Deutsche Bö rse Braced for Regulatory Scrutiny Over LSE Deal

May 31 2016 - 7:10AM

Dow Jones News

FRANKFURT—The chief executive of Deutsche Bö rse AG said his

planned merger with the London Stock Exchange Group PLC wouldn't

close before the first quarter of next year because of intense

regulatory scrutiny and that U.S. rivals could potentially still

torpedo the deal to create Europe's biggest stock-market

operator.

"We don't expect the deal to close before next year's first

quarter because regulators have to give their OK following

shareholder approval," Carsten Kengeter told journalists in

Frankfurt Monday.

Mr. Kengeter, who is poised to become chief executive of the

combined group, also criticized the French government, which he

said had a vested interest in undermining the deal. He noted that

the French state holds a 6% stake in Euronext NV, a rival to

Deutsche Bö rse and LSE Group.

His comments came in response to statements by French Finance

Minister Michel Sapin and the head of the country's central bank,

Franç ois Villeroy de Galhau, who earlier Monday raised concerns

about the tie-up of Deutsche Bö rse and LSE.

Mr. Sapin said such a move risked curtailing competition and

increasing market risk. He reiterated a call for European

authorities and other local supervisors to scrutinize the

British-German deal.

"We've been in a process of decreasing risk," Mr. Sapin said.

"If there is too much concentration, risks would increase."

Mr. Villeroy de Galhau said the creation of a large stock

clearing house "could create an operator that is too big to

fail."

Mr. Kengeter said Deutsche Bö rse and LSE would keep their

clearing houses separate but that customers and financial stability

could still benefit.

He also said that U.S. competitors such as Intercontinental

Exchange Inc. and CME Group Inc. could potentially bid for LSE or

Deutsche Bö rse. ICE in March said it was considering a bid for LSE

to rival Deutsche Bö rse, but said earlier this month that it would

not place a bid.

Mr. Kengeter said ICE could potentially make a new approach for

the LSE in November, when a standstill period ends. He speculated

that CME might also be interested in bidding for Deutsche Bö rse

should its LSE merger fall apart.

Write to Eyk Henning at eyk.henning@wsj.com

(END) Dow Jones Newswires

May 31, 2016 06:55 ET (10:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

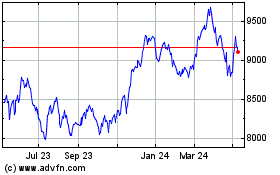

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

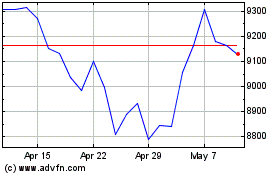

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024