Current Report Filing (8-k)

October 20 2017 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 19, 2017

Cidara Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

001-36912

(Commission File Number)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

46-1537286

|

|

(State or other jurisdiction

of incorporation)

|

|

(IRS Employer

Identification No.)

|

6310 Nancy Ridge Drive, Suite 101

San Diego, California 92121

(858) 752-6170

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrants Principal Executive Offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement.

The disclosure set forth below under Item 3.02 is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

On October 19, 2017, Cidara Therapeutics, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional investors named therein (the “Purchasers”), pursuant to which the Company agreed to sell and issue to the Purchasers an aggregate of 3,360,000 shares of its Common Stock (the “Shares”) at a purchase price of $6.00 per share (the “Offering”). The aggregate purchase price to be paid by the Purchasers for the Shares is approximately $20,000,000, and the Company expects to receive net proceeds of approximately $19,000,000, after deducting commissions and estimated offering expenses. The closing of the Offering (the “Closing”) is expected to occur on October 24, 2017.

The Purchase Agreement also requires the Company to register the Shares for resale. The Company is required to prepare and file a registration statement with the Securities and Exchange Commission within 45 days of the Closing and to use commercially reasonable efforts to have such registration statement declared effective as soon as practicable but no later than within 90 days after the Closing, if there is no review by the Securities and Exchange Commission, and within 120 days of the Closing in the event of such review. As set forth in the Purchase Agreement, if the Company fails to comply with certain obligations with respect to filing and securing effectiveness of such registration statement, the Company would be obligated to pay liquidated damages to the Purchasers in the amount of 1% on the day of such default and on every 30

th

day thereafter, up to a maximum of 6% of each Purchaser’s aggregate investment.

The Shares were offered and sold without registration under the Securities Act of 1933, as amended (the “Securities Act”), or state securities laws. The Company has relied on the exemption from the registration requirements of the Securities Act provided by Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D thereunder. In connection with the Purchasers’ execution of the Purchase Agreement, each Purchaser represented to the Company that it is an “accredited investor” as defined in Regulation D of the Securities Act and that the securities purchased by each Purchaser were acquired solely for its own account and for investment purposes, and not with a view to the future sale or distribution. Neither this Current Report on Form 8-K, nor the exhibits attached hereto is an offer to sell or the solicitation of an offer to buy the Shares.

The Purchase Agreement contains customary representations, warranties and covenants that were made solely for the benefit of the parties to the Purchase Agreement. Such representations, warranties and covenants (i) are intended as a way of allocating risk between the parties to the Purchase Agreement and not as statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by stockholders of, or other investors in, the Company. Accordingly, the Purchase Agreement is included with this filing only to provide investors with information regarding the terms of transaction and not to provide investors with any other factual information regarding the Company. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public disclosures.

The above description of the material terms of the Offering is qualified in its entirety by reference to the Purchase Agreement, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 7.01 Other Events.

On October 19, 2017, the Company issued the press release attached hereto as Exhibit 99.1 regarding the Offering described in Item 3.02. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

|

|

|

|

|

99.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: October 20, 2017

|

|

|

|

|

|

|

|

|

|

|

Cidara Therapeutics, Inc.

|

|

|

|

|

By:

|

|

/s/ Jeffrey L. Stein

|

|

|

|

Jeffrey L. Stein

|

|

|

|

President and Chief Financial Officer

(Principal Executive Officer)

|

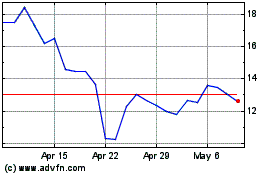

Cidara Therapeutics (NASDAQ:CDTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

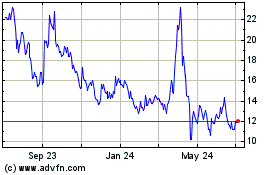

Cidara Therapeutics (NASDAQ:CDTX)

Historical Stock Chart

From Apr 2023 to Apr 2024