2 333.8 30.8 29.6 60.3 26.0 25.9 52.9

---------------- ------ ------ ------ ------- ------ ------ ------- ------ ------

By Geographic

Area

United Kingdom 43.5 43.8 87.7 6.9 7.0 14.5

Rest of Europe 49.7 34.5 77.1 7.3 5.7 11.7

North America 85.9 84.9 169.0 16.6 16.9 34.1

179.1 163.2 333.8 30.8 29.6 60.3

---------------- ------ ------ ------ ------- ------ ------

In the six months ended 31 March 2016 the newly acquired

businesses of WCIS, Cablecraft and Ascome as described in Note 10,

contributed GBP4.7m to revenue and GBP0.8m to adjusted operating

profit; after acquisition related charges of GBP1.2m, the

contribution to operating profit was a loss of GBP0.4m. The results

of WCIS are included within the Seals Sector and Cablecraft and

Ascome are included within the Controls Sector. Cablecraft is

reported within the Geographic Area of the United Kingdom and WCIS

and Ascome are reported within the Rest of Europe.

Total assets Total liabilities Net assets

31 31 30 31 31 30 31 31 30

Mar Mar Sept Mar Mar Sept Mar Mar Sept

2016 2015 2015 2016 2015 2015 2016 2015 2015

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------- ------ ------ ------ -------- -------- ------- ------- ------- -------

By Sector

Life Sciences 97.3 95.4 89.3 (15.3) (14.6) (14.7) 82.0 80.8 74.6

Seals 132.1 119.9 115.7 (18.5) (22.8) (16.2) 113.6 97.1 99.5

Controls 84.7 56.7 52.6 (18.7) (16.2) (13.5) 66.0 40.5 39.1

Unallocated

assets/(liabilities) 24.7 25.9 27.9 (74.7) (53.8) (46.3) (50.0) (27.9) (18.4)

----------------------- ------ ------ ------ -------- -------- ------- ------- ------- -------

338.8 297.9 285.5 (127.2) (107.4) (90.7) 211.6 190.5 194.8

----------------------- ------ ------ ------ -------- -------- ------- ------- ------- -------

Sector assets exclude cash and cash equivalents, deferred tax

assets and corporate assets that cannot be allocated on a

reasonable basis to a business sector. Sector liabilities exclude

borrowings, retirement benefit obligations, deferred tax

liabilities and corporate liabilities that cannot be allocated on a

reasonable basis to a business sector. These items that cannot be

allocated on a reasonable basis to a business sector are shown

collectively as "unallocated assets/ (liabilities)".

Capital expenditure Depreciation

31 31 Mar 30 Sept 31 Mar 31 Mar 30 Sept

Mar

2016 2015 2015 2016 2015 2015

GBPm GBPm GBPm GBPm GBPm GBPm

--------------- ------ ------- -------- ------- ------- --------

By Sector

Life Sciences 1.1 0.9 2.5 0.9 0.8 1.7

Seals 0.5 0.6 1.5 0.8 0.4 1.3

Controls - 0.2 0.3 0.3 0.2 0.5

1.6 1.7 4.3 2.0 1.4 3.5

--------------- ------ ------- -------- ------- ------- --------

During the period, GBP0.2m of capital expenditure was also

incurred in connection with the construction of a new facility at J

Royal in North Carolina, US, which is due to be completed in

January 2017. In 2015, GBP1.1m was incurred in connection with

constructing a new facility for FPE Seals in Darlington, UK which

was completed in September 2015. This expenditure has been included

in the Condensed Consolidated Statement of Financial Position as an

"Asset in course of construction".

Properties with a net book value of GBP2.0m were disposed of by

the Group during the six months ended 31 March 2016, resulting in a

net gain on disposal of GBP0.3m (2015: Nil).

4. FINANCIAL INCOME/(EXPENSE), NET

31 March 31 March 30 Sept

2016 2015 2015

GBPm GBPm GBPm

---------------------------------------------------------- --------- --------- --------

Interest expense and similar

charges

- bank facility and commitment

fees (0.1) (0.1) (0.2)

- interest payable on bank

and other borrowings (0.2) (0.1) (0.3)

* notional interest expense on the defined benefit

pension schemes (0.1) (0.1) (0.2)

Interest expense and similar

charges (0.4) (0.3) (0.7)

* fair value remeasurement of put options (note 11) (0.3) 0.4 (0.4)

---------------------------------------------------------- --------- --------- --------

Financial (expense)/income,

net (0.7) 0.1 (1.1)

---------------------------------------------------------- --------- --------- --------

5. TAXATION

31 March 31 March 30 Sept

2016 2015 2015

GBPm GBPm GBPm

------------------------------- --------- --------- --------

UK corporation tax 0.9 1.7 1.5

Overseas tax 6.2 5.6 12.9

Total tax on profit for the

period 7.1 7.3 14.4

------------------------------- --------- --------- --------

Taxation on profits before tax has been calculated by applying

the Directors' best estimate of the annual rates of taxation to

taxable profits for the period. The effective rate of taxation on

profit before tax for the period decreased to 27.7% (2015: 28.1%).

The Group's adjusted effective rate of tax on adjusted profit

before tax decreased to 26.0% (2015: 27.0%) reflecting a larger

contribution to profits before tax this period from the acquired

businesses that are taxed at lower tax rates.

6. EARNINGS PER SHARE

Basic and diluted earnings per share

Basic and diluted earnings per ordinary 5p share are calculated

on the basis of the weighted average number of ordinary shares in

issue during the period of 113,050,602 (2015: 112,995,991) and the

profit for the period attributable to shareholders of GBP18.1m

(2015: GBP18.3m). There were no potentially dilutive shares.

