Two years after a levy of about 10% sparked a decline, the

numbers are rising once again

By Amy Guthrie in Mexico City and Mike Esterl in Atlanta

Sales of soda are climbing two years after Mexico imposed a

roughly 10% tax on sugary drinks -- a bright spot for an industry

that has feared it could be cast as the next tobacco.

Mexico's tax was an attempt to cap alarming obesity and diabetes

rates in a country where per capita soda consumption is the highest

in the world. It came at a time when then Mayor Michael Bloomberg

was trying to limit sales of the beverages in New York City, and

more countries are weighing a similar tax.

Purchases, however, are rising in Mexico after an initial drop,

making the country a key-growth market again for soda giants

Coca-Cola Co. and PepsiCo Inc.

Underscoring the resiliency of sugary drinks, the tax of one

peso per liter has raised more than $2 billion since January 2014,

about a third more than the government expected.

"Coke is like cigarettes -- it turns you into an addict," said

Luis de León, a 24-year-old Mexico City parking attendant, who

stood next to a three-liter bottle he recently shared with two

other valets.

Mr. de León said he stopped drinking soda for a month after

seeing a publicity campaign financed by Bloomberg Philanthropies

that linked diabetes to sugary beverages and asked Mexicans if they

would eat 12 spoonfuls of sugar, roughly the amount in Coke's

popular 600-milliliter bottle.

While that public-health campaign is long gone, soda makers

continue to advertise their products heavily and say it is unfair

to single out something representing less than 10% of daily caloric

intake.

Coca-Cola Femsa SAB, the country's largest Coke bottler, said

last Wednesday that its Mexican soda volumes rose 5.5% in the first

quarter from a year earlier. Arca Continental SAB, the No. 2 Coke

bottler, reported soda volumes surged 11%.

The turnaround began last year, when Mexican soda-industry

volume rose 0.5% after falling 1.9% in 2014, said data service

Canadean.

Consumers also aren't flocking to untaxed zero-calorie sodas.

The market shares of full-calorie Coca-Cola and Pepsi-Cola inched

higher last year to 48% and 11%, respectively, according to

Euromonitor, another data service.

Antisoda groups aren't ready to declare the tax a failure and

say sales got a boost from unusually warm weather.

Mexico's National Institute of Public Health estimates per

capita consumption of sugar-sweetened beverages was 8% lower in

2015 than the pretax period of 2007 to 2013, after making

adjustments including population growth and economic activity.

Soda sales growth is slowing world-wide, with volumes rising

just 0.1% last year, according to Euromonitor. Companies such as

Coke and PepsiCo increasingly are relying on other products like

bottled water, whose global volumes were up 5.7% last year.

A World Health Organization commission recommended in January

that governments tax sugar-added beverages to reduce childhood

obesity, citing a joint study by Mexican health officials and the

University of North Carolina.

That peer-reviewed survey estimated 2014 purchases of sugary

beverages dropped 6% from the average of the previous two years. It

found the decline accelerated to 12% in the final month of 2014

from the previous two Decembers.

Several countries are debating special taxes on sodas including

India, South Africa and the Philippines. In the U.S.,

Philadelphia's mayor has proposed a 3-cent-per-ounce tax on

sweetened beverages.

The American Beverage Association is fighting that proposal and

plans to highlight a new study that found Mexico's beverage

industry lost about 3,000 jobs in the first quarter of 2014 due to

the tax. The survey, conducted by the Beverage Marketing Corp.,

estimates Mexican soda consumption returned to pretax levels by

mid-2015.

Even the initial downturn only lowered the average Mexican's

daily caloric intake by 6 to 7 calories, or 0.2%, according to the

study.

"We know these taxes don't work," said Coke Chief Executive

Muhtar Kent at a company's annual shareholder meeting last

Wednesday, pointing to Mexico.

Governments also must spend money to raise awareness about sugar

intake, require clear nutritional labels and encourage exercise,

among other things, health experts say.

"The sugar tax is an important piece but not the only one," said

Kelly Henning, who heads the public-health program at Bloomberg

Philanthropies.

Mr. Bloomberg also unsuccessfully tried to cap serving sizes of

sugary drinks as mayor of New York City.

Supporters of sugary-drink taxes say Mexico's levy should be

higher to have a bigger impact. Senator Armando Ríos Piter wants to

double the tax to offset the rising public-health cost of treating

people with diabetes, a disease that disproportionately affects

poor Mexicans, who buy the majority of sugary beverages.

Wilebaldo Ramírez, a 45-year-old shoe shiner in Mexico City,

said he allocates about 6% of his daily wages to soda even though

his wife has been pestering him to drink bottled water.

"If water was cheaper than soda, maybe I'd switch. But in the

meantime I want flavor," said Mr. Ramirez, after polishing off a

600-milliliter bottle of fruit-punch flavored Jarritos, a local

soda brand.

The bottle sells for 6.50 pesos (about 37 cents) at a store near

his shoe-shine stand, compared with at least 8 pesos for the same

size of bottled water.

Write to Amy Guthrie at amy.guthrie@wsj.com and Mike Esterl at

mike.esterl@wsj.com

(END) Dow Jones Newswires

May 04, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

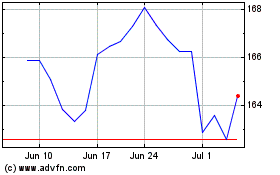

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

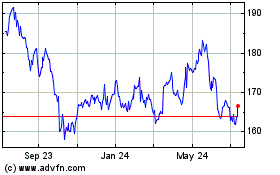

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024