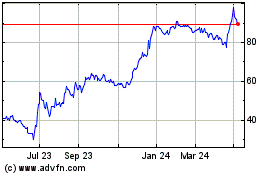

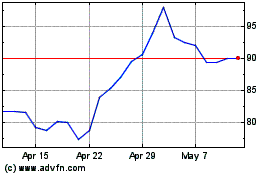

TIDMDLAR

RNS Number : 0674Z

De La Rue PLC

24 May 2016

De La Rue plc

24 May 2016

Solid performance and good early strategic progress

De La Rue plc (LSE: DLAR) (De La Rue, the "Group" or the

"Company") announces its full year results for the twelve months

ended 26 March 2016 (the period or full year).

KEY FINANCIALS

The table below shows the performance before and after the

disposal of the Cash Processing Solutions (CPS) business which was

sold on 22 May 2016.

Continuing Operations* Pre Disposal*

2015/16 2014/15 Change 2015/16 2014/15 Change

GBPm GBPm % GBPm GBPm %

Revenue 454.5 422.8 7% 488.2 472.1 3%

Underlying operating

profit** 70.4 69.1 2% 62.5 69.5 (10%)

Underlying operating

margin** 15.5% 16.3% (80bpts) 12.8% 14.7% (190bpts)

Underlying profit before

tax** 58.5 57.5 2% 50.4 57.7 (13%)

Reported profit before

tax 54.9 40.6 35% 20.8 38.9 (47%)

Underlying earnings

per share** 48.1p 46.1p 4% 41.0p 47.9p (14%)

Reported earnings per

share 46.8p 31.8p 47% 16.2p 34.0p (52%)

Total dividend per

share 25.0p 25.0p 0% 25.0p 25.0p 0%

* "Continuing Operations" is the Group excluding CPS, "Pre Disposal"

is the Group including CPS.

** On continuing operations basis, underlying numbers are before

a net exceptional charge of GBP3.6m (restated 2014/15: GBP16.9m).

Underlying EPS is calculated before the exceptional charge noted

above and exceptional tax credits of GBP2.3m (restated 2014/15:

GBP2.4m). On pre disposal basis, underlying numbers are before

a net exceptional charge of GBP29.6m (2014/15: GBP18.8m). Underlying

EPS is calculated before the exceptional charge noted above and

exceptional tax credits of GBP4.5m (2014/15: GBP4.7m).

FINANCIAL HIGHLIGHTS

-- Full year results in line with trading update on 13 April 2016

-- Year on year revenue up 7% and underlying operating profit up 2%(1)

-- Positive operating cash flow resulting in net debt reduction

of GBP4.9m to GBP106.1m. Net debt/EBITDA at 1.25x

-- Underlying earnings per share up 4% to 48.1p(1)

-- Final dividend maintained at 16.7p. Full year dividend unchanged at 25.0p.

-- Group 12 month order book up 62% year-on-year at GBP365m(1) ,

providing good visibility for the year ahead

OPERATIONAL HIGHLIGHTS

-- Banknotes volume up 9% to 7.1bn and Banknote Paper up 6% to

10,000 tonnes, benefiting from overspill contracts

-- Currency revenue up 11% and underlying operating profit up 9%

-- Successfully outsourced production of >500m banknotes

-- Product Authentication and Traceability underlying operating

profit up 19% due to reduced costs

-- Identity Solutions revenue and underlying operating profit

lower as a result of expected contractual reduction

-- Reorganisation from divisional to functional structure completed

-- 10% net average headcount reduction to 3,566 from operational improvements

STRATEGIC HIGHLIGHTS

-- Cash Processing Solutions business 'root and branch' review concluded with business sold

-- Encouraging progress in Polymer with a significant new

three-year contract and doubling the number of customers to 14 note

issuing authorities

-- Doubled number of patent filings. Launched next generation

security thread Active(TM) and two end-to-end software solutions -

DLR Identify(TM) and DLR Certify(TM)

-- Manufacturing footprint review completed: reducing capacity

by 25% and consolidating banknote print production to four sites(3)

to achieve >GBP13m savings p.a. from 2018/19

1. Continuing operations only

2. Excluding the site managed on behalf of Bank of England

3. Including the site managed on behalf of Bank of England

Martin Sutherland, Chief Executive Officer, commented:

"In the last year we have made good progress against our five

year strategic plan to transform De La Rue into a technology-led

security product and service provider. We have reorganised the

business structure, increased investment in product development and

new technologies, and successfully completed a manufacturing

footprint review.

"Our Currency product lines have performed very well during the

year. I am particularly pleased with our progress in Polymer which

is a large and growing market. We have doubled our customer base in

Polymer over the last year, including securing our first volume

customer, and as the only vertically integrated polymer substrate

manufacturer, we are well placed to continue to capture this growth

opportunity.

"CPS continued to underperform in the second half of the year.

Following a 'root and branch' review, we decided to exit the

business and have now completed the sale.

"Looking ahead, whilst there is more to do, I am pleased with

the progress we have made in the year and I am confident that the

right foundations are now in place to develop a more balanced

business portfolio and increase profitability. Our 12 month closing

order book of GBP365m provides good visibility for the year ahead.

Whilst, as previously announced, a material contract came to an

end, we are confident that we can mitigate the impact and our

expectations for the current year are unchanged."

Enquiries:

De La Rue plc +44 (0)1256 605000

------------------------------------------------- --------------------

Martin Sutherland Chief Executive Officer

------------------- ---------------------------- --------------------

Jitesh Sodha Chief Financial Officer

------------------- ---------------------------- --------------------

Lili Huang Head of Investor Relations

------------------- ---------------------------- --------------------

Brunswick +44 (0)207 404 5959

------------------------------------------------- --------------------

Jon Coles

------------------------------------------------- --------------------

Oliver Hughes

------------------------------------------------- --------------------

A presentation to analysts will take place at 9:00 am BST on 24

May 2016 at the Lincoln Centre, 18 Lincoln's Inn Fields, WC2A

3ED. This will also be accessible via a conference call and an

audio webcast. Dial-ins for the conference call are +44 (0) 20

3059 8125, passcode: De La Rue. An archive of the conference call

is also available for a week from midday 24 May 2016, which is

accessible via +44 (0) 121 260 4861, passcode: 3214 492#. For

the live video webcast, please register at www.delarue.com where

a replay will also be available subsequently.

About De La Rue

De La Rue is a leading commercial banknote printer, security paper

maker and provider of security products and software solutions and,

as a trusted partner of governments, central banks and commercial

organisations around the world, is at the forefront of the battle

against the counterfeiter.

De La Rue, as the world's largest commercial banknote printer, provides

customers with a fully integrated range of sophisticated products

and services which are available either individually or as a whole.

This includes a leading design capability, production of innovative

security components, manufacture of security paper and polymer substrates

and sophisticated printing of banknotes, all contributing to trust

in the integrity of currencies.

De La Rue is the world's largest commercial passport manufacturer

in an environment of increasing global concern over security at

national boundaries and border control. De La Rue also produces

a wide range of other security products, including tax stamps for

governments who are seeking to combat illicit trade and collect

excise duties. Other products include authentication labels, assuring

purchasers of product validity, and government identity documents.

De La Rue also provides a range of specialist services and software

solutions including government identity schemes and product authentication

systems.