Adjusted earnings per share

Adjusted earnings per share, defined in note 2, are calculated

as follows:

31 31 30 31 31 30

Mar Mar Sept Mar Mar Sept

2016 2015 2015 2016 2015 2015

pence pence pence

per per per

share share share GBPm GBPm GBPm

------------------------------- ------- -------- ------- ------- ------- -------

Profit before tax 25.6 26.0 51.8

Tax expense (7.1) (7.3) (14.4)

Minority interests (0.4) (0.4) (0.7)

------------------------------- ------- -------- ------- ------- ------- -------

Earnings for the period

attributable to

shareholders of the

Company 16.0 16.2 32.5 18.1 18.3 36.7

Acquisition related

charges 4.2 3.3 6.5 4.8 3.7 7.4

Fair value remeasurement

of put options 0.3 (0.4) 0.4 0.3 (0.4) 0.4

Gain on sale of properties (0.3) - - (0.3) - -

Tax effects on acquisition

related charges

and fair value remeasurements (0.7) (0.5) (1.2) (0.8) (0.6) (1.3)

Adjusted earnings 19.5 18.6 38.2 22.1 21.0 43.2

------------------------------- ------- -------- ------- ------- ------- -------

7. RECONCILIATION OF CASH FLOW FROM OPERATING ACTIVITIES

31 March 31 March 30 Sept

2016 2015 2015

GBPm GBPm GBPm

-------------------------------------- --------- --------- --------

Operating profit 26.0 25.9 52.9

Acquisition related charges (note

9) 4.8 3.7 7.4

-------------------------------------- --------- --------- --------

Adjusted operating profit 30.8 29.6 60.3

-------------------------------------- --------- --------- --------

Depreciation or amortisation of

tangible and other intangible

assets 2.0 1.4 3.5

Share-based payments expense 0.2 0.4 0.5

Cash paid into defined benefit

schemes (0.2) (0.2) (0.3)

-------------------------------------- --------- --------- --------

Non-cash items 2.0 1.6 3.7

-------------------------------------- --------- --------- --------

Increase in inventories (2.0) (4.4) -

(Increase)/decrease in trade and

other receivables (1.5) (2.4) 0.2

Increase/(decrease) in trade and

other payables 2.5 - (2.1)

-------------------------------------- --------- --------- --------

Increase in working capital (1.0) (6.8) (1.9)

-------------------------------------- --------- --------- --------

Cash flow from operating activities,

before acquisition expenses 31.8 24.4 62.1

-------------------------------------- --------- --------- --------

8. NET DEBT

The movement in net debt during the period is as follows:

31 March 31 March 30 Sept

2016 2015 2015

GBPm GBPm GBPm

---------------------------- ----------- ----------- ---------------------

Net (decrease)/increase in (1.6) (2.4) 2.6

cash and cash equivalents

Increase in borrowings (20.0) (33.5) (20.0)

---------------------------- ----------- ----------- ---------------------

(21.6) (35.9) (17.4)

Effect of exchange rates 0.8 (0.3) (0.9)

Movement in net debt/cash (20.8) (36.2) (18.3)

Net cash at beginning of

period 3.0 21.3 21.3

---------------------------- ----------- ----------- ---------------------

Net (debt)/cash at end of

period (17.8) (14.9) 3.0

---------------------------- ----------- ----------- ---------------------

Comprising:

Cash and cash equivalents 22.2 18.6 23.0

Borrowings (40.0) (33.5) (20.0)

---------------------------- ----------- ----------- ---------------------

Net (debt)/cash at end of

period (17.8) (14.9) 3.0

---------------------------- ----------- ----------- ---------------------

The Group has a committed multi-currency revolving facility of

GBP50m (2015: GBP40m) which expires on 23 June 2017. On 7 March

2016, the Group exercised its accordion option to increase the

committed bank facility from GBP40m to a maximum facility of

GBP50m. At 31 March 2016, the Group has utilised GBP40.0m (2015:

GBP33.5m) of this increased facility. Interest on this facility is

payable between 120 and 170bps over LIBOR, depending on the ratio

of net debt to EBITDA.

9. GOODWILL AND INTANGIBLE ASSETS

Acquisition

intangible

Goodwill assets

GBPm GBPm

------------------------------------- ----------- ------------

At 1 October 2014 80.2 28.6

Acquisitions 12.6 18.2

Adjustment to acquisitions in prior

year 0.1 0.2

Amortisation charge - (3.3)

Exchange adjustments (1.6) (0.6)

At 31 March 2015 91.3 43.1

Acquisitions 1.1 1.6

Amortisation charge - (3.6)

Exchange adjustments (3.1) (0.9)

------------------------------------- ----------- ------------

At 30 September 2015 89.3 40.2

Acquisitions (note 10) 13.5 19.4

Amortisation charge - (4.2)

Exchange adjustments 6.4 3.0

At 31 March 2016 109.2 58.4

------------------------------------- ----------- ------------

Goodwill of GBP13.5m and acquisition intangible assets of

GBP19.4m arose on the acquisition of businesses in the period and

related to the Seals and Controls Sectors.

Goodwill represents the amount paid for future sales growth from

both new customers and new products, operating cost synergies and

employee know-how. The acquisition intangible assets relate to

supplier and customer relationships and these assets will be

amortised over five to ten years.

Acquisition related charges of GBP4.8m (2015: GBP3.7m), which

are charged to the Consolidated Income Statement, comprised GBP4.2m

(2015: GBP3.3m) of amortisation of acquisition intangible assets

and GBP0.6m (2015: GBP0.4m) of acquisition expenses, net.

10. ACQUISITION OF SUBSIDIARIES

On 12 October 2015 the Group completed the acquisition of 100%

of West Coast Industrial Supplies Pty Limited based in Perth,