Current Report Filing (8-k)

December 05 2017 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington

, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 28, 2017

|

PREMIER BIOMEDICAL, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-54563

|

|

27-2635666

|

|

(State or other

jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

P.O. Box 25

Jackson Center, PA 16133

(Address of principal executive offices) (zip code)

(

814) 786-8849

(Registrant’s telephone number, including area code)

_____________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Section 1 – Registrant’s Business and Operations

Item 1.01 – Entry into a Material Definitive Agreement

Addendum No. 2 to the Securities Purchase Agreement

On November 28, 2017, we entered into Addendum No. 2 ( “

Addendum No. 2

”), dated November 20, 2017, of the Securities Purchase Agreement dated March 30, 2017 (as modified by an Addendum dated May 24, 2017 (“

Addendum No. 1

”) and an Amendment dated August 8, 2017 (the “

Amendment

”) and, collectively, the “

Purchase Agreement

”) by and between the Company and each of The Special Equities Group, LLC, RDW Capital LLC, and DiamondRock, LLC (each a “

Purchaser

” and collectively, the “

Purchasers

”).

On March 30, 2017, we received $300,000 from the Purchasers through the sale of stock and warrants (the “

First Closing

”). The Purchasers next purchased $150,000 of common stock and warrants in a second tranche on May 30, 2017 (the “

Second Closing

”). On August 8, 2017, we amended the Purchase Agreement and exchanged convertible notes with the investors for the warrants issued in the first tranche and the common stock issued in the second tranche, and we cancelled the shares issued in the first tranche and the warrants issued in the second tranche. We also amended the Purchase Agreement on that date. And finally, on October 30, 2017, the investors purchased an additional $150,000 of our convertible notes (the “

Third Closing

”).

Addendum No. 2 restores a provision to the Purchase Agreement that the parties mistakenly deleted in the Amendment. This provision, made effective by Addendum No. 2, restores the issuance of additional shares of common stock promised to the Purchasers in exchange for their funding commitments when the Purchase Agreement was originally signed.

Additional shares of common stock will be issued on each date that is eight (8) months after each of the First Closing, Second Closing and Third Closing. The number of additional shares to be issued on each of these dates is equal to (i) the Purchaser’s subscription amount on the applicable closing date divided by the Adjusted Per Share Purchase Price less (ii) the shares of common stock issued on the applicable closing date. The “

Adjusted Per Share Purchase Price

” is equal to 50% of the average of the closing bid prices for the three (3) lowest trading days during the eight (8) month period following the applicable closing date.

Section 3 – Securities and Trading Markets

Item 3.02 Unregistered Sale of Equity Securities

The disclosure under item 1.01 above is incorporated herein by reference. The sale of shares of common stock, if conducted pursuant to the Purchase Agreement and Addendum No. 2, will be a transaction exempt from registration under Rule 506 of Regulation D promulgated under the Securities Act of 1933. No general solicitation was made either by the Company or any person acting on its behalf, and each investor is an accredited, sophisticated investor.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Premier Biomedical, Inc.

|

|

|

|

|

|

|

|

Dated: December 4, 2017

|

By:

|

/s/ William Hartman

|

|

|

|

|

William Hartman

|

|

|

|

Its:

|

President and Chief Executive Officer

|

|

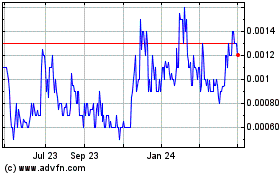

Premier Biomedical (PK) (USOTC:BIEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

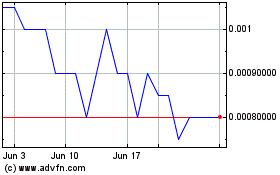

Premier Biomedical (PK) (USOTC:BIEI)

Historical Stock Chart

From Apr 2023 to Apr 2024