De La Rue is listed on the London Stock Exchange (LSE:DLAR). For

further information visit www.delarue.com

Cautionary note regarding forward-looking statements

These results include statements that are, or may be deemed to

be, "forward-looking statements". These forward-looking statements

can be identified by the use of forward-looking terminology,

including the terms "believes", "estimates", "anticipates",

"expects", "intends", "plans", "goal", "target", "aim", "may",

"will", "would", "could" or "should" or, in each case, their

negative or other variations or comparable terminology. These

forward-looking statements include all matters that are not

historical facts. They appear in a number of places throughout

these results and the information incorporated by reference into

these results and include statements regarding the intentions,

beliefs or current expectations of the directors, De La Rue or the

Group concerning, amongst other things, the results of operations,

financial condition, liquidity, prospects, growth, strategies and

dividend policy of De La Rue and the industry in which it

operates.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future and may be

beyond De La Rue's ability to control or predict. Forward-looking

statements are not guarantees of future performance. The Group's

actual results of operations, financial condition, liquidity,

dividend policy and the development of the industry in which it

operates may differ materially from the impression created by the

forward-looking statements contained in these results and/or the

information incorporated by reference into these results. In

addition, even if the results of operations, financial condition,

liquidity and dividend policy of the Group and the development of

the industry in which it operates, are consistent with the

forward-looking statements contained in these results and/or the

information incorporated by reference into these results, those

results or developments may not be indicative of results or

developments in subsequent periods.

Other than in accordance with its legal or regulatory

obligations, De La Rue does not undertake any obligation to update

or revise publicly any forward-looking statement, whether as a

result of new information, future events or otherwise.

PRELIMINARY STATEMENT

De La Rue's full year results were in line with the upgraded

expectations announced in the trading update on 13 April 2016. With

a backdrop of challenging market conditions and significant

internal changes, the Group has made good progress in the first

year of the five year strategic plan which aims to focus the

business into growth markets while driving operational efficiency.

The Group has strengthened the 12 month order book to GBP365m(1)

(2015: GBP226m) as at the end of the period.

Revenue in Currency product lines, encompassing Banknotes,

Banknote Paper, Polymer and Security Features, grew 11% whilst

underlying operating profit was up 9%. These increases were

primarily driven by higher banknote volumes, partly from overspill

orders, and from greater operational efficiencies. As previously

announced, a material security features contract which contributed

annual revenue of cGBP30m came to an end during the year.

There was encouraging progress in Polymer with the winning of a

significant three year contract and the doubling of the number of

customers to 14 issuing authorities. The Currency product lines'

closing order book was up 85% year on year.

Identity Solutions has performed as expected with lower revenue

and margin due to a contractual reduction in contribution from a

large contract. With the launch of our first identity software

solution DLR Identify(TM), we have strengthened our digital and

service offerings which will help us to capture a larger share of

the passport value chain. Revenue in Product Authentication &

Traceability (PA&T) was flat year on year with higher margins

due to cost savings from the Dulles site closure.

Cash Processing Solutions (CPS) continued to underperform in the

second half. Following the 'root and branch' review of CPS, we have

sold the business.

FINANCIAL RESULTS

On a pre disposal basis, group revenue grew 3% to GBP488.2m

(2014/15: GBP472.1m). Underlying operating profit fell by 10% to

GBP62.5m (2014/15: GBP69.5m), mainly due to a loss of GBP7.9m in

CPS (2014/15: profit GBP0.4m). Underlying profit before tax was 13%

lower at GBP50.4m (2014/15: GBP57.7m) and underlying earnings per

share decreased to 41.0p (2014/15: 47.9p).

On a continuing operations basis, group revenue was up 7% to

GBP454.5m (2014/15: GBP422.8m). Underlying operating profit

increased by 2% to GBP70.4m (2014/15: GBP69.1m). Underlying profit

before tax was GBP58.5m (2014/15: GBP57.5m) and underlying earnings

per share were up 4% to 48.1p (2014/15: 46.1p).

On a pre disposal basis, net exceptional charges before tax in

the period were GBP29.6m (2014/15: GBP18.8m) of which GBP26.0m

related to the CPS discontinued activities (more fully described in

notes 3 and 4). As a result, profit before tax was 47% lower at

GBP20.8m (2014/15: GBP38.9m).On a continuing operations basis,

profit before tax was up 35% to GBP54.9m (2014/15: GBP40.6m).

DIVID

The Board proposes to maintain the dividend at the 2014/15 level

and is recommending a final dividend of 16.7p per share (2014/15:

16.7p per share). Together with the interim dividend paid in

January 2016, this will give a total dividend for the year of 25.0p

per share (2014/15: 25.0p per share). Subject to shareholders'

approval, the final dividend will be paid on 3 August 2016 to

shareholders on the register on 24 June 2016.

The Board also recommends the introduction of an alternative

scrip dividend scheme. The proposed scheme will give shareholders

the option to receive new fully paid Ordinary Shares in the Company

in place of their cash dividend payments. The Board intends that

the necessary resolution to introduce the scrip dividend scheme

will be put to shareholders at the AGM on the 21 July 2016. Further

details will be provided with the AGM documentation when it is sent

to shareholders. If the scheme is approved by shareholders, the

last date for receipt of Scrip elections will be 13 July 2016.

STRATEGIC PROGRESS

In May 2015, we announced a clear strategic plan to transform De

La Rue in the five years to 2020 into a technology-led security

product and service provider, with a more balanced business

portfolio that will deliver growth and increased profits, as well

as reduce performance volatility. Changes in the market and

customers' shift towards more technology-based, value driven

procurement mean we must be more flexible and agile in our approach

to managing our customer relationships, product pipelines and

delivery.

During the year, we reorganised the business from a divisional

to a functional structure. We strengthened the Executive Leadership

Team with a number of new hires, including Chief Financial Officer

Jitesh Sodha, Chief Technology Officer Selva Selvaratnam and Chief

Commercial Officer Richard Hird. In addition, we streamlined and

reshaped our Senior Leadership Team to align with the functional

structure. We also established a product management team to ensure

focus on the development of each product line.

We are one year into our five year plan and have already made

good progress expanding our polymer product line and enhancing our

product and service offerings with the launch of two end-to-end

software solutions. We have also taken actions to address the

overcapacity in Banknotes and sold the underperforming cash

processing business. We are pleased with the progress we have made

in the first year and are confident that the right foundations are

now in place to grow the business. However, there is still much

more to do in order to deliver our strategic goals.

Optimise and Flex

Currency is core to our business and our brand. The number of

banknotes in circulation is expected to grow at 3-4% a year, but

with ongoing oversupply in both the banknotes and paper making

industries, we must optimise our capabilities by continuing to

drive operational efficiencies and cost reduction. The volatility

of the banknote market means it is essential that we build

flexibility into our production capacity.

Banknotes

We made good progress in achieving production cost reduction

through our ongoing Operational Excellence programme. We finished

rolling out the Advanced Product Quality Planning system, giving us

a standardised process across all manufacturing sites. This enables

us to share best practice, improve productivity and reduce

spoilage.

In December 2015, we announced the results of our manufacturing

footprint review. The review concluded that we can achieve more

than GBP13m of annual savings from FY2018/19 by reducing the number

of print lines and consolidating banknote production into four

centres of excellence(3) . This will reduce our banknote print

production capacity from eight billion to six billion(2) notes a

year, matching current and long term average market demand, as well

as increasing our machine utilisation. The implementation of the

restructuring plan is now under way following the conclusion of the

consultation with affected employees.

We plan to gain access to additional capacity, as and when

required, through external partnerships. During the year, we have

successfully outsourced the printing of 500 million banknotes to

three commercial and state banknote printers. We are now looking to

build stronger relationships with selected third parties.

Banknote Paper

In the past year we saw increased demand for Banknote Paper

though pricing remained competitive as a result of industry

overcapacity. We made good progress in reducing production costs by

driving efficiency and reducing overheads. We will continue to

drive down cost and focus on growing direct sales. We are also

seeking strategic partnerships in this market and exploratory

discussions with a number of parties are ongoing, though they are

complex and will take time.

Cash Processing Solutions

In November 2015, we announced a 'root and branch' review of CPS

to address ongoing underperformance. We have completed the review

and concluded that whilst CPS has a strong product profile and

excellent long term customer relationships, we do not believe that

this is a business which should form part of our portfolio. In

order to focus on our core businesses, we have decided to exit the

cash processing market by selling CPS to Privet Capital LLP

following an auction process. We believe that the business will

benefit from standalone ownership.

