Current Report Filing (8-k)

September 19 2017 - 5:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): September 15, 2017

EDGEWELL PERSONAL CARE COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Missouri

|

1-15401

|

43-1863181

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

1350 Timberlake Manor Parkway, Chesterfield, Missouri 63017

(Address of principal executive offices)

314-594-1900

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

Emerging growth company

|

o

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01 Entry Into A Material Definitive Agreement.

On September 15, 2017, Edgewell Personal Care, LLC, as the Seller ("Seller"), and Edgewell Personal Care Company, as Guarantor (the "Company"), entered into a Master Accounts Receivable Purchase Agreement (the "Receivables Purchase Agreement") with The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, as the Purchaser ("BTMU"), a copy of which is attached to this filing as Exhibit 10.1. Under the terms of the Receivables Purchase Agreement, Seller, a U.S. operating subsidiary of the Company, will sell a pool of trade accounts receivable from certain designated obligors, on a revolving basis, to BTMU (the "Receivables Sale Program"). Seller will service and administer the subject receivables for BTMU and will be paid a servicing fee for such services. The Company will guarantee the obligations of Seller under the Receivables Purchase Agreement.

The maximum amount which may be advanced to Seller at any one time in the form of a discounted purchase price for the trade receivables pursuant to the Receivables Sale Program is $150 million. The discount rate used to determine the purchase price for the subject receivables is based upon LIBOR plus a margin applicable to the specified obligor (currently 95 basis points for all obligors).

The term of the Receivables Purchase Agreement will end on September 14, 2018, subject to automatic 364-day extensions unless Seller or BTMU elects not to extend the term. Additionally, either Seller or BTMU may terminate the Receivables Purchase Agreement at any time after the initial 364-day term upon 30 days written notice.

The Receivables Purchase Agreement contains customary representations and warranties and covenants as to the Company, Seller and the subject receivables. The purchase and sale of subject receivables under the Receivables Purchase Agreement is intended to be an absolute and irrevocable transfer without recourse by the Purchaser to Seller for the creditworthiness of any obligor. Only under certain limited circumstances, including a material breach of a representation or warranty as to a subject receivable or a breach by Seller of certain of its servicing obligations as to the subject receivables, would Seller be obligated to repurchase some or all of the previously sold receivables.

BTMU is currently a lender under the Company's senior unsecured revolving credit facility. In addition, BTMU and/or its affiliates have or may have had various relationships with the Company and its subsidiaries involving the provision of a variety of financial services, including investment banking, underwriting, commercial banking and letters of credit, for which it and/or its affiliates receive or received customary fees and, in some cases, out-of-pocket expenses.

This summary does not purport to be complete, and is qualified in its entirety by reference to the Receivables Purchase Agreement, which is filed as Exhibit 10.1 below and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

.

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

Master Accounts Receivable Purchase Agreement dated as of September 15, 2017 among Edgewell Personal Care, LLC, as the Seller, Edgewell Personal Care Company, as Guarantor, and The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, as the Purchaser.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on From 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

EDGEWELL PERSONAL CARE COMPANY

By:

/s/ Sandra J. Sheldon

Sandra J. Sheldon

Chief Financial Officer

Dated: September 18, 2017

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

|

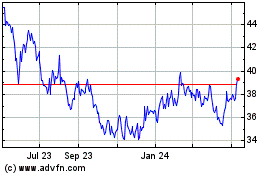

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

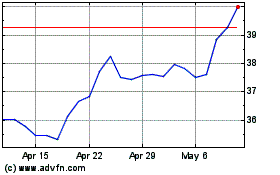

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Apr 2023 to Apr 2024