Diageo, Heineken Exchange Emerging-Market Assets--Update

October 07 2015 - 5:53AM

Dow Jones News

By Ed Ballard

LONDON---Drinks companies Diageo PLC and Heineken NV on

Wednesday announced an exchange of emerging-market brewing assets

in a deal that will result in a profit for Diageo of GBP440 million

($671 million).

London-based Diageo is selling its stakes in brewing ventures in

Jamaica and South-East Asia to Heineken and buying out the Dutch

firm's stake in a Ghanaian drinks company. The companies have

struck licensing agreements for their respective brands in Jamaica

and Ghana.

The deal, which Diageo and Heineken said will bring "increased

focus to their respective beer businesses", follows the termination

of a similar partnership in South Africa.

"Our close collaboration with Diageo has been very productive

over the years and I would like to thank them for their valued

partnership," said Heineken Chief Executive and Chairman

Jean-François van Boxmeer.

It also coincides with a landmark in the drinks industry's

recent consolidation wave. Anheuser-Busch InBev NV on Wednesday

revealed its plan to buy SABMiller PLC in a potential combination

of the world's two largest brewers.

In the three-part deal, Diageo has sold its 57.9% stake in

Desnoes & Geddes Ltd., the Jamaican brewer of Red Stripe lager

and Dragon stout, to Heineken, which already held 15.5% in D&G

and now controls over 73%.

Diageo--known for its Johnnie Walker whisky and Smirnoff

vodka--has also sold 49.99% of GAPL Pte Ltd., which distributes

stout beer in Singapore and Malaysia, handing Heineken full

ownership.

"Having greater commercial control in the important regions of

Southeast Asia and the Caribbean will allow us to maximize the

strong potential of our brands in these growth markets," Mr. Van

Boxmeer said.

At the same time, Diageo acquired Heineken's 20% stake in

Guinness Ghana Breweries Ltd., increasing its shareholding to

72.4%. The move comes on the heels of Diageo's plan to increase its

stake in Guinness Nigeria as it seeks to wield more control over

its African business.

Wednesday's transaction "provides a strong route to consumer for

Guinness which will grow the brand in these markets," Diageo Chief

Executive Ivan Menezes said.

Diageo will receive a net payment of $780.5 million in cash,

which it will use to pay down debt, and record an exceptional

profit of around GBP440 million after tax.

Write to Ed Ballard at ed.ballard@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 07, 2015 05:38 ET (09:38 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

Diageo (LSE:DGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

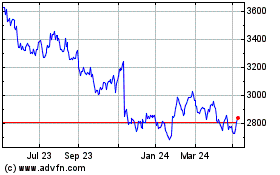

Diageo (LSE:DGE)

Historical Stock Chart

From Apr 2023 to Apr 2024