Invest and Build

We continue to build on De La Rue's long history of innovation,

investing in differentiating features, new technologies and digital

solutions. We have restructured our R&D team and prioritised

our efforts in high growth and high margin product lines. We plan

to double our R&D investment by 2020.

In order to accelerate growth in Identity Solutions and Product

Authentication and Traceability (PA&T), we plan to invest in

new capabilities and skills to create a centre of excellence for

identity and security print at the De La Rue site in Malta. We have

also put in place a dedicated team with new skills to strengthen

our sales effort for both Identity Solutions and PA&T.

Polymer

Launched in 2012, sales of our polymer substrate Safeguard(R)

have started to gain traction. We built on the progress made in

2014 by growing the number of customers from seven to 14, including

all three Scottish note issuing banks. We reached an important

milestone by winning our first volume customer, with a significant

three year contract for polymer substrate and a technology

partnership. This raises our nominal market share to c5% by volume.

We aim to continue to grow our market share by targeting customers

who already use polymer as well as those looking to convert paper

and coins to polymer.

We continue to focus much of our R&D efforts on developing

our polymer capability, expanding the number of polymer-suited

security features and enhancing the process for substrate

manufacturing and banknote printing. There is a growing interest in

polymer banknotes as central banks look for ways to reduce the

overall cost of banknote ownership. As the only integrated polymer

substrate manufacturer and experienced polymer banknote printer, we

are well placed to capture this growth opportunity.

Security Features

We believe that continuous innovation will give us greater

differentiation and a unique advantage in a competitive market.

In 2015 we made good progress in security feature development,

with the launch of a micro-optics security thread - Active(TM) -

which has already won its first two customers. The combination of

cutting edge lenticular technology with microscopic fine line

printing gives the new feature a distinctive 3D colour shifting

effect that is simple to verify but difficult for counterfeiters to

replicate.

To maximise the value of our existing product capabilities, we

have started to explore cross-product utilisation, such as applying

polymer and holographic features to passports. We also leverage our

award winning design capabilities to enhance the sales channel for

our new features by incorporating them into banknote and passport

designs. In order to be at the forefront of technological progress

and to accelerate product development, we continue to seek

partnerships with research institutes and universities.

Identity Solutions

In collaboration with Her Majesty's Passport Office in the UK,

we redesigned the UK passport. The redesign was launched in

November 2015. The passport won the prestigious London Design Award

for its intricate design and sophisticated security layering. It

includes one of our latest inventions, the Continuous Bio-Data

Page(TM) construction method which makes the passport much harder

to counterfeit. To further enhance our passport offering we also

acquired laminate capability by partnering with Japanese printer

Dai Nippon Printing Co.

As countries increasingly look for secure and technology based

population authentication and border control, there is expected to

be a growing demand for end-to-end solutions and services. In June,

we launched our first identity software suite - DLR Identify(TM)

which provides an end-to-end solution for governments to manage and

monitor the process for authenticating and issuing a passport. The

second module of the DLR Identify(TM), which enables electronic

registration of births, is expected to launch in July 2016.

Product Authentication and Traceability

We made steady progress in PA&T during the year, with the

launch of our next generation digital solution - DLR Certify(TM).

The end-to-end solution provides a track and trace capability,

helping governments and commercial organisations to protect tax

revenue and the integrity of their products and brands. We have

already secured our first customer and will continue to focus on

building credibility by securing reference customers. We have also

initiated discussions with a number of potential technology

partners to strengthen our digital platform.

OPERATING REVIEWS

Currency

2015/16 2014/15 Change

Banknote print volume (bn notes) 7.1 6.5 9%

Banknote paper volume ('000 tonnes) 10.0 9.4 6%

GBPm GBPm

Revenue 353.3 317.9 11%

Operating profit* 55.1 50.5 9%

Operating margin* 15.6% 15.9% (30bpts)

*Segmental operating profit and operating margin are stated before

exceptional items

The Currency segment comprises Banknotes, Banknote Paper,

Polymer, and Security Features.

The segment grew its revenue by 11% to GBP353.3m (2014/15:

GBP317.9m) and operating profit by 9% to GBP55.1m (2014/15:

GBP50.5m), primarily reflecting the increased volumes in

Banknotes.

While volatility in the banknote market continued and orders

remained lumpy, overall margins in the year were stable. Banknote

volumes increased by 9% to 7.1bn notes (2014/15: 6.5bn) partly due

to winning overspill orders. Following extensive trials, production

of the new GBP5 Sterling polymer notes began in October 2015 and is

progressing well.

Banknote Paper volumes were up 6% to 10,000 tonnes (2014/15:

9,400 tonnes), also benefiting from overspill contracts. Margins,

however, continued to face downward pressure from oversupply in the

industry.

Polymer gained encouraging momentum marked by the significant

three year contract with a large customer, which resulted in a

modest revenue contribution and a small operating loss for the

year.

Security Features performed as expected, though an important

five year contract, which contributed annual revenue of GBP30m,

came to an end and was not renewed. While this is expected to

affect the profitability of this product line in 2016/17, we are

confident that we can mitigate the impact through other

opportunities that we are actively pursuing. We remain optimistic

about the long term growth prospect of this business.

At the year end the 12 month order book for Currency including

estimated call-off orders for material contracts was up 85% at

GBP278m on a like for like basis (2014/15: GBP150m). This provides

good visibility for 2016/17.

Identity Solutions (previously Identity Systems)

2015/16 2014/15 Change

GBPm GBPm

Revenue 65.8 69.0 (5%)

Operating profit* 6.4 11.1 (42%)

Operating margin* 9.7% 16.1% (640bpts)

*Segmental operating profit and operating margin are stated before

exceptional items

Revenue was 5% lower at GBP65.8m (2014/15: GBP69.0m) and

operating profit was down to GBP6.4m (2014/15: GBP11.1m. The

decline in both revenue and operating profit was expected and

predominantly due to contractual reduction in contribution on a

large contract.

The ten year contract with HMPO in the UK to produce and issue

passports continues to perform well. Volumes were up 2% year on

year. A new design of the passport was launched in November 2015

which included our latest security features Continuous Bio-Data

Page(TM) and SkyLight(TM).

Sales of ePassports were slower than anticipated as a number of

expected tenders were delayed, although the sales pipeline remained

good. Our main focus in the next 12 months is to convert some of

the pipeline to revenue and profit.

In June 2015, we launched our first identity software suite, DLR

Identify(TM). During the year, we sold and successfully installed

the software with its first customer.

Product Authentication & Traceability (PA&T, formerly

Security Products)

2015/16 2014/15 Change

GBPm GBPm

Revenue 39.5 39.6 0%

Operating profit* 8.9 7.5 19%

Operating margin* 22.5% 18.9% 360bpts

*Segmental operating profit and operating margin are stated before

exceptional items

Revenue was flat year on year at GBP39.5m (2014/15: GBP39.6m),

with operating profit up 19% to GBP8.9m (2014/15: GBP7.5m). The

higher operating margin was due to cost savings from the closure of

the Dulles site in 2014/15.

We continued to focus on building reference customers in both

the public and private sectors, aiming particularly at central

governments and enterprises that produce high value goods or

operate in highly regulated industries.

Our first track and trace solution DLR Certify(TM) was launched

in April 2015 and successfully delivered to its first customer in

November 2015.

Cash Processing Solutions (CPS)

2015/16 2014/15 Change

GBPm GBPm

Revenue 33.9 50.7 (33%)

Operating profit* (7.9) 0.4

*Segmental operating profit is stated before exceptional items

Sales volumes in Cash Processing Solutions (CPS) was affected by

increased competition and adverse foreign exchange movement, which

resulted in a 33% decline in revenue to GBP33.9m (2014/15:

GBP50.7m) and an operating loss of GBP7.9m (2014/15: operating

profit of GBP0.4m).

