Deutsche Lufthansa Lifts Full-Year Outlook

October 19 2016 - 2:50PM

Dow Jones News

LONDON—German airline Deutsche Lufthansa AG late Wednesday

raised its full-year earnings forecast, backtracking partially on a

profit warning issued only three months ago.

Adjusted earnings before interest and taxes this year are

expected to be roughly on part with last year's 1.8 billion-euro

($2 billion) level, Germany's largest airline said. Lufthansa

credited better-than-expected short-term business travel bookings

in September.

The reversal punctuates the high level of volatility European

airlines are trying to manage.

The revised outlook remains below the projection Lufthansa had

given earlier in the year, when it promised investors a slight

improvement in earnings this year. But in July, after terrorist

attacks in Europe spooked travelers, Lufthansa warned profit could

fall below 2015's level.

European airlines have issued a flurry of profit warnings in

recent months amid an unusually challenging time for the industry.

Overcapacity has driven down ticket prices, terror attacks have

weighed on demand and repeated air-traffic-control strikes have led

to thousands of flight cancellations.

Britain's vote to leave the European Union has created further

turmoil, causing a slump in the British currency that has weighed

on airlines serving the U.K. Ryanair Holdings PLC, Europe's biggest

discount airline, on Tuesday said its profit in the fiscal year

ending March 31, 2017, would advance more slowly than expected.

British Airways parent International Consolidated Airlines Group

SA and Air France-KLM SA are among other European carriers to issue

profit warnings in the past four months.

Lufthansa said measures it took to reduce capacity as well as

other adjustments have been successful. Still, it cautioned

"political and economic uncertainties continue to significantly

burden long-term bookings, especially on long-haul routes to

Europe." Projecting short-term bookings remained difficult, it

said, would could spur "significant volatility in earnings going

forward."

Lufthansa said sales in the January through September period

fell slightly to €23.9 billion from €24.3 billion in the year-prior

period. The carrier generated adjusted earnings of €1.7 billion, or

€16 million below the prior-year level. Earnings at the core

passenger airline unit rose 4% to €1.4 billion.

Earnings have benefited from a €798 million drop in the

airline's fuel bill in the nine months compared with the same

prior-year period.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

October 19, 2016 14:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

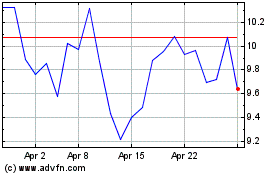

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024