Current Report Filing (8-k)

July 11 2017 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 5, 2017

|

|

|

|

|

|

|

Analog Devices, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts

|

|

1-7819

|

|

04-2348234

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Technology Way, Norwood, MA

|

|

02062

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 10, 2017, Analog Devices, Inc. (the “

Company

”) acquired Linear Technology Corporation (“

Linear

”). On July 5, 2017, to promote the successful integration of Linear, pursuant to the Company’s Amended and Restated 2006 Stock Incentive Plan, the Compensation Committee of the Board of Directors of the Company approved the grant of performance-based restricted stock units (“

PRSUs

”), effective July 17, 2017, to members of the Company’s senior executive team, including 5,276 PRSUs to Eileen Wynne, the Company’s interim Chief Financial Officer, and 16,232 PRSUs to Peter Real, the Company’s Senior Vice President and Chief Technology Officer. PRSUs were not granted to the Company’s Chief Executive Officer. The PRSUs are subject to the achievement of a pre-established performance goal based on the trailing twelve month non-GAAP operating profit before taxes (“

OPBT

”) as a percentage of revenue of the Company, determined as of the end of the second quarter of the Company’s fiscal year 2020. A number of PRSUs equal to 120% of the target number of PRSUs will vest on July 17, 2020 only if the Compensation Committee has certified that the OPBT goal has been attained and is subject to the participant’s continued service through the vesting date. The Compensation Committee may exercise negative discretion to reduce (but not increase) the number of PRSUs that would otherwise vest by considering the attainment level of the following two additional performance goals: (i) 50% of the PRSUs that are determined to vest based on the attainment of the OPBT goal may be reduced based on the attainment level of the pre-established net synergy goal achieved in connection with the acquisition of Linear, and (ii) 50% of the PRSUs that are determined to vest based on the attainment of the OPBT goal may be reduced based on the attainment level of the pre-established three-year cumulative revenue goal of Linear on a standalone basis. Attainment among performance parameters is subject to interpolation on a linear basis. The foregoing description of the PRSUs is qualified in its entirety by reference to the complete copy of the PRSU award agreement attached hereto as Exhibit 10.1 and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

Exhibit No.

Description

|

|

|

|

10.1

|

Form of Linear Integration Performance Restricted Stock Unit Agreement for Employees for usage under the Analog Devices, Inc. Amended and Restated 2006 Stock Incentive Plan

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: July 11, 2017

|

ANALOG DEVICES, INC.

|

|

|

|

By:

|

/s/ Margaret K. Seif

|

|

|

|

|

Margaret K. Seif

|

|

|

|

|

Senior Vice President, Chief Legal Officer and Secretary

|

|

EXHIBIT INDEX

Exhibit No.

Description

|

|

|

|

10.1

|

Form of Linear Integration Performance Restricted Stock Unit Agreement for Employees for usage under the Analog Devices, Inc. Amended and Restated 2006 Stock Incentive Plan

|

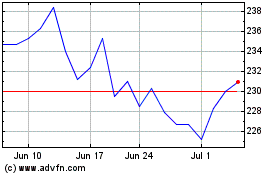

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

From Mar 2024 to Apr 2024

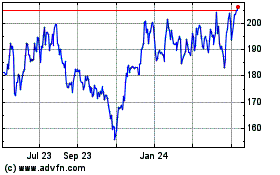

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

From Apr 2023 to Apr 2024