Current Report Filing (8-k)

October 04 2017 - 2:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): September 29,

2017

001-35922

(Commission file number)

PEDEVCO CORP.

(Exact name of registrant as specified in its charter)

|

Texas

|

22-3755993

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer Identification

No.)

|

4125 Blackhawk Plaza Circle, Suite 201

Danville, California 94506

(Address of principal executive offices)

(855) 733-3826

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

|

[

]

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

|

|

|

[

]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17

CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of

1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act.

☐

ITEM 1.02

TERMINATION OF

A MATERIAL DEFINITIVE AGREEMENT.

On September 29, 2017, PEDEVCO Corp. (the

“

Company

”,

“

we

”, “

us

” or “

PEDEVCO

”)

was notified by Dragon Gem Limited (“

DGL

”) that DGL was terminating that certain

Series B Convertible Preferred Stock and Warrant Subscription

Agreement (the “

Subscription

Agreement

”) entered into

on August 17, 2017, by and among the Company, DGL and Absolute

Frontier Limited (together with DGL, the “

Investors

”),

as originally disclosed by the Company in a Current Report on Form

8-K filed with the U.S. Securities and Exchange Commission on

August 18, 2017 (the “

August 18, 2017

Current Report

”). The

Investors terminated the transaction, effective September 30, 2017,

as the Company and the Investors were unable to agree to an

extension to the previously agreed upon outside closing date of

September 30, 2017, as provided under the Subscription Agreement,

which extension was required in order to accommodate review and

approval of the transaction by the

U.S. Department of

Treasury Committee on Foreign Investment in the United States

(“

CFIUS

”), which approval

was jointly sought by the parties on September 17, 2017, and is

currently pending before CFIUS

. As a

result of the termination of the Subscription Agreement, the debt

conversion and equity financing transaction contemplated under the

Subscription Agreement as described in the August 18, 2017 Current

Report has been terminated, with no termination penalties incurred

by any of the parties.

The

Company has immediately reinitiated discussions with other

potential equity investors in an effort to identify an alternative

source of equity capital to fund the approximately $12 million

equity investment previously contemplated under the Subscription

Agreement. As previously disclosed by the Company in its filings

with the U.S. Securities and Exchange Commission, the Company is

seeking to raise approximately $12 million in equity financing

coupled with the satisfaction and/or discharge of approximately $61

million of the Company’s debt, leaving approximately only

$5.8 million of restructured senior secured debt and approximately

$475,000 in junior bridge notes in the recapitalized Company. In

connection with the Subscription Agreement, the Company was

negotiating the final terms and documentation for the conversion

and/or satisfaction of approximately $61 million of Company debt

when the Investors notified the Company that they were terminating

the transaction. The Company still plans to seek to finalize the

terms and documentation for conversion and/or satisfaction of this

debt as it works to identify a new equity investor to complete the

transaction as previously contemplated. However, an alternative

equity financing partner may not be identified and the debt

conversion and equity investment transactions pursued by the

Company may not be completed on favorable terms, if at all, or such

transactions may not be completed in a timely manner.

ITEM 7.01 REGULATION FD DISCLOSURE.

The

Company issued a press release on October 4, 2017 regarding the

matters discussed in Item 1.02 above

.

A copy of the

press release is furnished herewith as Exhibit 99.1 and is

incorporated by reference herein.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

|

Exhibit No.

|

Description

|

|

|

|

|

|

Press

Release dated October 4, 2017

|

*

Furnished herewith.

Forward-Looking Statements

Some of

the statements contained in this report discuss future

expectations, contain projections of results of operations or

financial condition, or state other “

forward-looking

”

information. The words “

believe,

”

“

intend,

”

“

plan,

”

“

expect,

”

“

anticipate,

”

“

estimate,

”

“

project,

”

“

goal

”

and similar expressions identify such a statement was made,

although not all forward-looking statements contain such

identifying words. These statements are subject to known and

unknown risks, uncertainties, and other factors that could cause

the actual results to differ materially from those contemplated by

the statements. The forward-looking information is based on various

factors and is derived using numerous assumptions. Factors that

might cause or contribute to such a discrepancy include, but are

not limited to, the risks discussed in this and our other SEC

filings. We do not promise to or take any responsibility to update

forward-looking information to reflect actual results or changes in

assumptions or other factors that could affect those statements

except as required by law. Future events and actual results could

differ materially from those expressed in, contemplated by, or

underlying such forward-looking statements.

PEDEVCO’s

forward-looking statements are based on assumptions that PEDEVCO

believes to be reasonable but that may not prove to be accurate.

PEDEVCO cannot guarantee future results, level of activity,

performance or achievements. Moreover, PEDEVCO does not assume

responsibility for the accuracy and completeness of any of these

forward-looking statements. PEDEVCO assumes no obligation to update

or revise any forward-looking statements as a result of new

information, future events or otherwise, except as may be required

by law. Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date

hereof.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

|

|

|

|

|

PEDEVCO

CORP.

|

|

|

|

|

|

|

By:

|

/s/ Michael L.

Peterson

|

|

|

|

Michael

L. Peterson

|

|

|

|

President

and

Chief

Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

October 4, 2017

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

|

|

|

Press

Release dated October 4, 2017

|

*

Furnished herewith.

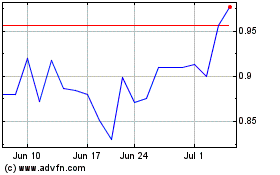

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024