Strong Pipeline Momentum

Continues

CytomX Therapeutics, Inc. (Nasdaq:CTMX), a biopharmaceutical

company developing investigational Probody™ therapeutics for the

treatment of cancer, today reported second quarter 2017 financial

results.

As of June 30, 2017, CytomX had cash, cash equivalents and

short-term investments of $335.9 million. Based upon its current

operating plan, the Company expects its existing capital resources

will be sufficient to fund operations into 2020.

“During the second quarter, our pipeline of innovative Probody

therapeutics continued to advance. We now have two wholly owned

product candidates in clinical studies - CX-072, a PD-L1-targeting

Probody therapeutic, and CX-2009, a Probody drug conjugate that

targets the novel, highly expressed tumor antigen, CD-166,” said

Sean McCarthy, D.Phil., president and chief executive officer of

CytomX Therapeutics. "We remain on track to disclose data from

these initial Probody clinical trials in 2018, and also expect

clinical trial initiation for two partnered programs during this

timeframe.”

Q2’17 BUSINESS HIGHLIGHTS AND RECENT

DEVELOPMENTS

PROCLAIM-CX-072 (PD-L1 Probody) Clinical

Program

- Patient enrollment has progressed well in the monotherapy dose

escalation arm of the study evaluating CX-072 in patients with

advanced unresectable solids tumors or lymphomas. This arm was

initiated in 1Q’17 and enrollment is expected to be completed in 2H

’17.

- Patient enrollment has been initiated in a combination arm of

the study evaluating a concomitant schedule for CX-072 plus

ipilimumab in patients with advanced unresectable solids tumors or

lymphomas.

- Patient enrollment has also been initiated in a vemurafenib

combination arm, evaluating CX-072 plus vemurafenib in patients

with V600E BRAF-positive melanoma.

- During the first half of 2018, an expansion cohort of the study

at the recommended Phase 2 dose is expected to begin enrolling

patients to evaluate CX-072 as monotherapy in a tumor type with

known sensitivity to PD-L1 and/or PD-1 inhibitors.

PROCLAIM-CX-2009 (CD166 Probody Drug Conjugate) Clinical

Program

- Patient enrollment is underway in the PROCLAIM-CX-2009 study, a

Phase 1/2 clinical trial evaluating CX-2009 as monotherapy in a

subset of CD166-positive cancers.

- CX-2009 is a first-in-class Probody drug conjugate (PDC) that

targets CD-166, an antigen that is broadly and highly expressed in

many types of cancers, but has been considered undruggable given

that it is also expressed in normal tissue.

- CX-2009 has broad potential across multiple solid tumor types

and is the first PDC to enter the clinic.

CX-2029 Preclinical Program (Co-Development Partnership

with AbbVie)

- CX-2029, a first-in-class PDC-targeting CD71 being developed by

CytomX in collaboration with AbbVie, was advanced into GLP

toxicology studies, resulting in a $15 million milestone

payment from AbbVie to CytomX to be received during the

3Q’17.

- CD71, otherwise known as the transferrin receptor, is a high

potential target, which, like CD166, has previously been considered

undruggable given its expression and function in normal

tissues.

- CytomX remains on track to file an IND for CX-2029 in

2018.

Bristol-Myers Squibb (BMS) Partnership

- BMS is progressing IND-enabling studies for

a CTLA-4-directed Probody therapeutic discovered within

the collaboration and expects to initiate a clinical trial in early

2018.

- During the second quarter, CytomX recognized receipt of a $200

million upfront payment under the previously announced expansion of

the Bristol-Myers Squibb worldwide collaboration.

- BMS selected its fifth target in the collaboration, the first

under the newly expanded agreement. BMS has now selected five of

ten available oncology targets.

Second Quarter Financial ResultsCash, cash

equivalents and investments totaled $335.9 million as of June 30,

2017, compared to $181.9 million as of December 31, 2016. The

increase reflects a $200 million upfront payment received from BMS

in connection with the expansion of the existing collaboration.

Revenue was $8.8 million for the three months ended June 30,

2017, compared to $3.1 million for the three months ended June 30,

2016. The increase was primarily attributable to recognized revenue

from the upfront payment received from BMS in connection with the

expansion of the existing collaboration.

Research and development expenses were $28.1 million for the

three months ended June 30, 2017, compared to $12.7 million for the

three months ended June 30, 2016. The increase was primarily

attributable to a $10.0 million sublicense payment made to UCSB,

which was triggered by the receipt of the $200 million upfront

payment from BMS in connection with the expanded collaboration, an

increase of $2.8 million to advance the Company’s CX-072 and

CX-2009 into Phase 1/2 clinical development, an increase of $1.0

million in milestone payments to UCSB triggered by the development

of CX-2009, an increase of $1.0 million in facilities-related

expenses, and an increase of $0.8 million in personnel-related

expenses due to an increase in headcount.

