Current Report Filing (8-k)

June 08 2017 - 8:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

June 5, 2017

Date

of Report (Date of earliest event reported)

ATMOS ENERGY

CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

TEXAS AND VIRGINIA

|

|

1-10042

|

|

75-1743247

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1800 THREE LINCOLN CENTRE,

5430 LBJ FREEWAY, DALLAS, TEXAS

|

|

75240

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(972)

934-9227

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On June 5, 2017, Atmos Energy Corporation (“Atmos Energy”) entered into an underwriting agreement (the “Underwriting Agreement”) with

BNP Paribas Securities Corp., Credit Agricole Securities (USA) Inc., J.P. Morgan Securities LLC and Wells Fargo Securities, LLC, as representatives of the several underwriters named in Schedule I thereto, with respect to the offering and sale in an

underwritten public offering (the “Offering”) by Atmos Energy of $500 million aggregate principal amount of its 3.000% Senior Notes due 2027 (the “2027 Notes”), with a yield to maturity of 3.032% and an effective yield to

maturity of 3.115%, after giving effect to related fees and original issuance discount; and $250 million aggregate principal amount of its 4.125% Senior Notes due 2044 (the “new 2044 Notes”), with a

re-offer

yield of 3.889% and an effective yield to maturity of 4.394%, after giving effect to related fees and the settlement of interest rate swaps (together with the 2027 Notes, the “Notes”). The

new 2044 Notes constitute an additional issuance by Atmos Energy of the $500 million aggregate principal amount of the 4.125% Senior Notes due 2044 previously issued by Atmos Energy on October 15, 2014. The Offering has been registered

under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a registration statement on Form

S-3

(Registration

No. 333-210424)

of

Atmos Energy (the “Registration Statement”) and the prospectus supplement dated June 5, 2017, which was filed with the Securities and Exchange Commission pursuant to Rule 424(b) of the Securities Act on June 7, 2017. Legal

opinions related to the Registration Statement are also filed herewith as Exhibits 5.1 and 5.2.

Atmos Energy expects to receive net proceeds, after the

underwriting discount and estimated offering expenses, of approximately $752 million. The Offering is expected to close on or about June 8, 2017, subject to customary closing conditions.

The Notes will be issued pursuant to an indenture dated March 26, 2009 (the “Indenture”) between Atmos Energy and U.S. Bank National

Association, as trustee (the “Trustee”), to be modified by an Officers’ Certificate setting forth the terms of the Notes (the “Officers’ Certificate”), to be dated June 8, 2017 and delivered to the Trustee pursuant

to Section 301 of the Indenture. The 2027 Notes and the new 2044 Notes will each be represented by a global security, forms of which are filed as exhibits hereto. The form of Officers’ Certificate and the Underwriting Agreement are each

also filed as an exhibit hereto.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement dated as of June 5, 2017

|

|

|

|

|

4.1

|

|

Form of Officers’ Certificate, to be dated June 8, 2017

|

|

|

|

|

4.2

|

|

Form of Global Security for 3.000 Senior Notes due 2027

|

|

|

|

|

4.3

|

|

Form of Global Security for 4.125% Senior Notes due 2044 (incorporated by reference to Exhibit 4.2 to Atmos Energy’s Current Report on Form

8-K

filed with the Securities and Exchange

Commission on October 9, 2014)

|

|

|

|

|

5.1

|

|

Opinion of Gibson, Dunn & Crutcher LLP

|

|

|

|

|

5.2

|

|

Opinion of Hunton & Williams LLP

|

|

|

|

|

23.1

|

|

Consent of Gibson, Dunn & Crutcher LLP (included in Exhibit 5.1)

|

|

|

|

|

23.2

|

|

Consent of Hunton & Williams LLP (included in Exhibit 5.2)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

ATMOS ENERGY CORPORATION

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

DATE: June 8, 2017

|

|

By:

|

|

/s/ CHRISTOPHER T. FORSYTHE

|

|

|

|

|

|

Christopher T. Forsythe

|

|

|

|

|

|

Senior Vice President and

|

|

|

|

|

|

Chief Financial Officer

|

INDEX TO EXHIBITS

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement dated as of June 5, 2017

|

|

|

|

|

4.1

|

|

Form of Officers’ Certificate, to be dated June 8, 2017

|

|

|

|

|

4.2

|

|

Form of Global Security for 3.000% Senior Notes due 2027

|

|

|

|

|

4.3

|

|

Form of Global Security for 4.125% Senior Notes due 2044 (incorporated by reference to Exhibit 4.2 to Atmos Energy’s Current Report on Form

8-K

filed with the Securities and Exchange

Commission on October 9, 2014)

|

|

|

|

|

5.1

|

|

Opinion of Gibson, Dunn & Crutcher LLP

|

|

|

|

|

5.2

|

|

Opinion of Hunton & Williams LLP

|

|

|

|

|

23.1

|

|

Consent of Gibson, Dunn & Crutcher LLP (included in Exhibit 5.1)

|

|

|

|

|

23.2

|

|

Consent of Hunton & Williams LLP (included in Exhibit 5.2)

|

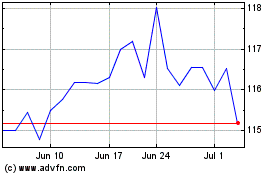

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Mar 2024 to Apr 2024

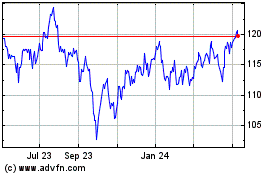

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Apr 2023 to Apr 2024