Diploma PLC Acquisition (3303H)

March 13 2015 - 3:00AM

UK Regulatory

TIDMDPLM

RNS Number : 3303H

Diploma PLC

13 March 2015

DIPLOMA PLC

12 CHARTERHOUSE SQUARE, LONDON EC1M 6AX

TELEPHONE: +44 (0)20 7549 5700

FACSIMILE: +44 (0)20 7549 5715

FOR IMMEDIATE RELEASE

13 March 2015

DIPLOMA PLC

DIPLOMA ACQUIRES KUBO GROUP FOR A MAXIMUM

NET CASH CONSIDERATION OF GBP22.5m (CHF32.9m)

Diploma PLC, the international group of businesses supplying

specialised technical products and services, is pleased to announce

the acquisition of 100% of Rutin AG, the Swiss non-trading holding

company of the Kubo Group ("Kubo") of companies based in

Switzerland and Austria.

Kubo is a long established and leading supplier of seals,

O-Rings, gaskets and moulded rubber parts to a large and diverse

base of industrial customers in Switzerland and Austria. Kubo's

principal location is in Effretikon, near Zurich in Switzerland,

comprising a modern building with a combination of warehouse,

manufacturing and office facilities. Kubo employs ca. 100 people,

of which ca. 15 are based in the facility in Linz, Austria.

Kubo serves both the Industrial OEM and Aftermarket sectors,

typically in applications that require a high degree of technical

knowledge and support. The business specialises in high value

products that address harsh environments or complex applications.

Kubo also retains exclusive distribution rights in Switzerland and

Austria for certain large international manufacturers of sealing

products and O-Rings.

Prior to acquisition, Kubo was privately owned by Dr Thomas

Raible, its Chief Executive Officer ("CEO") and majority

shareholder, together with members of the Gebert family (Cyrill,

Manuel and Rebecca, represented by Christa Gebert) and Dr Georges

Bindschedler. Of the Sellers, only Dr Raible had an active

management role in Kubo and he will remain as the CEO of Kubo until

30 June 2015 to ensure a smooth management transition.

Profit before tax for Kubo in the year ended 31 December 2014

was CHF4.9m (GBP3.4m) on revenues of CHF32.4m (GBP22.2m); gross

assets at 31 December 2014 were CHF36.1m (GBP24.7m).

The cash consideration before acquisition costs is CHF39.9m

(GBP27.3m), which will be met from the Group's existing cash

resources and revolving bank credit facility. At completion, net

assets are expected to be approximately CHF30.3m (GBP20.7m),

including net cash of approximately CHF7.0m (GBP4.8m) and goodwill

of CHF11.6m (GBP7.9m). Also included in the net assets is the

freehold facility in Effretikon, with a net book value of CHF7.0m

(GBP4.8m) and a market value of at least CHF10.0m (GBP6.8m).

This transaction will be immediately earnings enhancing to the

Company and will be reported as part of the Seals sector

activities.

Bruce Thompson, Chief Executive of Diploma PLC said:

"The acquisition of Kubo Group fits very well with Diploma's

strategy in Seals of building a stronger European business in the

supply of seals, gaskets and related products to both the

Industrial OEM and Aftermarket sectors. The acquisition will also

open up opportunities for cross selling of products with Diploma's

other Seals businesses, including access to Kubo's high precision,

manufactured parts."

+44 (0)20 7549

Diploma PLC - 5700

Bruce Thompson, Chief Executive

Officer

Nigel Lingwood, Group Finance

Director

+44 (0)20 7353

Tulchan Communications - 4200

David Allchurch

Martin Robinson

NOTE TO EDITORS:

Diploma PLC is an international group of businesses supplying

specialised technical products and services to the Life Sciences,

Seals and Controls industries.

Diploma's businesses are focussed on supplying essential

products and services which are funded by the customers' operating

rather than their capital budgets, providing recurring income and

stable revenue growth.

Our businesses design their individual business models to

closely meet the requirements of their customers, offering a blend

of high quality customer service, deep technical support and value

adding activities. By supplying essential solutions, not just

products, we build strong long term relationships with our

customers and suppliers, which support attractive and sustainable

margins.

Finally we encourage an entrepreneurial culture in our

businesses through our decentralised management structure. We want

our managers to feel that they have the freedom to run their own

businesses, while being able to draw on the support and resources

of a larger group. These essential values ensure that decisions are

made close to the customer and that the businesses are agile and

responsive to changes in the market and the competitive

environment.

The Group employs ca. 1,300 employees and its principal

operating businesses are located in the UK, Germany, US, Canada and

Australia.

Over the last five years, the Group has grown adjusted earnings

per share at an average of 20% p.a. through a combination of

organic growth and acquisitions. Diploma is a member of the FTSE

250 with a market capitalisation of ca. GBP900m.

Further information on Diploma PLC, together with a copy of this

Announcement, is available at www.diplomaplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQPKBDBABKDBND

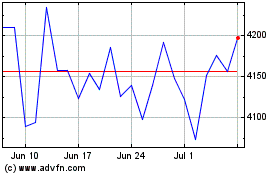

Diploma (LSE:DPLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

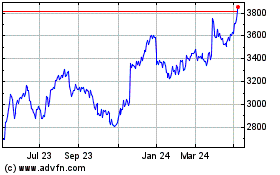

Diploma (LSE:DPLM)

Historical Stock Chart

From Apr 2023 to Apr 2024