Current Report Filing (8-k)

June 28 2017 - 5:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8

‑

K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) June 26, 2017

TEMPUR SEALY INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-31922

|

33-1022198

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

1000 Tempur Way

Lexington, Kentucky 40511

(Address of principal executive offices) (Zip Code)

(800) 878-8889

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

|

|

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01 Entry into a Material Definitive Agreement

On June 26, 2017, Tempur Sealy International, Inc. (the “

Company

”) entered into a Non-Disclosure and Standstill Agreement (the “

Agreement

”) with Usman Nabi, a director of the Company (the “

Director

”), and H Partners Management, LLC (“

H Partners

”); H Partners, LP; H Partners Capital, LLC; P H Partners LTD.; H Offshore Fund LTD.; and Rehan Jaffer (together with H Partners, the “

H Partners Group

”), which collectively beneficially owns 8,500,000 shares of the outstanding common stock of the Company, par value $0.01 per share (the “

Common Stock

”). The following is a summary of the terms of the Agreement. The summary does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Confidentiality and Permitted Information Sharing

. Except as provided in the Agreement, the Director agreed not to disclose any Confidential Information (as defined in the Agreement) to third parties or use any Confidential Information other than in connection with serving as a director of the Company without in each instance securing the prior written consent of the Company. However, the Director is permitted to disclose Confidential Information to officers, directors, accountants and counsel for the Company or any other Tempur Company (as defined in the Agreement). In addition, the Director is permitted, subject to the terms and conditions of the Agreement, to disclose Confidential Information to his legal counsel and to other parties within the H Partners Group for the purpose of assisting him in the performance of his duties as a director of the Company.

Either the Company or the Director may terminate this right to share information at any time by written notice. The date these rights terminate, either in accordance with the terms of the Agreement or otherwise, is referred to as the “

Information Termination Date

.”

Restrictions on Trading

. The Director, any Director Representative (as defined in the Agreement) and each other H Partners Group Member and H Partners Representative who receives Confidential Information have agreed or will agree to comply with the Company’s Insider Trading Policy (as defined in the Agreement). Each of the parties identified above has also agreed that it, he or she will only transact in securities of the Company during “open windows”

and subject to the preclearance procedures which apply to all directors and executive officers of the Company under the Insider Trading Policy.

Standstill

. Under the terms of the Agreement, each H Partners Group Member also agreed to limited standstill provisions, effective as of the date of the Agreement and continuing until six months after the Information Termination Date (the “

Standstill Period

”). The standstill provisions generally prohibit each H Partners Group Member from taking specified actions with respect to the Company and its securities, including, among others: (i) acquiring beneficial ownership of twenty percent (20%) or more of the Company’s then outstanding Common Stock in the aggregate (amongst all of the H Partners Group Members and their Affiliates and Associates (as defined in the Agreement)) or (ii) seeking or in any way assisting or facilitating any other person in seeking, among other things, to acquire control of the Company or to engage in certain other extraordinary transactions with respect to the Company or any of its subsidiaries or any material portion of its or their businesses, all as more fully described in the Agreement.

The Agreement contains no restrictions on the ability of the H Partners Group to vote its shares of Common Stock, including in any proxy contest, or to transfer its Common Stock. In addition, the standstill provisions under the Agreement do not purport to prevent the Director or any other director from exercising his or her rights or complying with his or her fiduciary duties as a director of the Company or from participating in board room discussions or private discussions with other members of the Company’s Board of Directors.

Item 7.01 Regulation FD Disclosure

The information under Item 1.01 above (including Exhibit 10.1) is incorporated by reference into this Item 7.01.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

10.1

|

|

Non-Disclosure and Standstill Agreement, dated as of June 26, 2017, by and among Tempur Sealy International, Inc., Usman Nabi, H Partners Management, LLC and the other parties named therein.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 28, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tempur Sealy International, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Barry A. Hytinen

|

|

|

Name:

|

Barry A. Hytinen

|

|

|

Title:

|

Executive Vice President & Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

10.1

|

|

Non-Disclosure and Standstill Agreement, dated as of June 26, 2017, by and among Tempur Sealy International, Inc., Usman Nabi, H Partners Management, LLC and the other parties named therein.

|

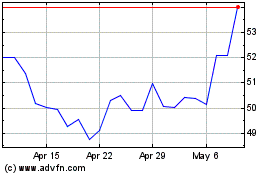

Tempur Sealy (NYSE:TPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

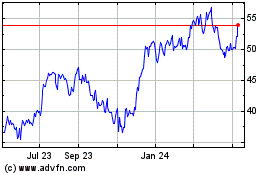

Tempur Sealy (NYSE:TPX)

Historical Stock Chart

From Apr 2023 to Apr 2024