Following a 'root and branch' review initiated in November 2015,

we decided to exit the cash processing market. The sale of the CPS

business was completed on 22 May 2016.

FINANCE CHARGE

On a continuing operations basis, the Group's net interest

charge was GBP4.8m (2014/15: GBP4.6m) reflecting an increase in the

average level of net debt during the period. The IAS 19 related

finance cost, which represents the difference between the interest

on pension liabilities and assets was GBP7.1m (2014/15:

GBP7.0m).

EXCEPTIONAL ITEMS

During the period exceptional items on continuing operations,

summarised below, totalling GBP3.6m net, have been charged

(2014/15: GBP16.9m net - see note 4 for details).

Site relocation and restructuring costs in 2015/16 were GBP9.2m

net (2014/15: GBP2.8m net). Restructuring costs were incurred as

part of the redesign of the organisation structure and the

optimisation of manufacturing capabilities including the impact of

the manufacturing footprint review which will reduce our banknote

print production capacity from eight billion to six billion(2)

notes a year.

The sale of surplus land in Overton generated a profit of

GBP9.5m while surplus warranty provisions of GBP1.3m, previously

charged as exceptional items (2014/15: GBP3.0m) were released in

the period.

Following a review of capitalised assets, GBP5.2m of tangible

assets within the Currency segment were written down representing

assets linked with specific products whose future income streams

are forecast to be insufficient to support the current carrying

value.

The net cash cost of exceptional items for continuing operations

in the period was GBP12.5m. GBP17.6m of cash costs related to prior

periods and predominantly reflected the settlement of the

invocation of guarantees provided for as a post balance sheet event

in 2014/15.

Exceptional charges on discontinued operations were GBP26.0m -

see note 3 for details. These related to the Cash Processing

Solutions which was sold on 22 May 2016.

Site closure and restructuring costs in 2015/16 were GBP2.6m

(2014/15: GBP1.9m) mainly reflecting the closure of the Brazil

operation.

Asset impairments of GBP23.4m arising on the remeasurement of

the disposal group to fair value less costs to sell have been

recognised. The impairment has been applied to software intangibles

of GBP1.6m, goodwill of GBP4.0m and inventories of GBP17.8m.

The cash costs for exceptional items, on discontinued

operations, was GBP1.0m (2014/15: GBP1.7m).

CASH FLOW AND BORROWING

Underlying operating cash flow, comprising underlying operating

profit adjusted for depreciation and the movement in working

capital, was GBP100.2m (2014/15: GBP85.6m). This represents a cash

conversion ratio (underlying operating cash flow divided by

underlying operating profit) of 160% (2014/15:123%).

Net debt decreased by GBP4.9m to GBP106.1m (2014/15: GBP111.0m).

This was predominantly from improved working capital with increased

payments in advance received from customers.

The Group utilises a GBP250m revolving credit facility which

expires in December 2019. The Group has operated well within the

key financial covenants on this facility. These are that the ratio

of EBIT to net interest payable be greater than four times and the

net debt to EBITDA ratio be less than three times. At the period

end the specific bank covenant tests were as follows: EBIT/net

interest payable of 12.9 times and Net debt/EBITDA of 1.25

times.

CAPITAL STRUCTURE

At 26 March 2016 the Group had net liabilities of GBP145.6m (28

March 2015: GBP146.9m) mainly due to the recognition of the long

term retirement benefit obligations of GBP219.9m (2014/15:

GBP236.7m) in accordance with IAS 19.

The Company had shareholders' funds of GBP174.4m (2014/15:

GBP199.6m) and had 101.4m fully paid ordinary shares in issue

(2014/15: 101.1m) at the year end.

TAXATION

On a continuing operations basis, the net tax charge for the

year was GBP6.3m (2014/15: GBP7.7m). The effective tax rate before

exceptional items was 14.7% (2014/15: 17.6%). The tax rate is lower

than the prior year primarily as a result of favourable changes to

UK tax rates, reducing from 21% to 20% in the current year and

further reducing to 18% from April 2020. The Group has also

benefited from the increasing relief available under the UK Patent

Box regime.

Net tax credits relating to exceptional items, on continuing

operations, arising in the period were GBP1.8m (2014/15 GBP2.4m).

In addition there was an exceptional credit of GBP0.5m (2014/15:

GBPnil) in respect of the determination of the tax treatment of a

prior year exceptional restructuring item.

PENSION DEFICIT AND FUNDING

During 2015/16, special funding payments of GBP19.1m (including

scheme administration fees) were made to the Group's UK defined

benefit pension scheme (closed to new members in 2010 and future

accrual from April 2013). The Group's formal triennial funding

valuation of the UK defined benefit pension scheme as at 5 April

2015 has not been finalised as the company and scheme Trustees

continue discussions with the Pensions Regulator. The previous

valuation took place on 5 April 2012 and identified that the scheme

had a deficit of GBP180m. The Group had agreed with the scheme

Trustees and Pension Regulator deficit funding payments to the

scheme of GBP18.9m in 2016/17, rising by 4% per annum. Pending

finalisation of the 2015 valuation, the special funding

arrangements agreed in 2012 which aim to eliminate the deficit by

2022 remain unchanged.

Recognition of the current deficit in accordance with IFRS when

combined with overseas unfunded obligations results in the negative

net assets shown on the Group balance sheet.

The valuation of the UK pension scheme under IAS 19 principles

indicates a pre-tax scheme deficit at 26 March 2016 of GBP217.6m

(28 March 2015: GBP234.1m). The decrease of GBP16.5m is largely a

reflection of the increase in the discount rate used to project the

value of the scheme liabilities (3.5% in 2015/16 compared with 3.2%

in the prior year) and the Group funding contributions. The

decrease has been partly offset by an increase in the life

expectancy of members and lower than expected returns of scheme

assets.

In common with other final salary schemes the scheme valuation

is very sensitive to any movement in the discount rate, with a

0.25% increase in discount rate resulting in a GBP49m decrease in

liabilities or vice versa and hence the deficit would reduce should

interest and discount rates increase in the future.

The charge to operating profit in respect of the UK defined

benefit pension scheme for 2015/16 was GBP1.2m (2014/15: GBP1.1m).

In addition, under IAS 19 there was a finance charge of GBP7.1m

arising from the difference between the interest cost on

liabilities and the interest income on scheme assets (2014/15:

GBP7.0m).

EVENTS SINCE THE BALANCE SHEET DATE

Since the year end the following material non adjusting event

has occurred:

On 22 May 2016 the sale of the Cash Processing Solutions

business was completed. The sale is expected to result in a profit

on disposal in the range of GBPnil to GBP3m, which will be

recognised in the half year ending 24 September 2016. This

estimated loss includes the loss on disposal of certain current

assets and liabilities held for sale (refer to note 3), and the

recycling through the income statement of accumulated foreign

exchange translation losses recorded in reserves and the estimated

costs of disposal.

In addition to the cash payment upon completion and deferred

cash payments there is also a contingent element of consideration

which is dependent upon the disposed business meeting certain

future targets. This contingent element of the consideration has

not been factored into the estimated loss on disposal.

BOARD CHANGES

There have been significant changes to both the Board and the

executive management team in the past year.

We have welcomed four new Board members since the AGM on 23 July

2015. Sabri Challah and Maria da Cunha joined the Board as

Non-executive Directors to replace Warren East and Gill Rider who

stood down after serving eight years and nine years respectively.

Sabri Challah was appointed Chair of the Remuneration Committee in

July 2015, replacing Gill Rider.

Jitesh Sodha, appointed in August 2015 to replace Colin Child as

Chief Financial Officer, and the Group's Chief Operating Officer

Rupert Middleton also joined the Board as an Executive Director

after the AGM.

Victoria Jarman has informed the Board of her decision to step

down after the AGM having served six years as a Non-executive

Director. We are in the advanced stages of recruiting a new

Non-executive Director to the Board whom we anticipate will succeed

Victoria as Chair of the Audit Committee. We would like to thank

Victoria for the significant contribution she has made during her

time on the Board.

