Diploma PLC Acquisition (4560R)

March 09 2016 - 2:00AM

UK Regulatory

TIDMDPLM

RNS Number : 4560R

Diploma PLC

09 March 2016

DIPLOMA PLC

12 CHARTERHOUSE SQUARE, LONDON EC1M 6AX

TELEPHONE: +44 (0)20 7549 5700

FACSIMILE: +44 (0)20 7549 5715

FOR IMMEDIATE RELEASE

9 March 2016

DIPLOMA PLC

DIPLOMA ACQUIRES CABLECRAFT LIMITED FOR A MAXIMUM

NET CASH CONSIDERATION OF GBP26.0M

Diploma PLC, the international group of businesses supplying

specialised technical products and services, is pleased to announce

the acquisition of 100% of Cablecraft Limited ("Cablecraft"), a

group of businesses headquartered near Dunstable in the UK and

providing essential cable identification, management and

termination products and solutions to a broad base of primarily UK

based customers. This transaction will be immediately earnings

enhancing to the Group and will be reported as part of the Controls

Sector activities.

Cablecraft is a long established and leading supplier of cable

accessory products which are used to identify, connect, secure and

protect electrical cables. The business supplies to wholesalers,

distributors and end-users in a range of industries including

Electrical contracting, Control panel building, Rail and signalling

engineering and Energy & Utilities.

Cablecraft supplies products from leading branded manufacturers,

but also manufactures the Betaduct branded range of control panel

trunking from its Tewkesbury facility and manufactures heat

shrinkable sleevings and specialist thermal insulation products

from its facility in Plymouth. The Cablecraft group of businesses

employs 98 staff across its three locations in the UK.

Prior to acquisition, Cablecraft was owned by Christopher Jenart

and Ian King-Lee, joint Managing Directors and their immediate

family (Linda Jenart and Susan King-Lee). Both Christopher Jenart

and Ian King-Lee will remain with the business in their current

roles until at least 31 March 2017 to ensure a smooth management

transition.

Audited consolidated financial statements for the year ended 31

March 2015 reported that profit before tax for Cablecraft was

GBP3.5m on revenues of GBP15.4m; the remuneration of the Managing

Directors has largely been taken in the form of dividends, rather

than salaries. Gross assets at 31 March 2015 were GBP11.0m.

The initial net cash consideration to be paid on Completion will

be GBP21.0m, before acquisition costs, which will be met from the

Group's existing cash resources and revolving bank credit facility.

Deferred consideration up to a maximum of GBP5.0m will be payable

based on Earnings Before Interest and Tax achieved in each of the

12 month periods ending 31 March 2016 and 2017.

At Completion, net assets are expected to be ca. GBP10m,

including cash of ca. GBP6m and freehold property of GBP1.1m, which

will be sold to the vendors and leased back to the business. The

cash and the property proceeds will be included in the gross

consideration.

Bruce Thompson, Chief Executive of Diploma PLC said:

"The acquisition of Cablecraft is an exciting addition to our

Controls Sector. It supplies a range of essential products that are

similar to those supplied by the IS-Group but extends substantially

both the product range and the industrial end markets served. The

acquisition fits very well with Diploma's strategy of building a

larger, broader base of specialised businesses in the Controls

Sector. The acquisition also opens up opportunities for cross

selling products with Diploma's other Controls Sector

businesses."

+44 (0)20 7549

Diploma PLC - 5700

Bruce Thompson, Chief Executive

Officer

Nigel Lingwood, Group Finance

Director

+44 (0)20 7353

Tulchan Communications - 4200

David Allchurch

Martin Robinson

NOTE TO EDITORS:

Diploma PLC is an international group of businesses supplying

specialised technical products and services to the Life Sciences,

Seals and Controls industries.

Diploma's businesses are focussed on supplying essential

products and services which are funded by the customers' operating

rather than their capital budgets, providing recurring income and

stable revenue growth.

Our businesses then design their individual business models to

closely meet the requirements of their customers, offering a blend

of high quality customer service, deep technical support and value

adding activities. By supplying essential solutions, not just

products, we build strong long term relationships with our

customers and suppliers, which support attractive and sustainable

margins.

Finally we encourage an entrepreneurial culture in our

businesses through our decentralised management structure. We want

our managers to feel that they have the freedom to run their own

businesses, while being able to draw on the support and resources

of a larger group. These essential values ensure that decisions are

made close to the customer and that the businesses are agile and

responsive to changes in the market and the competitive

environment.

The Group employs ca. 1,500 employees and its principal

operating businesses are located in the UK, Northern Europe, North

America and Australia.

Over the last five years, the Group has grown adjusted earnings

per share at an average of ca. 15% p.a. through a combination of

organic growth and acquisitions. Diploma is a member of the FTSE

250 with a market capitalisation of ca. GBP850m.

Further information on Diploma PLC, together with a copy of this

Announcement, is available at www.diplomaplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQAKFDNABKDONK

(END) Dow Jones Newswires

March 09, 2016 02:00 ET (07:00 GMT)

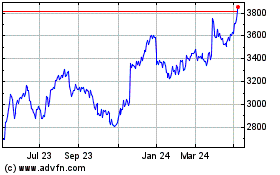

Diploma (LSE:DPLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

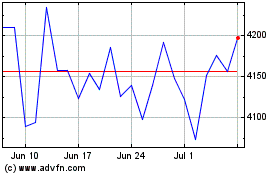

Diploma (LSE:DPLM)

Historical Stock Chart

From Apr 2023 to Apr 2024