By Margot Patrick And Anuj Gangahar

LONDON-- Deutsche Bank AG's warning that it expects a 6.2

billion-euro ($6.98 billion) third-quarter loss highlights a

potentially bumpy financial-reporting season looming for European

banks, as a slate of new chief executives confront concerns over

profitability.

Credit Suisse Group AG, Standard Chartered PLC and Deutsche Bank

AG, all under new chief executives, are among banks facing muted

growth in their home markets and coping with more stringent

regulation and capital requirements.

Those issues, coupled with factors including uncertainty over

China's growth, U.S. interest rates and the slide in global

commodities prices, have combined to depress profits for European

banks.

Meanwhile, U.S. rivals, most of which restructured fairly

quickly following the global financial crisis, are now in growth

mode, winning business away from European rivals, who have been

slower to adapt.

European banks need to rethink quickly or risk losing more

ground, according to analysts.

Restructuring "remains top of the agenda" for Europe's banks,

analysts at Morgan Stanley wrote in a note this week, predicting

U.S. banks once again would put in a better revenue performance

this year in fixed income and equities and continue beating

European rivals next year across investment banking.

Deutsche Bank late on Wednesday took a multi-billion-dollar

charge against assets in its investment bank and retail- and

private-banking operations for the third quarter. It said the

charge would materially impact third-quarter results, which it

reports on Oct. 29. New chief executive John Cryan on that day will

announce a new strategy, widely expected to ratchet up the bank's

earlier attempts to cut costs and shed unwanted assets.

Credit Suisse Chief Executive Tidjane Thiam, who joined the bank

in July, is expected to outline sharp investment banking cuts, as

part of an effort to meet global capital rules and new Swiss

bank-specific requirements. The bank is also thought to be readying

a substantial capital increase to be unveiled alongside Mr. Thiam's

grand plan.

A poll of investors by Goldman Sachs analysts found 91% expected

the bank to raise more than 5 billion Swiss francs ($5.16 billion)

in fresh capital.

On Thursday, in response to an article in the Financial Times

that reported that Credit Suisse planned to raise an amount in line

with that figure, the bank said: "we are conducting a thorough

assessment of Credit Suisse's strategy, evaluating all options for

the group, its businesses and its capital usage and

requirements."

Standard Chartered, under new chief executive Bill Winters, is

also considering raising equity, according to analysts and people

familiar with the matter. Standard Chartered is among U.K. banks

most exposed to commodities and China, two markets under intense

pressure in recent weeks. The bank could raise as much as $8

billion, according to Jefferies analyst Joseph Dickerson.

At Barclays, investment banking head Tom King last month told

analysts the division is smaller but better positioned after a

two-year process of going from being a balance sheet,

revenue-focused investment bank "to a much more returns-based

model."

He said the bank saved costs by cutting back on managing

directors, the highest internal rank below the most-senior

executives, which typically includes division heads and trading

desk managers. Barclays previously has said around 7,000 jobs in

all will be cut in the unit.

The bank is set to name a new CEO within the next few months.

Barclays officials say the post may go to a former investment

banker, raising the likelihood of more structural tweaks.

Elsewhere, HSBC Holdings PLC previously has said it is ending

relationships with hundreds of clients who weren't making it enough

money. In the third quarter, it continued a reduction of assets it

loaded up on before the financial crisis, such as U.S.

mortgage-backed securities.

Chief Executive Stuart Gulliver said in August that HSBC's

Global Banking & Markets business is "the right size" in terms

making money and serving clients but that low-returning loans and

other boom-time assets were eating up too much of the unit's

capital.

Meanwhile, Royal Bank of Scotland Group PLC continues to slash

jobs and pull out of countries covered by its investment bank. The

bank cut several high level capital-markets jobs last month and

assigned new responsibilities to sales head Scott Satriano, now

head of financing & risk solutions, and Kieran Higgins, who

took over flow sales in addition to being head of sales.

The British bank, 73% owned by the government, has taken the

most-radical moves in moving out of investment banking to focus

instead on lending to domestic businesses and households.

Write to Margot Patrick at margot.patrick@wsj.com

Access Investor Kit for "Deutsche Bank AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0005140008

Access Investor Kit for "Barclays Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB0031348658

Access Investor Kit for "Barclays Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US06738E2046

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 08, 2015 14:43 ET (18:43 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

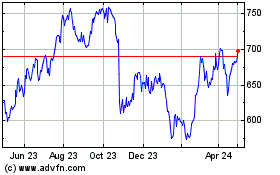

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

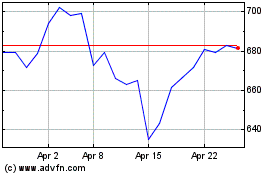

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024