We believe that the current Board composition offers the right

balance of experience and skills to provide insightful strategic

guidance as well as robust corporate governance to the

business.

OUTLOOK

The Group's 12 month closing order book of GBP365m(1) provides

good visibility for the year ahead. Whilst, as previously

announced, a material contract came to an end, we are confident we

can mitigate the impact and our expectations for the current year

are unchanged.

-ends-

Martin Sutherland Jitesh Sodha

Chief Executive Officer Chief Financial Officer

24 May 2016

GROUP INCOME STATEMENT For the period ended 26

March 2016

=========================================================== ====== ======== =========

2016 Restated*

Notes GBPm 2015

GBPm

=========================================================== ====== ======== =========

Revenue 454.5 422.8

======== =========

Operating expenses - ordinary (384.1) (353.7)

Operating expenses - exceptional 4 (3.6) (16.9)

======== =========

Total operating expenses (387.7) (370.6)

=========================================================== ====== ======== =========

Operating profit 66.8 52.2

Comprising:

======== =========

Underlying operating profit 70.4 69.1

Exceptional items 4 (3.6) (16.9)

======== =========

Profit before interest and taxation 66.8 52.2

Interest income 0.1 0.1

Interest expense (4.9) (4.7)

Net retirement benefit obligation finance cost (7.1) (7.0)

=========================================================== ====== ======== =========

Net finance expense (11.9) (11.6)

=========================================================== ====== ======== =========

Profit before taxation 54.9 40.6

Comprising:

-------- ---------

Underlying profit before tax 58.5 57.5

Exceptional items (3.6) (16.9)

-------- ---------

Taxation 5 (6.3) (7.7)

=========================================================== ====== ======== =========

Profit for the year from continuing operations 48.6 32.9

----------------------------------------------------------- ------ -------- ---------

Comprising:

-------- ---------

Underlying profit for the year 49.9 47.4

Loss for the year on exceptional items (1.3) (14.5)

-------- ---------

(Loss)/profit from discontinued operations (31.0) 2.2

Profit for the year 17.6 35.1

=========================================================== ====== ======== =========

Profit attributable to equity shareholders of the 47.4

company

Profit for the year from continuing operations (31.0) 32.1

Loss for the year from discontinuing operations 16.4 2.2

Total profit for the year attributable to equity 34.3

shareholders of the company

Profit attributable to non-controlling interests 1.2

Profit for the year from continuing operations - 0.8

Profit for the year from discontinuing operations 1.2 -

Total profit for the year attributable to non-controlling 0.8

interests

17.6 35.1

=========================================================== ====== ======== =========

*2015 figures have been restated for the impact

of discontinued operations - see note 3

Profit for the year attributable to the Company's Notes 2016 2015

equity holders GBPm GBPm

================================================= ===== ========= =======

Earnings per share 6 46.8p

Basic (30.6p)

Basic EPS continuing operations 16.2p 31.8p

Basic EPS discontinued operations 2.2p

Total Basic Earnings per share 34.0p

Diluted 6 46.2p

Diluted EPS continuing operations (30.2p) 31.3p

Diluted EPS discontinued operations 16.0p 2.1p

Total Diluted Earnings per share 33.4p

================================================= ===== ========= =======

Earnings per share - underlying 6 48.1p

Basic (7.1p)

Basic EPS continuing operations 41.0p 46.1p

Basic EPS discontinued operations 1.8p

Total Basic Earnings per share 47.9p

Diluted 6 47.5p

Diluted EPS continuing operations (7.0p) 45.5p

Diluted EPS discontinued operations 40.5p 1.8p

Total Diluted Earnings per share 47.2p

==================================== ======== =======

GROUP STATEMENT OF COMPREHENSIVE INCOME For the

period ended 26 March 2016

========================================================= ===== ======

2016 2015

GBPm GBPm

========================================================= ===== ======

Profit for the year 17.6 35.1

========================================================== ===== ======

Other comprehensive income

Items that are not reclassified subsequently to

profit or loss:

Remeasurement losses on retirement benefit obligations 5.4 (79.1)

Tax related to remeasurement of net defined benefit

liability (5.4) 16.0

Items that may be reclassified subsequently to

profit or loss:

Foreign currency translation differences for foreign

operations 1.5 (10.4)

Change in fair value of cash flow hedges 4.1 (7.3)

Change in fair value of cash flow hedges transferred

to profit or loss 1.6 5.3

Change in fair value of cash flow hedges transferred

to non-current assets 1.5 1.6

Income tax relating to components of other comprehensive

income (1.8) (0.1)

Other comprehensive income for the year, net of

tax 6.9 (74.0)

========================================================== ===== ======

Total comprehensive income for the year 24.5 (38.9)

========================================================== ===== ======

Comprehensive income for the year attributable

to:

Equity shareholders of the Company 23.3 (39.7)

Non-controlling interests 1.2 0.8

========================================================== ===== ======

24.5 (38.9)

========================================================= ===== ======

GROUP BALANCE SHEET At 26 March 2016

================================================= === ======= =======

2016 2015

GBPm GBPm

================================================= === ======= =======

Assets

Non-current assets

Property, plant and equipment 167.0 179.3

Intangible assets 13.4 16.6

Investments in associates and joint ventures 0.1 0.1

Deferred tax assets 41.6 47.7

Derivative financial assets 1.9 0.3

224.0 244.0

===================================================== ======= =======

Current assets

Inventories 67.1 71.2

Trade and other receivables 93.5 105.4

Current tax assets 1.3 2.2

Derivative financial assets 15.0 7.8

Cash and cash equivalents 40.5 30.8

Assets classified as held for sale 11.2 -

228.6 217.4

===================================================== ======= =======

Total assets 452.6 461.4

====================================================== ======= =======

Liabilities

Current liabilities

Borrowings (146.6) (141.8)

Trade and other payables (171.5) (159.1)

Current tax liabilities (17.6) (19.6)

Derivative financial liabilities (12.0) (12.0)

Provisions for liabilities and charges (9.0) (26.6)

Liabilities classified as held for sale (10.5) -

====================================================== ======= =======

(367.2) (359.1)

===================================================== ======= =======

Non-current liabilities

Retirement benefit obligations (219.9) (236.7)

Deferred tax liabilities (1.6) (1.1)

Derivative financial liabilities (1.2) (1.0)

Provisions for liabilities and charges (6.9) (3.5)

Other non-current liabilities (1.4) (6.9)

====================================================== ======= =======

(231.0) (249.2)

===================================================== ======= =======

Total liabilities (598.2) (608.3)

====================================================== ======= =======

Net liabilities (145.6) (146.9)

====================================================== ======= =======

Equity

Share capital 46.6 46.5

Share premium account 35.7 35.5

Capital redemption reserve 5.9 5.9

Hedge reserve 2.3 (3.5)

Cumulative translation adjustment (12.3) (13.8)

Other reserves (83.8) (83.8)

Retained earnings (146.6) (139.4)

====================================================== ======= =======

Total equity attributable to shareholders of the

Company (152.2) (152.6)

Non-controlling interests 6.6 5.7

====================================================== ======= =======

Total equity (145.6) (146.9)

====================================================== ======= =======

GROUP STATEMENT OF CHANGES IN EQUITY For the period ended

26 March 2016

Attributable to equity shareholders Non-controlling Total

interests equity

======================================================================

Share Capital Cumulative

Share premium redemption Hedge translation Other Retained

capital account reserve reserve adjustment reserve earnings

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

================================= ======= ======= ========== ======= =========== ======= ========= =============== =======

Balance at 29 March

2014 46.3 35.3 5.9 (3.2) (3.4) (83.8) (72.6) 5.1 (70.4)

------- ------- ---------- ------- ----------- ------- --------- --------------- -------