General and administrative expenses were $6.0 million for the

three months ended June 30, 2017, compared to $4.6 million for the

three months ended June 30, 2016. The increase was attributable to

$0.6 million in personnel-related expenses due to an increase in

headcount, an increase of $0.4 million in severance payment, and an

increase of $0.3 million in facilities-related expenses.

Conference Call/Webcast InformationIn

conjunction with today’s financial results announcement, the

Company will provide a mid-year update via webcast or

teleconference. Interested parties may access the live audio

webcast of the teleconference today at 5:00 p.m. ET through the

Investor and News page of CytomX's website

at http://ir.cytomx.com or by dialing 1-877-809-6037 and

using the passcode 61956517. A replay will be available on

the CytomX website or by dialing 1-855-859-2056 and using the

passcode 61956517. The replay will be available

from August 7, 2017, until August 14, 2017.

About CytomX Therapeutics CytomX Therapeutics

is a clinical-stage biopharmaceutical company with a deep and

differentiated oncology pipeline of Probody™ therapeutics. Probody

therapeutics exploit unique conditions of the tumor

microenvironment to more effectively localize antibody binding and

activity while limiting activity in healthy tissues. The Company’s

pipeline includes proprietary cancer immunotherapies against

clinically-validated targets, such as PD-L1, and first-in-class

Probody drug conjugates against highly attractive targets, such as

CD166 and CD71, which are considered to be inaccessible to

conventional antibody drug conjugates due to their presence on

healthy tissue. In addition to its wholly owned programs, CytomX

has strategic collaborations with AbbVie, Bristol-Myers

Squibb Company, Pfizer Inc., MD Anderson Cancer

Center and ImmunoGen, Inc. For more information,

visit www.cytomx.com or follow us on Twitter.

CytomX Therapeutics Forward-Looking

StatementsThis press release includes forward-looking

statements. Such forward-looking statements involve known and

unknown risks, uncertainties and other important factors that are

difficult to predict, may be beyond our control, and may cause the

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied in such statements. Accordingly, you should

not rely on any of these forward-looking statements, including

those relating to the potential efficacy of CytomX’s product

candidates, administered separately or in combination , CytomX’s

ability and the ability of its collaborative partners to develop

and advance product candidates into and successfully complete

clinical trials, including CytomX’s Phase 1/2 clinical trials of

CX-072 and CX-2009 and the timing of any future clinical trials to

be initiated by CytomX or any of its collaborative partners. Two of

our product candidates under our Probody platform are in the

initial stages of clinical development and our other product

candidates are currently in preclinical development, and the

process by which preclinical and clinical development could

potentially lead to an approved product is long and subject to

significant risks and uncertainties. Projected net cash utilization

and capital resources are subject to substantial risk of variance

based on a wide variety of factors that can be difficult to

predict. Applicable risks and uncertainties include those

relating to our preclinical research and development, clinical

development, and other risks identified under the heading "Risk

Factors" included in CytomX’s Quarterly Report on Form 10-Q filed

with the SEC on August 7, 2017. The forward-looking statements

contained in this press release are based on information currently

available to CytomX and speak only as of the date on which they are

made. CytomX does not undertake and specifically disclaims any

obligation to update any forward-looking statements, whether as a

result of any new information, future events, changed circumstances

or otherwise.

