Current Report Filing (8-k)

June 26 2017 - 5:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 22, 2017

AMEREN CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Missouri

|

|

1-14756

|

|

43-1723446

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

1901 Chouteau Avenue, St. Louis, Missouri 63103

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code: (314)

621-3222

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this

chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.03 Creation of a Direct Financial Obligation or an Obligation under an

Off-

Balance Sheet Arrangement of a Registrant.

On June 22, 2017, Ameren Transmission Company

of Illinois (“ATXI”), a wholly owned subsidiary of Ameren Corporation (“Ameren”), entered into a note purchase agreement (the “Note Purchase Agreement”) with the purchasers shown as signatories to the agreement included

as Exhibit 4.1 to this report (the “Purchasers”). Pursuant to the Note Purchase Agreement, ATXI agreed to issue to the Purchasers $450 million aggregate principal amount of its 3.43% Senior Notes due 2050 (the “Notes”)

through a private placement offering exempt from registration under the Securities Act of 1933, as amended. In accordance with the Note Purchase Agreement, ATXI issued $150 million aggregate principal amount of the Notes on June 22, 2017,

with the remaining $300 million aggregate principal amount of the Notes to be issued on August 31, 2017. The Notes are unsecured. The proceeds of the Notes will be used by ATXI to repay existing short-term and long-term affiliate debt owed

to Ameren.

ATXI may prepay at any time all or any part of the Notes, in an amount not less than 5% of the aggregate principal amount of

Notes then outstanding in the case of a partial prepayment, at 100% of the principal amount so prepaid plus a make-whole premium as set forth in the Note Purchase Agreement. ATXI must also make prepayments of principal on the Notes in accordance

with the amortization schedule set forth in the Note Purchase Agreement, subject to modifications based on certain prepayments. In the event of a Change of Control (as defined in the Note Purchase Agreement), each holder of the Notes may require

ATXI to prepay the entire unpaid principal amount of the Notes held by such holder at a price equal to 100% of the principal amount of such Notes together with accrued and unpaid interest thereon, but without any make-whole or other premium.

The Note Purchase Agreement includes financial covenants that require ATXI not to permit at any time: (i) Consolidated Debt to exceed 70%

of Consolidated Total Capitalization; or (ii) Priority Debt to exceed 10% of Consolidated Total Assets (as those terms are defined in the Note Purchase Agreement). The Note Purchase Agreement also contains restrictive covenants that, among

other things, restrict the ability of ATXI to: (i) enter into transactions with affiliates; (ii) consolidate, merge, transfer or lease all or substantially all of its assets; and (iii) create liens.

The Note Purchase Agreement contains customary events of default (subject in certain cases to specified cure periods), including but not

limited to payment defaults, cross defaults with certain other indebtedness, breaches of covenants, and bankruptcy events. In the case of an event of default, the Purchasers may, among other remedies, accelerate the payment of the Notes, including a

make-whole premium.

The foregoing description of the Note Purchase Agreement is qualified in its entirety by reference to the full text

of the Note Purchase Agreement, which is filed as Exhibit 4.1 and incorporated by reference herein.

|

ITEM 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit

Number

|

|

Title

|

|

|

|

|

4.1

|

|

Note Purchase Agreement, dated June 22, 2017, between Ameren Transmission Company of Illinois and the several purchasers named therein.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

AMEREN CORPORATION

|

|

(Registrant)

|

|

|

|

|

By:

|

|

/s/ Martin J. Lyons, Jr.

|

|

Name:

|

|

Martin J. Lyons, Jr.

|

|

Title:

|

|

Executive Vice President and

|

|

|

|

Chief Financial Officer

|

Date: June 26, 2017

Exhibit Index

|

|

|

|

|

Exhibit

Number

|

|

Title

|

|

|

|

|

4.1

|

|

Note Purchase Agreement, dated June 22, 2017, between Ameren Transmission Company of Illinois and the several purchasers named therein.

|

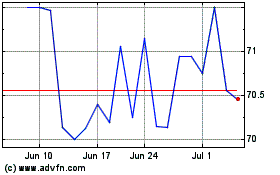

Ameren (NYSE:AEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

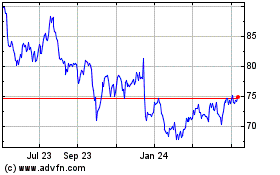

Ameren (NYSE:AEE)

Historical Stock Chart

From Apr 2023 to Apr 2024