Profit for the year - - - - - - 34.3 0.8 35.1

Other comprehensive

income for the year,

net of tax - - - (0.3) (10.4) - (63.3) - (74.0)

------- ------- ---------- ------- ----------- ------- --------- --------------- -------

Total comprehensive

income for the year - - - (0.3) (10.4) - (29.0) 0.8 (38.9)

Transactions with

owners of the Company

recognised directly

in equity:

Share capital issued 0.2 0.2 - - - - - - 0.4

Employee share scheme:

* value of services provided - - - - - - (0.5) - (0.5)

Income tax on income

and expenses recognised

directly in equity - - - - - - (0.5) - (0.5)

Dividends paid - - - - - - (36.8) (0.2) (37.0)

================================= ======= ======= ========== ======= =========== ======= ========= =============== =======

Balance at 28 March

2015 46.5 35.5 5.9 (3.5) (13.8) (83.8) (139.4) 5.7 (146.9)

------- ------- ---------- ------- ----------- ------- --------- --------------- -------

Profit for the year - - - - - - 16.4 1.2 17.6

Other comprehensive

income for the year,

net of tax - - - 5.8 1.5 - (0.4) - 6.9

------- ------- ---------- ------- ----------- ------- --------- --------------- -------

Total comprehensive

income for the year - - - 5.8 1.5 - 16.0 1.2 24.5

Transactions with

owners of the Company

recognised directly

in equity:

Share capital issued 0.1 0.2 - - - - - - 0.3

Employee share scheme:

* value of services provided - - - - - - 2.4 - 2.4

Income tax on income

and expenses recognised

directly in equity - - - - - - (0.3) - (0.3)

Dividends paid - - - - - - (25.3) (0.3) (25.6)

================================= ======= ======= ========== ======= =========== ======= ========= =============== =======

Balance at 26 March

2016 46.6 35.7 5.9 2.3 (12.3) (83.8) (146.6) 6.6 (145.6)

================================= ======= ======= ========== ======= =========== ======= ========= =============== =======

GROUP CASH FLOW STATEMENT For the period ended

26 March 2016

======================================================== ====== ====== ======

2016 2015

Notes GBPm GBPm

======================================================== ====== ====== ======

Cash flows from operating activities

Profit before tax 20.8 38.9

Adjustments for:

Finance income and expense 12.1 11.9

Depreciation 23.0 23.0

Amortisation 3.2 1.8

Decrease in inventory 5.0 5.7

(Increase)/decrease in trade and other receivables (2.0) 0.1

Increase/(decrease) in trade and other payables 11.4 (5.4)

Increase/(decrease) in reorganisation provisions 0.4 (0.3)

Special pension fund contributions (19.1) (18.6)

(Profit)/loss on disposal of property, plant, equipment

and software intangibles (7.6) 2.2

Asset impairment 10.8 3.8

Other non-cash movements 0.9 0.5

Cash generated from operating activities 58.9 63.6

Tax paid (4.7) (9.3)

======================================================== ====== ====== ======

Net cash flows from operating activities 54.2 54.3

======================================================== ====== ====== ======

Cash flows from investing activities

Purchases of property, plant, equipment and software

intangibles (25.0) (28.8)

Development assets capitalised (3.0) (5.1)

Proceeds from sale of property, plant and equipment 9.9 0.2

======================================================== ====== ====== ======

Net cash flows from investing activities (18.1) (33.7)

======================================================== ====== ====== ======

Net cash flows before financing activities 36.1 20.6

======================================================== ====== ====== ======

Cash flows from financing activities

Proceeds from issue of share capital 0.3 0.4

Proceeds from/(repayments of) borrowings 3.6 (6.8)

Interest received 0.1 0.2

Interest paid (4.2) (4.8)

Dividends paid to shareholders (25.3) (36.8)

Dividends paid to non-controlling interests (0.3) (0.2)

======================================================== ====== ====== ======

Net cash flows from financing activities (25.8) (48.0)

======================================================== ====== ====== ======

Net increase/(decrease) in cash and cash equivalents

in the year 10.3 (27.4)

Cash and cash equivalents at the beginning of the

year 28.9 56.2

Exchange rate effects (1.3) 0.1

======================================================== ====== ====== ======

Cash and cash equivalents at the end of the year 37.9 28.9

======================================================== ====== ====== ======

Cash and cash equivalents consist of:

Cash at bank and in hand 8 40.5 28.6

Short term bank deposits 8 - 2.2

Bank overdrafts 8 (2.6) (1.9)

======================================================== ====== ====== ======

8 37.9 28.9

======================================================== ====== ====== ======

1 Basis of preparation and accounting policies

The preliminary announcement for the period ended 26 March 2016

has been prepared consistently with International Accounting Standards

and International Financial Reporting Standards (collectively "IFRS")

as adopted by the European Union (EU) at 26 March 2016. Details

of the accounting policies applied are those set out in De La Rue

plc's annual report 2015. For 2015/16 there is an additional accounting

policy included in the Group Financial Statements covering Classification

of assets held for resale which addresses the discontinued operations

of the CPS business.

During the period a number of amendments to IFRS became effective

and were adopted by the Group, none of which had a material impact

on the Group's net cash flows, financial position, total comprehensive

income or earnings per share.

A number of other new and amended IFRS were issued during the year,

which do not become effective until after 27 March 2016. IFRS 15

Revenue from Contracts with Customers (effective for the year ending

30 March 2019, not yet endorsed by the EU) provides a single, principles

based, five step model to be applied to all sales contracts. Based

on a provisional assessment, IFRS 15 is not expected to have a

significant impact on the timing of revenue recognition in the

Group. The group will continue to assess the impact during 2016/17.

Otherwise, none of the new or amended IFRSs are expected to have

a material impact on the Group for the 2016/17 period.

In applying the accounting policies, management has made appropriate

estimates in many areas, and the actual outcome may differ from

those calculated. The key sources of estimation uncertainty at

the balance sheet date were the same as those that applied to the

consolidated financial statements of the Group for the period ended

28 March 2015, apart from an additional accounting policy included

in the Group Financial Statements covering Classification of assets

held for resale which addresses the discontinued operations of

the CPS business.

The financial information set out above does not constitute the

Group's statutory accounts for the periods ended 26 March 2016

or 28 March 2015. The financial information for the period ended

26 March 2016 is derived from the statutory accounts for the period

ended 26 March 2016 which will be delivered to the registrar of

companies. The auditor has reported on the accounts for the period

ended 26 March 2016; their report was (i) unqualified, (ii) did

not include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3)

of the Companies Act 2006.

These consolidated financial statements have been prepared on the

going concern basis and using the historical cost convention, modified

for certain items carried at fair value, as stated in the Group's

accounting policies.

2 Segmental analysis

The continuing operations of the Group have three main operating

units: Currency, Identity Solutions and Product Authentication

and Traceability. The Board, which is the Group's Chief Operating

Decision Maker, monitors the performance of the Group at this

level and there are therefore three reportable segments. The principal

financial information reviewed by the Board is revenue and underlying

operating profit, measured on an IFRS basis.

The Group's segments are:

* Currency - provides printed banknotes, banknote paper

and polymer substrates and banknote security features

* Identity Solutions - involved in the provision of

passport, ePassport, national ID and eID, driving

licence and voter registration schemes

* Product Authentication and Traceability (previously

Security Products) - produces security documents,

including authentication labels, brand licensing

products, government documents, cheques and postage

stamps

Inter-segmental transactions are eliminated upon consolidation.

Discontinued operations - The Cash Processing Solutions (CPS)

operation, primarily focused on the production of large banknote

sorters and authentication machines for central banks, has been

classified as a disposal group held for sale (see note 3).