| |

| CYTOMX THERAPEUTICS, INC. |

| CONDENSED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

| (in thousands, except share and per share

data) |

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

8,283 |

|

|

$ |

2,539 |

|

|

$ |

19,459 |

|

|

$ |

4,322 |

|

| Revenues from related

party |

|

|

469 |

|

|

|

555 |

|

|

|

946 |

|

|

|

995 |

|

| Total

revenues |

|

|

8,752 |

|

|

|

3,094 |

|

|

|

20,405 |

|

|

|

5,317 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research

and development |

|

|

28,076 |

|

|

|

12,705 |

|

|

|

42,652 |

|

|

|

26,070 |

|

| General

and administrative |

|

|

6,049 |

|

|

|

4,647 |

|

|

|

11,740 |

|

|

|

9,687 |

|

| Total

operating expenses |

|

|

34,125 |

|

|

|

17,352 |

|

|

|

54,392 |

|

|

|

35,757 |

|

| Loss from

operations |

|

|

(25,373 |

) |

|

|

(14,258 |

) |

|

|

(33,987 |

) |

|

|

(30,440 |

) |

| Interest

income, net |

|

|

357 |

|

|

|

195 |

|

|

|

594 |

|

|

|

332 |

|

| Other

income (expense), net |

|

|

(174 |

) |

|

|

(110 |

) |

|

|

(54 |

) |

|

|

(91 |

) |

| Loss before provision

for income taxes |

|

|

(25,190 |

) |

|

|

(14,173 |

) |

|

|

(33,447 |

) |

|

|

(30,199 |

) |

| Provision

for income taxes |

|

|

26 |

|

|

|

3 |

|

|

|

26 |

|

|

|

6 |

|

| Net loss |

|

$ |

(25,216 |

) |

|

$ |

(14,176 |

) |

|

$ |

(33,473 |

) |

|

$ |

(30,205 |

) |

| Net loss per share,

basic and diluted |

|

$ |

(0.69 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.91 |

) |

|

$ |

(0.84 |

) |

| Shares used to compute

net loss per share, basic and diluted |

|

|

36,780,897 |

|

|

|

36,113,363 |

|

|

|

36,660,548 |

|

|

|

36,088,393 |

|

| CYTOMX THERAPEUTICS, INC. |

| CONDENSED BALANCE SHEETS |

| (in thousands, except share and per share

data) |

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

272,860 |

|

|

$ |

104,645 |

|

|

Short-term investments |

|

|

63,056 |

|

|

|

77,293 |

|

| Accounts

receivable |

|

|

158 |

|

|

|

2,159 |

|

| Related

party accounts receivable |

|

|

27 |

|

|

|

154 |

|

| Prepaid

expenses and other current assets |

|

|

4,579 |

|

|

|

3,896 |

|

| Total current

assets |

|

|

340,680 |

|

|

|

188,147 |

|

| Property and equipment,

net |

|

|

4,319 |

|

|

|

4,392 |

|

| Intangible assets |

|

|

1,750 |

|

|

|

1,750 |

|

| Goodwill |

|

|

949 |

|

|

|

949 |

|

| Restricted cash |

|

|

917 |

|

|

|

917 |

|

| Other assets |

|

|

3,240 |

|

|

|

2,973 |

|

| Total assets |

|

$ |

351,855 |

|

|

$ |

199,128 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

6,364 |

|

|

$ |

6,596 |

|

| Accrued

liabilities |

|

|

7,499 |

|

|

|

8,824 |

|

| Deferred

revenues, current portion |

|

|

46,772 |

|

|

|

20,347 |

|

| Total current

liabilities |

|

|

60,635 |

|

|

|

35,767 |

|

| Deferred revenue, net

of current portion |

|

|

237,053 |

|

|

|

83,803 |

|

| Deferred tax

liability |

|

|

539 |

|

|

|

513 |

|

| Other long-term

liabilities |

|

|

1,391 |

|

|

|

566 |

|

| Total liabilities |

|

|

299,618 |

|

|

|

120,649 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Preferred stock,

$0.00001 par value; 10,000,000 shares authorized and no shares

issued and outstanding at June 30, 2017 and December 31, 2016. |

|

|

— |

|

|

|

— |

|

| Common stock, $0.00001

par value; 75,000,000 shares authorized; 36,839,342 and 36,490,169

shares issued and outstanding at June 30, 2017 and December 31,

2016, respectively |

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

262,185 |

|

|

|

254,871 |

|

|

Accumulated other comprehensive loss |

|

|

(110 |

) |

|

|

(27 |

) |

|

Accumulated deficit |

|

|

(209,839 |

) |

|

|

(176,366 |

) |

| Total stockholders'

equity |

|

|

52,237 |

|

|

|

78,479 |

|

| Total liabilities and

stockholders' equity |

|

$ |

351,855 |

|

|

$ |

199,128 |

|

Media Contact:

Spectrum

Christine Quern

cquern@spectrumscience.com

202-587-2588

Investor Contact:

Trout Group

Pete Rahmer

prahmer@troutgroup.com

646-378-2973

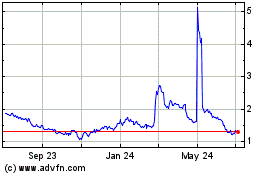

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

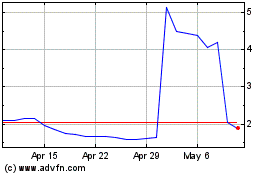

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Apr 2023 to Apr 2024