Derwent London Says Brexit May Slow Letting; Lowers Guidance -- Update

August 11 2016 - 8:39AM

Dow Jones News

By Olga Cotaga

(Adds analyst comments and share price.)

LONDON--Derwent London PLC (DLN.LN) said the uncertainty caused

by the U.K. vote to leave the European Union is going to take a

toll on the London office market, and as a result, lowered its

expectations on how much in rent it will be able to get in

2016.

"We recognize that, in the short term, political and economic

uncertainty is likely to lower demand," Derwent said.

Derwent, a real estate investment trust with assets in central

London, said it now expects the estimated rental value of its

portfolio to grow between 1% to 5% in 2016, down from a 5% to 8%

previously-guided growth.

Chief Executive John Burns said the change in rent value

expectations comes "from being cautious" and that he would "like a

surprise on the upside."

Derwent said yields might rise marginally in the second half of

the year in response to a lower demand.

After the company ended its half-year period, it had let a total

of 112,600 square feet, almost half of the lettings agreed on in

the six months to June 30. UBS, who had a 'buy' rating for the

company, said these six months were Derwent's "most active

half-year ever."

Just 2% of the commercial space Derwent rents is empty.

Derwent targets middle market rents in areas such as Islington,

Shoreditch and Whitechapel, and only 2.3% of its June rental income

came from tenants in the financial sector.

One of Derwent's big developments, the White Collar Factory,

that is next to the Old Street roundabout, is 56% pre-let, said Mr.

Burns, adding that companies such as Adobe and Capital One are

among those who have reserved some of the office space. The office

tower of the development is 70% pre-let.

The rent agreed on at the White Collar Factory is above the

estimated rental value, the company said. Construction at the

293,000 square feet development is due to complete at the end of

2016.

Other major developments due over the next 18 months are 58%

pre-let.

The chief executive said the company hasn't made any changes to

its developments after Brexit, but reiterated on its cautious

outlook.

UBS said there is a possibility for Derwent to defer its Brunel

building in Paddington after 2019, but added that most probably the

company will go ahead with the scheme as planned. The Brunel

development is expected to be completed in the first half of

2019.

The board raised the interim dividend by 10% to 13.86 pence a

share.

Derwent made a pretax profit of GBP98.5 million ($127 million)

for the six months period, much less than the GBP405 million for

the same period last year, despite gross property and other income

rising to GBP101.4 million from GBP91.1 million.

The revaluation surplus this half-year was of GBP64.5 million,

smaller than the GBP361 million a year earlier. Derwent's adjusted

profit before tax rose 15% to GBP44.8 million.

Shares were down 3.3% at 2725 pence.

Write to Olga Cotaga at olga.cotaga@wsj.com, Twitter

@OlgaCotaga

(END) Dow Jones Newswires

August 11, 2016 08:24 ET (12:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

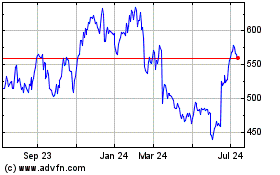

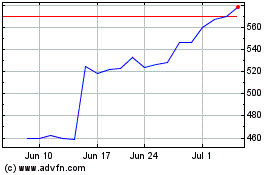

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024