2016 Currency Identity Product Unallocated Total Discontinued Total

Solutions Authentication of Continuing operations

and Traceability operations

------------------ --------- ----------- ------------------ ------------ --------------- ------------- --------

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Total revenue 353.3 65.8 39.5 - 458.6 33.9 492.5

Less:

inter-segment

revenue (0.8) - (3.3) - (4.1) (0.2) (4.3)

------------------ --------- ----------- ------------------ ------------ --------------- ------------- --------

Revenue 352.5 65.8 36.2 - 454.5 33.7 488.2

------------------ --------- ----------- ------------------ ------------ --------------- ------------- --------

Underlying

operating

profit/(loss) 55.1 6.4 8.9 - 70.4 (7.9) 62.5

Exceptional items

- operating

(note 4, 3) (13.1) - (0.5) 10.0 (3.6) (26.0) (29.6)

------------------ --------- ----------- ------------------ ------------ --------------- ------------- --------

Operating

profit/(loss) 42.0 6.4 8.4 10.0 66.8 (33.9) 32.9

Net interest

expense (4.8) (4.8) (0.2) (5.0)

Retirement

benefit

obligations

net finance

expense (7.1) (7.1) - (7.1)

------------------ --------- ----------- ------------------ ------------ --------------- ------------- --------

Profit/(loss)

before taxation 54.9 (34.1) 20.8

------------------ --------- ----------- ------------------ ------------ --------------- ------------- --------

Segment assets 238.4 38.9 20.8 143.3 441.4 11.2 452.6

Segment

liabilities (119.4) (26.7) (7.2) (434.4) (587.7) (10.5) (598.2)

Capital

expenditure on

property,

plant and

equipment 11.1 0.2 1.7 3.5 16.5 - 16.5

Capital

expenditure on

intangible

assets 3.3 1.4 0.3 - 5.0 0.3 5.3

Depreciation of

property,

plant and

equipment 17.0 2.6 1.4 2.0 23.0 - 23.0

Impairment of

property, plant

and equipment 5.2 - - - 5.2 - 5.2

Amortisation of

intangible

assets 2.2 0.7 0.1 - 3.0 0.2 3.2

Impairment of

intangible

assets - - - - - 5.6 5.6

2015 Currency Identity Product Unallocated Total Discontinued Total

Solutions Authentication of Continuing operations

and operations

Traceability

-------------------- --------- ----------- ---------------- ------------ --------------- ------------- --------

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Total revenue 317.9 69.0 39.6 - 426.5 50.7 477.2

Less: inter-segment

revenue (0.8) - (2.9) - (3.7) (1.4) (5.1)

-------------------- --------- ----------- ---------------- ------------ --------------- ------------- --------

Revenue 317.1 69.0 36.7 - 422.8 49.3 472.1

-------------------- --------- ----------- ---------------- ------------ --------------- ------------- --------

Underlying

operating

profit/(loss) 50.5 11.1 7.5 - 69.1 0.4 69.5

Exceptional items -

operating

(note 4, 3) (10.7) - (6.2) - (16.9) (1.9) (18.8)

-------------------- --------- ----------- ---------------- ------------ --------------- ------------- --------

Operating

profit/(loss) 39.8 11.1 1.3 - 52.2 (1.5) 50.7

Net interest

expense (4.6) (4.6) (0.2) (4.8)

Retirement benefit

obligations

net finance

expense (7.0) (7.0) - (7.0)

-------------------- --------- ----------- ---------------- ------------ --------------- ------------- --------

Profit/(loss)

before taxation 40.6 (1.7) 38.9

-------------------- --------- ----------- ---------------- ------------ --------------- ------------- --------

Segment assets 241.7 38.8 19.8 128.0 428.3 33.1 461.4

Segment liabilities (128.8) (21.6) (9.1) (437.7) (597.2) (11.1) (608.3)

Capital expenditure

on property,

plant and

equipment 19.6 0.9 1.0 1.8 23.3 - 23.3

Capital expenditure

on intangible

assets 3.8 0.6 0.9 - 5.3 1.0 6.3

Depreciation of

property,

plant and

equipment 17.3 2.7 1.6 1.4 23.0 - 23.0

Amortisation of

intangible

assets 1.3 0.4 - - 1.7 0.1 1.8

Impairment of

intangible assets - - 3.8 - 3.8 - 3.8

-------------------- --------- ----------- ---------------- ------------ --------------- ------------- --------

3 Discontinued operations

The Cash Processing Solutions business (CPS) is presented as a

disposal group held for sale following the conclusion of a root and

branch review. The Board concluded that whilst CPS has a good

product profile and long term customer relationships, it does not

believe that this is a business which should form part of the

Group's portfolio and has therefore decided to exit this market.

This will enable the continuing Group to focus on its core business

and future growth areas, as well as allow CPS to achieve its full

potential under new dedicated ownership.

The CPS assets and liabilities that the group plans to dispose

of were transferred into the disposal group at their carrying

value. A charge of GBP23.4m arising on the remeasurement of the

disposal group to the lower of the carrying amount and its fair

value less costs to sell has been recognised in exceptional items.

This has been applied first to non-current assets and then to

inventory within the disposal group.

In line with IFRS 5 no remeasurement has been applied to

financial assets. The fair value reflects the anticipated sales

price to be achieved upon completion.

No UK pension liability will transfer with the disposal

group.

Results of the discontinued operation including the disposal

group held for sale

2016 2015

GBPm GBPm

================================================ ====== ======

Revenue 33.7 49.3

====== ======

Operating expenses - ordinary (41.6) (48.9)

Operating expenses - exceptional (26.0) (1.9)

====== ======

Total operating expenses (67.6) (50.8)

================================================= ====== ======

Operating loss (33.9) (1.5)

Comprising:

====== ======

Underlying operating (loss)/profit (7.9) 0.4

Exceptional items (26.0) (1.9)

====== ======

Loss before interest and taxation (33.9) (1.5)

Interest income - 0.1

Interest expense (0.2) (0.3)

Net finance expense (0.2) (0.2)

================================================= ====== ======

Loss before taxation (34.1) (1.7)

Comprising:

====== ======

Underlying (loss)/profit before tax (8.1) 0.2

Exceptional items (26.0) (1.9)

====== ======

Taxation 3.1 3.9

================================================= ====== ======

(Loss)/profit from discontinued operations (31.0) 2.2

================================================= ====== ======

Comprising:

====== ======

Underlying (loss)/profit for the year (7.2) 1.8

(Loss)/profit for the year on exceptional items (23.8) 0.4

====== ======

Assets/liabilities held for sale/disposal group

2016 2015

Notes GBPm GBPm

=================================== ======= ===== =====

Assets classified as held for sale

Derivative financial assets 0.2 -

Trade and other receivables 11.0 -

11.2 -

=========================================== ===== =====

2016 2015

GBPm GBPm

Liabilities classified as held for sale

Trade and other payables (10.0) -

Derivative financial liabilities (0.3) -

Provisions for liabilities and charges (0.2) -

(10.5) -

======================================== ====== =====

2016 2015

GBPm GBPm

Exceptional items on discontinued operations

Site closures and restructuring (2.6) (1.9)

Assessment of carrying value following classification

as an asset for sale (23.4) -

Exceptional items (26.0) (1.9)

======================================================= ====== =====

Tax credit on exceptional items 2.2 2.3

======================================================= ====== =====

Site closure and restructuring costs in 2015/16 were GBP2.6m

(2014/15: GBP1.9m) comprising GBP0.7m (2014/15: GBP1.5m) in staff

compensation, and GBP1.9m (2014/15: GBPnil) for site exit costs and

GBPnil (2014/15: GBP0.4m) in other associated reorganisation

costs.

Asset impairments of GBP23.4m arising on the remeasurement of

the disposal group to fair value less costs to sell have been

recognised. The impairment has been applied to software intangibles

of GBP1.6m, goodwill of GBP4.0m and inventories of GBP17.8m.

The cash cost for exceptional items in the period was GBP1.0m

(2014/15: GBP1.7m).

