Diana Shipping Inc. (NYSE:DSX) (the “Company”), a global shipping

company specializing in the ownership of dry bulk vessels, today

announced that it has priced its previously announced underwritten

public offering of 17,500,000 common shares, par value US$0.01 per

share, at a price of US$4.00 per share. The Company has granted the

underwriters an over-allotment option for a period of 30 days from

the closing of this offering to purchase up to an additional

2,625,000 shares of common stock at the public offering price,

less underwriting discounts.

As part of the offering, entities affiliated

with Simeon Palios, the Company’s Chief Executive Officer and

Chairman, executive officers and certain directors, have agreed to

purchase an aggregate of 5,500,000 common shares at the public

offering price.

The gross proceeds from the offering before

underwriting discounts and other offering expenses are expected to

be US$70.0 million. The offering is expected to close on April 26,

2017, subject to customary conditions.

Substantially all of the net proceeds of the

offering are expected to be used to fund the acquisition costs of

additional dry bulk vessels, including two 2013-built Post-Panamax

dry bulk vessels that the Company has agreed to purchase from

unaffiliated third parties and one 2013-built Kamsarmax dry bulk

vessel that the Company has agreed to purchase from an unaffiliated

third party. The acquisition of the three vessels is subject to

approval by the Board of Directors of the Company. Any net proceeds

from the offering not used for vessel acquisitions will be used for

general corporate purposes.

Wells Fargo Securities, LLC and Clarksons Platou

Securities, Inc. are acting as joint book-running managers in the

offering and BNP Paribas Securities Corp. is acting as co-lead

manager.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities, in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction. This

offering is being made only by means of a prospectus supplement and

accompanying base prospectus. A prospectus supplement related to

the offering will be filed with the U.S. Securities and Exchange

Commission (the “SEC”) and will be available on the SEC’s website

located at www.sec.gov. When available, copies of the

prospectus supplement and the accompanying base prospectus relating

to this offering may be obtained from Wells Fargo Securities,

Attention: Equity Syndicate Department, 375 Park Avenue, New York,

New York, 10152, at (800) 326-5897 or email a request to

cmclientsupport@wellsfargo.com or Clarksons Platou Securities,

Inc., 280 Park Avenue, 21st floor, New York, NY 10019, (or by phone

at (212) 317-7080, or by e-mail at prospectuses@clarksons.com).

About the Company

Diana Shipping Inc. is a global provider of

shipping transportation services through its ownership of dry bulk

vessels. The Company’s vessels are employed primarily on medium to

long-term charters and transport a range of dry bulk cargoes,

including such commodities as iron ore, coal, grain and other

materials along worldwide shipping routes. Diana Shipping Inc.’s

fleet currently consists of 48 dry bulk vessels (4 Newcastlemax, 14

Capesize, 3 Post-Panamax, 4 Kamsarmax and 23 Panamax). The Company

also expects to take delivery of two 2013-built Post-Panamax dry

bulk vessels and one 2013-built Kamsarmax dry bulk vessel during

June 2017. As of today, the combined carrying capacity of the

Company’s fleet, excluding the three vessels not yet delivered, is

approximately 5.7 million dwt with a weighted average age of 7.89

years. A table describing the current Diana Shipping Inc. fleet can

be found on the Company’s website, www.dianashippinginc.com.

Information contained on the Company’s website does not constitute

a part of this press release.

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

The Company desires to take advantage of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995 and is including this cautionary statement in

connection with this safe harbor legislation. The words “believe,”

“anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,”

“potential,” “may,” “should,” “expect,” “pending” and similar

expressions identify forward-looking statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, the Company’s management’s examination of historical

operating trends, data contained in the Company’s records and other

data available from third parties. Although the Company believes

that these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond the Company’s control, the Company cannot assure you that it

will achieve or accomplish these expectations, beliefs or

projections.

In addition to these important factors, other

important factors that, in the Company’s view, could cause actual

results to differ materially from those discussed in the

forward-looking statements include the strength of world economies

and currencies, general market conditions, including fluctuations

in charter rates and vessel values, changes in demand for dry bulk

shipping capacity, changes in the Company’s operating expenses,

including bunker prices, drydocking and insurance costs, the market

for the Company’s vessels, availability of financing and

refinancing, changes in governmental rules and regulations or

actions taken by regulatory authorities, potential liability from

pending or future litigation, general domestic and international

political conditions, potential disruption of shipping routes due

to accidents or political events, vessel breakdowns and instances

of off-hires and other factors. Please see the Company’s filings

with the SEC for a more complete discussion of these and other

risks and uncertainties.

Corporate Contact:

Ioannis Zafirakis

Director, Chief Operating Officer and Secretary

Telephone: + 30-210-9470-100

Email: izafirakis@dianashippinginc.com

Website: www.dianashippinginc.com

Investor and Media Relations:

Edward Nebb

Comm-Counsellors, LLC

Telephone: + 1-203-972-8350

Email: enebb@optonline.net

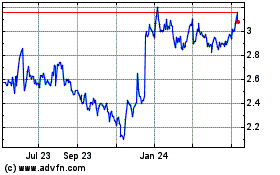

Diana Shipping (NYSE:DSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

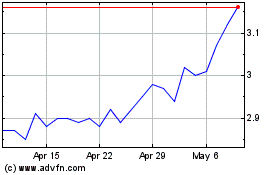

Diana Shipping (NYSE:DSX)

Historical Stock Chart

From Apr 2023 to Apr 2024