Current Report Filing (8-k)

November 20 2017 - 4:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 20, 2017 (November 17, 2017)

Array BioPharma Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-16633

|

|

84-1460811

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer Identification

No.)

|

3200 Walnut Street, Boulder, Colorado 80301

(Address of principal executive offices, including Zip Code)

(303) 381-6600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

In this report, “Array BioPharma,” “Array,” the “Company,” “we,” “us” and “our” refer to Array BioPharma Inc., unless the context otherwise provides.

Item 1.01

Entry into a Material Definitive Agreement.

As previously announced by Array BioPharma, on November 16, 2017, Array BioPharma entered into separate, privately negotiated exchange agreements (“Exchange Agreements”) with a limited number of holders (“Noteholders”) of its outstanding 3.00% Convertible Senior Notes due 2020 (“2020 Notes”), pursuant to which the Company agreed to exchange (the “Exchanges”) approximately $107.1 million in aggregate principal amount of 2020 Notes held by the Noteholders for (i) a number of newly issued shares of its common stock (with such number rounded down to the nearest whole share for each holder) to be determined based on the volume-weighted average trading price of its common stock on November 17, 2017 (the “Reference Date”) (collectively, the “Exchange Shares”), and (ii) an aggregate of $107.1 million in aggregate principal amount of its newly issued 2.625% Convertible Senior Notes due 2024 (the “2024 Notes”).

Subsequent to that announcement, certain affiliated holders of 2020 Notes (the “Subsequent Noteholders” and together with the Prior Noteholders, the “Noteholders”) inquired about their ability to participate in the exchange of 2020 Notes for the same consideration. As a result of those inquiries and through separate negotiations, Array entered into a separate privately negotiated Exchange Agreement dated November 20, 2017 providing for the exchange of an additional $19.0 million in principal amount of 2020 Notes on the same terms as those that apply to the Prior Noteholders. Accordingly, subject to the satisfaction of customary closing conditions, Array will exchange 2020 Notes in the aggregate principal amount of $126.1 million held by the Noteholders for 2024 Notes in an aggregate principal amount of $126.1 million and the Exchange Shares (the “Exchanges”).

In addition, on November 17, 2017, the number of Exchange Shares to be issued in the Exchanges was determined as well as the coupon rate on the 2024 Notes. An aggregate of 7,955,560 Exchange Shares will be issued upon completion of the Exchanges based on the volume-weighted average trading price of approximately $11.67 as of the Reference Date. The 2024 Notes will bear interest at the rate of 2.625% per annum. The Company will receive no cash proceeds for the issuance of the Exchange Shares or the 2024 Notes. The principal amount of 2020 Notes to be exchanged for each $1,000 in principal amount of 2024 Notes was determined in individual negotiations between the Company and the Noteholders.

The Company anticipates that the Exchanges will be completed on or about December 1, 2017, subject to satisfaction of customary closing conditions. Upon completion of the Exchanges, the aggregate principal amount of the 2020 Notes will be reduced to approximately $6.2 million.

The foregoing description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the form of Exchange Agreement filed as Exhibit 10.1 to its Current Report on Form 8-K filed by the Company on November 17, 2017, which is incorporated by reference herein.

In connection with the issuance of the 2024 Notes, the Company will enter into an Indenture (the “Indenture”) with The Bank of New York Mellon Trust Company, N.A., as trustee. The Company will file a copy of the Indenture on a Form 8-K following the closing of the Exchange.

This Current Report does not constitute an offer to sell, or a solicitation of an offer to buy, any security and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offering would be unlawful.

Item 3.02

Unregistered Sales of Equity Securities

As disclosed in Item 1.01 of this Current Report on Form 8-K, on November 17, 2017, the Company entered into the Exchange Agreement pursuant to which the Company will, subject to the satisfaction of customary closing conditions, issue the 2024 Notes and the Exchange Shares to the Subsequent Noteholders. The 2024 Notes and Exchange Shares were offered, and will be sold, pursuant to the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). This offer was made by the Company to no more than ten persons, each of which is an accredited investor (within the meaning of Rule 501 promulgated under the Securities

2

Act) and a qualified institutional buyer (as defined in Rule 144A under the Securities Act). The Company will not receive any proceeds from the issuance of the 2024 Notes or the Exchange Shares.

Upon conversion of the 2024 Notes, the Company will pay cash and, if applicable, deliver shares of the Company’s common stock to the converting holder based on a conversion premium of approximately 32.5% above the arithmetic average of the daily volume weighted average price of the Company’s common stock as published on Bloomberg page “ARRY <equity> AQR” on the Reference Date.

The number of Exchange Shares to be issued upon completion of the Exchanges based on the volume-weighted average trading price of approximately $11.67 on the Reference Date, will be an aggregate of 7,955,560 shares. Additional information pertaining to the exchange of 2020 Notes for the 2024 Notes and the Exchange Shares is contained in Item 1.01 of this Current Report on Form 8-K and incorporated herein by reference.

The 2024 Notes, any shares of common stock issuable upon conversion of the 2024 Notes and the Exchange Shares have not been, and will not be, registered under the Securities Act or any state securities law. The Company does not intend to file a registration statement for resale of the 2024 Notes, the shares of the common stock, if any, issuable upon conversion thereof or the Exchange Shares.

This Current Report on Form 8-K does not constitute an offer to sell, or a solicitation of an offer to buy, any security and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offering would be unlawful.

Item 8.01

Other Events

As disclosed above under Item 1.01, on November 17, 2017, the number of Exchange Shares to be issued in the Exchanges was determined as well as the coupon rate on the 2024 Notes. An aggregate of 7,955,560 Exchange Shares will be issued upon completion of the Exchanges based on the volume-weighted average trading price of approximately $11.67 as of the Reference Date. The 2024 Notes will bear interest at the rate of 2.625% per annum.

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 20, 2017

|

Array BioPharma Inc.

|

|

|

|

|

|

By:

|

/s/ Jason Haddock

|

|

|

|

Jason Haddock

|

|

|

|

Chief Financial Officer

|

4

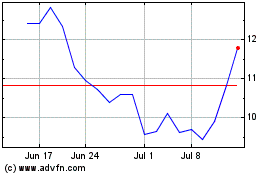

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

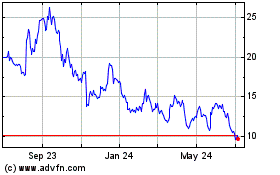

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Apr 2023 to Apr 2024