Tax credits relating to the exceptional items arising in the

period were GBP0.3m (2014/15: GBP0.4m). In addition there was an

exceptional credit of GBP1.9m in respect of the determination of

the tax treatment of prior year discontinued exceptional items

(2014/15: GBP1.9m).

Accumulated foreign currency translation gains and losses within

the disposal group held for sale

The Group has accumulated foreign currency translation gains and

losses in relation to the entities included within the disposal

group. IAS 21 requires recycling of these foreign currency

translation gains or losses, which have previously been taken

direct to reserves, through the income statement at the point of

disposal. At 26 March 2016 these foreign exchange gains or losses

have not been recycled. If a sale of the disposal group had been

completed as at 26 March 2016 the amount that would have been

recycled through the income statement is cGBP3.5m gain.

Subsequent to the year end the disposal of the CPS business has

been completed, refer to note 10.

4 Exceptional items

====================================== ========== ========

2016 Restated

GBPm 2015

GBPm

====================================== ========== ========

Site relocation and restructuring (9.2) (2.8)

Invocation of guarantees - (13.3)

Sale of land 9.5 -

Warranty provisions 1.3 3.0

Asset impairment (5.2) (3.8)

Exceptional items in operating profit (3.6) (16.9)

====================================== ========== ========

Tax credit on exceptional items 2.3 2.4

====================================== ========== ========

Site relocation and restructuring costs in 2015/16 were GBP9.2m

net (2014/15: GBP2.8m net). Restructuring costs were incurred as

part of the redesign of the organisation structure and the optimisation

of manufacturing capabilities including the impact of the manufacturing

footprint review which will reduce our banknote print production

capacity from eight billion to six billion notes a year(2) .

The GBP9.2m net exceptional operating charge in respect of site

relocation and restructuring (2014/15: GBP2.8m) comprised GBP8.4m

(2014/15: GBP2.8m) in staff compensation, GBP1.0m (2014/15: GBP1.9m)

for site exit costs offset by credits on existing provisions of

GBP0.2m (2104/15: GBP1.2m) in staff compensation and GBPnil (2014/15:

GBP0.7m) for site exit costs. The GBP9.2m charge was split between

the operating segments as follows: Currency GBP8.7m, Product Authentication

and Traceability GBP0.5m.

The sale of surplus land in Overton generated a profit of GBP9.5m

while surplus warranty provisions of GBP1.3m, previously charged

as exceptional items (2014/15: GBP3.0m) were released in the period.

Following a review of capitalised assets, GBP5.2m of tangible assets

within the Currency segment were written down representing assets

linked with specific products whose future income streams are forecast

to be insufficient to support the current carrying value.

The net cash cost of exceptional items for continuing operations

in the period was GBP12.5m. GBP17.6m of cash cost of exceptional

items related to prior periods and predominantly reflected the

settlement of the invocation of guarantees provided for as a post

balance sheet event in 2014/15.

In addition the following exceptional items were incurred in the

prior year: GBP13.3m of charges in relation to the invocation of

guarantees and GBP3.8m write off on first generation software within

the Product Authentication and Traceability segment.

Tax credits relating to continuing exceptional items arising in

the period were GBP1.8m (2014/15 GBP2.4m). In addition there was

an exceptional credit of GBP0.5m (2014/15: GBPnil) in respect of

the determination of the tax treatment of a prior year exceptional

restructuring item.

5 Taxation

========================================================= ===== ========

2016 Restated

GBPm 2015

GBPm

========================================================= ===== ========

Consolidated income statement

========================================================= ===== ========

Current tax:

UK corporation tax:

- Current tax 8.3 6.1

- Adjustment in respect of prior years (0.1) (1.2)

========================================================= ===== ========

8.2 4.9

========================================================= ===== ========

Overseas tax charges:

- Current year 2.2 2.8

- Adjustment in respect of prior years (0.7) (0.3)

========================================================= ===== ========

1.5 (2.5)

========================================================= ===== ========

Total current income tax charge 9.7 7.4

========================================================= ===== ========

Deferred tax:

========================================================= ===== ========

- Origination and reversal of temporary differences,

UK (3.3) 0.3

- Origination and reversal of temporary differences, (0.1) -

overseas

========================================================= ===== ========

Total deferred tax (credit)/charge (3.4) 0.3

========================================================= ===== ========

Income tax expense reported in the consolidated

income statement in respect of continuing operations 6.3 7.7

========================================================= ===== ========

Income tax expense in respect of discontinued operations

(note 3) (3.1) (3.9)

========================================================= ===== ========

Total income tax charge in the consolidated income

statement 3.2 3.8

========================================================= ===== ========

Tax on continuing operations attributable to:

- Ordinary activities 8.6 10.1

- Exceptional items (2.3) (2.4)

Tax on discontinuing operations attributable to:

- Ordinary activities (0.9) (1.6)

- Exceptional items (2.2) (2.3)

========================================================= ===== ========

Consolidated statement of comprehensive income:

========================================================= === ======

- On remeasurement of net defined benefit liability 5.4 (16.0)

- On cash flow hedges 1.4 (0.1)

- On foreign exchange on quasi-equity balances 0.4 0.2

Income tax charge/(credit) reported within comprehensive

income 7.2 (15.9)

========================================================= === ======

Consolidated statement of changes in equity:

========================================================= === ======

- On share options 0.3 0.5

========================================================= === ======

Income tax charge reported within equity 0.3 0.5

========================================================= === ======

The tax on the Group's consolidated profit before tax for continuing

operations differs from the UK tax rate of 20 per cent as follows:

2016 Restated 2015

Before Before

exceptional Exceptional exceptional Exceptional

items items Total items items Total

GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------------- ------------- -------------- -------- ------------- -------------- --------

Profit before tax 58.5 (3.6) 54.9 57.5 (16.9) 40.6

--------------------------------- ------------- -------------- -------- ------------- -------------- --------

Tax calculated at UK tax

rate of 20 per cent (2014/15:

21 per cent) 11.7 (0.7) 11.0 12.1 (3.5) 8.6

Effects of overseas taxation (1.1) - (1.1) (1.4) - (1.4)

(Credits)/charges not allowable

for tax purposes (1.5) 0.8 (0.7) 1.1 0.9 2.0

Increase in unutilised tax

losses - (1.9) (1.9) - 0.4 0.4

Adjustments in respect of

prior years (0.1) (0.5) (0.6) (1.5) (0.2) (1.7)

Change in UK tax rate (0.4) - (0.4) (0.2) - (0.2)

--------------------------------- ------------- -------------- -------- ------------- -------------- --------

Tax charge/(credit) 8.6 (2.3) 6.3 10.1 (2.4) 7.7

--------------------------------- ------------- -------------- -------- ------------- -------------- --------

The underlying effective tax rate excluding exceptional items was

14.7 per cent (restated 2014/15: 17.6 per cent).

6 Earnings per share

2016 2016 2016 Restated Restated Restated

Continuing Discontinued Total 2015 2015 2015

operations operations pence Continuing Discontinued Total

pence pence per operations operations

per per share pence pence pence

share share per per per

share share share

=========================== ============ ============== ======= =========== ============= ========

Earnings per share

Basic earnings per share 46.8 (30.6) 16.2 31.8 2.2 34.0

Diluted earnings per share 46.2 (30.2) 16.0 31.3 2.1 33.4

=========================== ============ ============== ======= =========== ============= ========

Underlying earnings per

share

Basic earnings per share 48.1 (7.1) 41.0 46.1 1.8 47.9

Diluted earnings per share 47.5 (7.0) 40.5 45.5 1.8 47.3

--------------------------- ------------ -------------- ------- ----------- ------------- --------

Basic earnings per share is calculated by dividing the profit attributable to

equity shareholders by the weighted average number of ordinary shares outstanding

during the year, excluding those held in the employee share trust which are

treated as cancelled.

For diluted earnings per share, the weighted average number of ordinary shares

in issue is adjusted for the impact of the dilutive effect of share options.