Current Report Filing (8-k)

December 22 2017 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________

FORM 8-K

____________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2017

____________

R1 RCM Inc.

(Exact Name of Registrant as Specified in Charter)

____________

|

|

|

|

|

|

|

Delaware

|

001-34746

|

02-0698101

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

401 North Michigan Avenue, Suite 2700, Chicago, Illinois

|

60611

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (312) 324-7820

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 20, 2017, R1 RCM Inc. (the “Company”) granted performance-based restricted stock unit awards (“PBRSUs”) to the Company’s chief executive officer and chief financial officer and to the chairman of the Company’s Board of Directors (the “Board”) in the amounts set forth opposite their names in the table below. The PBRSUs will be subject to the terms of the Second Amended and Restated 2010 Stock Incentive Plan (the “Plan”) and the applicable PBRSU agreement.

|

|

|

|

|

|

|

Name

|

Title

|

PBRSU Target Award

|

|

Joseph Flanagan

|

Chief Executive Officer and President

|

2,581,614

|

|

Christopher Ricaurte

|

Chief Financial Officer and Treasurer

|

553,206

|

|

Steven Shulman

|

Chairman of the Board of Directors

|

1,475,208

|

Pursuant to the PBRSU award agreements, the PBRSUs will be subject to both a time-based vesting condition and a performance-based vesting condition. The time-based vesting condition may be satisfied on the earlier of December 31, 2020 and a qualifying change of control (the “Performance Period”), subject to the recipient not having ceased to perform services with the Company. The performance-based vesting condition may be satisfied based upon an average per share price of the Company’s common stock as defined in the applicable PBRSU agreement, measured at the end of the Performance Period. The number of shares earned will be based upon the achievement of a performance-based vesting condition and will range from 0% to 350% of the target award, in the case of the chief executive officer, and 0% to 200% of the target award, in the case of the chief financial officer and the chairman of the Board. In the case of the chief financial officer and the chairman of the Board, if such individual ceases to perform services for the Company for any reason, all PBRSUs granted to such individual that are unvested are forfeited to the Company. In the case of the chief executive officer, all granted PBRSUs that are unvested are forfeited after he ceases to perform services for the Company, other than for certain qualifying terminations, which allow for pro-rata vesting as described in his agreement. The agreements with the chief executive officer and the chairman of the Board also provide that any vested award, whether settled in cash or shares, will remain nontransferable until certain change of control events occur or the ownership interests of specified shareholders diminish to specified levels, all as defined in the applicable agreement. Additionally, in the case of the chief executive officer and the chairman of the Board, the PBRSU award is intended to be settled in cash until such time as the share reserve available under the Plan has been deemed sufficient by the Compensation Committee of the Board to allow for the settlement of the PBRSUs in shares. Pursuant to the applicable agreement with each of the chief executive officer, the chief financial officer and the chairman of the Board, if such individual is terminated for cause, as defined in the applicable agreement, such individual would be required to forfeit any shares or cash received pursuant to the award and forfeit any after-tax proceeds from the sale of such shares.

The foregoing description is qualified in its entirety by reference to the applicable PBRSU award agreement, copies of which are filed as Exhibits 10.1, 10.2 and 10.3, respectively, hereto and are incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1*

|

Grant of Performance Based Awards pursuant to the R1 RCM Inc. Second Amended and Restated 2010 Stock Incentive Plan to Joseph Flanagan

|

|

10.2*

|

Grant of Performance Based Awards pursuant to the R1 RCM Inc. Second Amended and Restated 2010 Stock Incentive Plan to Christopher Ricaurte

|

|

10.3*

|

Grant of Performance Based Awards pursuant to the R1 RCM Inc. Second Amended and Restated 2010 Stock Incentive Plan to Steven Shulman

|

*Management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date:

|

December 21, 2017

|

|

|

|

|

|

|

|

|

|

|

R1 RCM Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Christopher S. Ricaurte

|

|

|

|

|

|

|

|

|

|

Christopher S. Ricaurte

|

|

|

|

|

Chief Financial Officer and Treasurer

|

INDEX TO EXHIBITS

(d) Exhibits.

*Management contract or compensatory plan or arrangement.

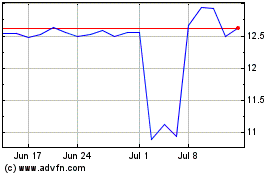

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

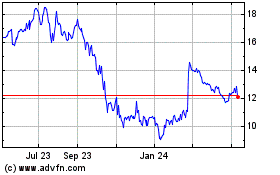

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Apr 2023 to Apr 2024