Deal-Hungry Suncor Energy Posts First Quarter Net Profit, Operating Loss

April 28 2016 - 12:30AM

Dow Jones News

CALGARY, Alberta—Suncor Energy Inc., Canada's largest crude-oil

producer, reported a first-quarter net profit on foreign

exchange-related gains on Wednesday even as it posted an operating

loss from sharply lower commodity prices.

Like most other major North American energy producers, Suncor's

cash flow suffered from a glut in crude oil and natural gas. Still,

the company has used its strong balance sheet and falling asset

prices to grow through a series of acquisitions this year.

More deals may be in the offing, according to the company's

chief executive, Steve Williams. Suncor will "continue to look for

opportunities to grow our business through acquisitions, by adding

assets that fit strategically at competitive valuations," Mr.

Williams said in a statement.

The Calgary-based company's net profit was 257 million Canadian

dollars ($204.17 million), or 17 Canadian cents a share, in the

first three months of the year, compared to a net loss of C$341

million, or 24 Canadian cents a share, in the year-earlier period.

It attributed that mostly to a C$855 million currency gain from the

revaluation of U.S. dollar-denominated debt.

On an operating, or adjusted, basis that excludes one-time

items, Suncor reported an operating loss of C$500 million, or 33

Canadian cents a share, for the three months ended March 31. That

was slightly higher than a consensus forecast of financial analysts

compiled by the company that estimated a loss of 32 Canadian cents

a share, according to RBC Dominion Securities.

Cash flow from operations in the three months to March 31 fell

to C$682 million, down from C$1.48 billion in the prior-year

period. It blamed a 43% drop in the price of benchmark Western

Canadian Select crude oil compared with the first quarter of

2015.

That weaker pricing environment has whetted Suncor's appetite

for deals.

The company announced plans earlier Wednesday to buy out Murphy

Oil Corp.'s stake in the Syncrude oil sands consortium, lifting its

ownership to 53.74%. Suncor said it will pay C$937 million for

Murphy Oil's 5% equity. It comes a month after it completed a

takeover of Canadian Oil Sands Ltd. that boosted its share in

Syncrude to 48.74% from 12% previously.

Total production at Suncor rose to 691,400 barrels of oil

equivalent per day in the first quarter, up from 602,400 barrels of

oil equivalent a day in the year-earlier period. The gain stemmed

largely from its increased stake in Syncrude and higher oil sands

output.

Oil sands production climbed to 453,000 barrels a day in the

first three months of the year, up from 440,400 barrels per day in

the same quarter of 2015.

That prompted the company to revise its full-year production

guidance upward to a range of 620,000 to 665,000 barrels of oil

equivalent per day, from its previous 2016 forecast of 525,000 to

565,000 barrels of oil equivalent a day.

Suncor kept its spending plans for the year unchanged at a range

of C$6 billion to C$6.5 billion.

Write to Chester Dawson at chester.dawson@wsj.com

(END) Dow Jones Newswires

April 28, 2016 00:15 ET (04:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

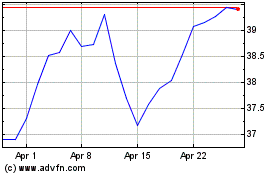

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Apr 2023 to Apr 2024