TIDMDVW TIDMSVT

RNS Number : 9686W

Dee Valley Group PLC

15 February 2017

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

FOR IMMEDIATE RELEASE

This announcement contains inside information

15 FEBRUARY 2017

RECOMMED ACQUISITION

of

DEE VALLEY GROUP PLC

by

SEVERN TRENT WATER LIMITED

Scheme becomes Effective

Dee Valley announces that the Scheme to effect the Revised

Severn Trent Acquisition has become Effective in accordance with

its terms.

Dealings in Voting Shares were suspended at 7:30 am this

morning. Cancellation of the listing of Voting Ordinary Shares and

Non-Voting Ordinary Shares will take effect at 8:00 am tomorrow, 16

February 2017 and the latest date for the despatch of cheques or

settlement through CREST (as appropriate) will be 1 March 2017.

Directors' resignations and appointments

All of the directors of Dee Valley, being Jon Schofield, Ian

Plenderleith, Kevin Starling and Philip Holder, resigned from their

positions as directors of Dee Valley upon the Scheme becoming

Effective. Andrew Duff, Kevin Beeston, James Bowling, John Coghlan,

Emma FitzGerald, Olivia Garfield, Philip Remnant, Angela Strank and

Dominique Reiniche have been appointed as directors of Dee Valley

with effect from the Scheme becoming Effective.

Capitalised terms used and not defined in this announcement have

the meanings given to them in the circular relating to the Scheme

dated 2 December 2016.

Enquiries:

Dee Valley +44(0)1978

Ian Plenderleith, Chief Executive 846946

Investec (Financial Adviser to

Dee Valley)

Jeremy Ellis/George Price/Jonathan +44(0)20

Wynn 7597 4000

Tavistock (Financial Public Relations

Adviser to Dee Valley)

Matt Ridsdale/Simon Hudson/Mike +44(0)20

Bartlett/Sophie Praill 7920 3150

Important notice relating to financial advisers

Investec, which is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority in the United Kingdom, is acting as

exclusive financial adviser to Dee Valley and no one else in

connection with the Revised Severn Trent Acquisition. In connection

with such matters, Investec, its affiliates and their respective

directors, officers, employees and agents will not regard any other

person as their client, nor will they be responsible to any other

person for providing the protections afforded to their clients or

for providing advice in relation to the Revised Severn Trent

Acquisition, the contents of this Announcement or any other matter

referred to herein.

Further information

This Announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of any securities, or the solicitation of any

vote or approval in any jurisdiction, pursuant to the Revised

Severn Trent Acquisition or otherwise. The Revised Severn Trent

Acquisition has been made solely by means of the Severn Trent

Acquisition Document, which also contains the full terms and

conditions of the Contractual Offer, including details of how the

Contractual Offer may be accepted. Any response to the proposed

Revised Severn Trent Acquisition should be made only on the basis

of information contained in the Severn Trent Acquisition Document.

Holders of Voting Ordinary Shares and Non-Voting Ordinary Shares in

Dee Valley ("Dee Valley Shareholders") are advised to read the

formal documentation in relation to the Revised Severn Trent

Acquisition carefully.

This Announcement has been prepared for the purposes of

complying with English law, the rules of the London Stock Exchange

and the Takeover Code and the information disclosed may not be the

same as that which would have been disclosed if this Announcement

had been prepared in accordance with the laws and regulations of

any jurisdiction outside the United Kingdom.

Overseas jurisdictions

The distribution of this Announcement in jurisdictions other

than the United Kingdom and the ability of the Ordinary

Shareholders who are not resident in the United Kingdom to

participate in the Revised Severn Trent Acquisition may be affected

by the laws of relevant jurisdictions. Therefore any persons who

are subject to the laws of any jurisdiction other than the United

Kingdom or Ordinary Shareholders who are not resident in the United

Kingdom will need to inform themselves about, and observe, any

applicable legal or regulatory requirements. Any failure to comply

with the applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. Further details in

relation to Overseas Shareholders will be contained in the Severn

Trent Acquisition Document.

The offers by Severn Trent Water for the Ordinary Shares are not

being, and will not be, made available, directly or indirectly, in

or into or by the use of the mails of, or by any other means or

instrumentality of interstate or foreign commerce of, or any

facility of a national state or other securities exchange of, any

Restricted Jurisdiction.

Accordingly, copies of this Announcement and all documents

relating to the Revised Severn Trent Acquisition are not being, and

must not be, directly or indirectly, mailed, transmitted or

otherwise forwarded, distributed or sent in, into or from any

Restricted Jurisdiction and persons receiving this Announcement

(including, without limitation, agents, nominees, custodians and

trustees) must not distribute, send or mail it in, into or from

such jurisdiction. Any person (including, without limitation, any

agent, nominee, custodian or trustee) who has a contractual or

legal obligation, or may otherwise intend, to forward this

Announcement and/or the Severn Trent Acquisition Document and/or

any other related document to a jurisdiction outside the United

Kingdom should inform themselves of, and observe, any applicable

legal or regulatory requirements of their jurisdiction.

Disclosure requirements of the Takeover Code

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in 1 per cent. or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the offer period and, if later, following the

announcement in which any securities exchange offeror is first

identified. An Opening Position Disclosure must contain details of

the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s). An Opening

Position Disclosure by a person to whom Rule 8.3(a) applies must be

made by no later than 3.30 pm (London time) on the 10th Business

Day following the commencement of the offer period and, if

appropriate, by no later than 3.30 pm (London time) on the 10th

Business Day following the announcement in which any securities

exchange offeror is first identified. Relevant persons who deal in

the relevant securities of the offeree company or of a securities

exchange offeror prior to the deadline for making an Opening

Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange

offeror(s), save to the extent that these details have previously

been disclosed under Rule 8. A Dealing Disclosure by a person to

whom Rule 8.3(b) applies must be made by no later than 3.30 pm

(London time) on the Business Day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on website

A copy of this Announcement will be available, subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions, for inspection on Dee Valley Water's website at

www.deevalleywater.co.uk by no later than 12 noon (London time) on

the Business Day following the date of this Announcement. For the

avoidance of doubt the content of that website is not incorporated

into, and does not form part of, this Announcement.

Dee Valley Shareholders may request a hard copy of this

Announcement by contacting Tracy Bragg, Head of Legal and

Regulation, during business hours on +44 (0)1978 833213 or by

submitting a request in writing to Tracy Bragg, Head of Legal and

Regulation at Dee Valley, Packsaddle, Wrexham Road, Rhostyllen,

Wrexham, LL14 4EH. Dee Valley Shareholders may also request that

all future documents, announcements and information to be sent to

them in relation to the Revised Severn Trent Acquisition should be

in hard copy form.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFILFLIELID

(END) Dow Jones Newswires

February 15, 2017 06:03 ET (11:03 GMT)

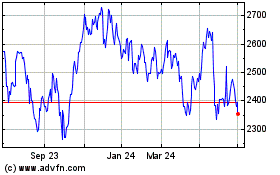

Severn Trent (LSE:SVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

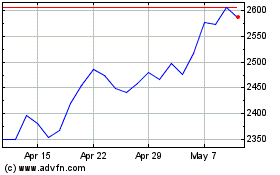

Severn Trent (LSE:SVT)

Historical Stock Chart

From Apr 2023 to Apr 2024