Current Report Filing (8-k)

June 06 2017 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported):

June 6, 2017

SALLY BEAUTY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-33145

|

|

36-2257936

|

|

(State or other jurisdiction of

|

|

(Commission file number)

|

|

(I.R.S. Employer

|

|

incorporation)

|

|

|

|

Identification Number)

|

3001 Colorado Boulevard

Denton, Texas 76210

(Address of principal executive offices)

(940) 898-7500

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communication pursuant to Rule 425 under Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act CFR 240.17R 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02.

Results of Operations and Financial Condition

and

Item 7.01.

Regulation FD Disclosure

On June 6, 2017, Sally Beauty Holdings, Inc. (the “Company”) announced that its wholly-owned subsidiaries, Sally Holdings LLC (“Holdings”) and Sally Capital Inc. (together with Holdings, the “Issuers”), issued a conditional notice of redemption, to redeem on July 6, 2017, subject to the satisfaction or waiver of the condition precedent described below, the entire $850 million aggregate principal amount of their 5.75% Senior Notes due 2022 (“Notes”). The redemption is being made pursuant to the terms of the Indenture dated May 18, 2012, as supplemented by the Supplemental Indenture dated May 18, 2012, at a redemption price equal to 102.875% of the principal amount of the Notes plus accrued but unpaid interest, to, but not including, the redemption date.

This redemption is contingent upon the completion by the Issuers of one or more debt financings, all upon terms and conditions satisfactory to the Issuers in their sole discretion, in an amount sufficient to make the redemption payment in full. In the Issuers’ discretion, the redemption date may be delayed until such time as such condition precedent shall be satisfied, or such redemption may not occur and the notice of conditional redemption may be rescinded, in the event such condition precedent shall not have been satisfied by the redemption date, or by the redemption date as so delayed.

The proposed redemption is expected to be funded by the proceeds of a proposed new term loan B, which is expected to be in the original principal amount of $850 million. Simultaneously with the closing of the term loan, Holdings expects to enter into an amended and restated ABL revolving credit facility that extends the maturity of the existing facility by five years and reduces the applicable margins with respect to the loans made thereunder, but otherwise contains substantially the same terms and conditions as the existing facility. The ability of the Issuers to consummate the term loan and the amended and restated ABL revolving credit facility and redeem the Notes is subject to market and other conditions, and may not occur as described or at all. Neither the redemption of the Notes nor the amendment and restatement of the ABL revolving credit facility is conditioned upon the occurrence of the other.

In connection with obtaining the proposed refinancing, the Company will be disclosing to certain lenders preliminary monthly results of operations for the months ended April 30, 2017 and May 31, 2017 as described below.

The Company’s consolidated revenue for the months of April and May 2017 combined was $662.8 million, a decline of 0.4% compared to the prior year’s April and May combined. The Company had one less sales day in April 2017 due to the shift of the Easter holiday from March in the prior year to April in the current year. This calendar shift negatively impacted revenue growth in the two-month period by approximately 79 basis points. Further, foreign currency translation negatively impacted revenue growth in the two-month period by approximately 121

basis points.

2

Adjusting for both the Easter calendar shift and foreign currency translations noted above, revenue growth versus the prior year in the two-month period was 1.6%.

The Company’s consolidated same store sales growth for the months of April and May 2017 combined was 0.4%. The Easter calendar shift issue discussed above negatively impacted same store sales growth in the two-month period by approximately 96 basis points, resulting in adjusted same store sales growth in the two-month period of 1.3%.

The Company is today also reaffirming its expectation of consolidated full-year same-store sales growth of approximately flat versus the prior year.

The foregoing information is preliminary and subject to change. Preliminary results are inherently uncertain. We undertake no obligation to update this information. Our preliminary results may differ from actual results. Actual results remain subject to the completion of management’s final review, as well as quarter-end review by our registered independent public accounting firm Our registered independent public accounting firm does not assume any responsibility for the accuracy of this information and is not providing any opinion or other assurance with respect to these preliminary results.

We do not, as a matter of course, make public preliminary results of operations for monthly periods. Accordingly, we do not anticipate that we will do so in the future, and we disclaim any obligation to furnish updated disclosures to reflect any changed circumstances.

Investors should exercise caution in relying on this information and should not draw any inferences from this information regarding financial or operating data not provided or our performance for the entire quarter or other future periods.

This report does not constitute a notice of redemption under the Indenture, nor an offer to tender for, or purchase, any Notes or any other security. We cannot provide any assurances about the timing, terms or interest rate associated with the proposed redemption and refinancing, or that the proposed redemption and refinancing transactions can be completed at all.

All of the information furnished in Items 2.02 and 7.01 of this report shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, unless expressly incorporated by reference therein.

Use of Non-GAAP Financial Measures

This report includes the following financial measures that have not been calculated in accordance with accounting principles generally accepted in the U.S., or GAAP, and are therefore referred to as non-GAAP financial measures: (1) adjusted revenue growth; and (2) adjusted same store sales growth, each of which have been adjusted to account for the effects of differing numbers of sales day during periods and foreign currency translation.

3

We believe that these non-GAAP financial measures provide valuable information regarding business trends by excluding specific items that we believe are not indicative of the

ongoing operating results of our businesses and providing a useful way for investors to make a comparison of our performance over time and against other companies in our industry.

We have provided these non-GAAP financial measures as supplemental information to our GAAP financial measures and believe these non-GAAP measures provide investors with additional meaningful financial information regarding our operating performance. We believe that these non-GAAP measures also provide meaningful information for investors and securities analysts to evaluate our historical and prospective financial performance. These non-GAAP measures should not be considered a substitute for or superior to GAAP results. Furthermore, the non-GAAP measures presented by us may not be comparable to similarly titled measures of other companies.

Cautionary Notice Regarding Forward-Looking Statements

Statements in this report which are not purely historical facts or which depend upon future events may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would,” or similar expressions may also identify such forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements as such statements speak only as of the date they were made. Any forward-looking statements involve risks and uncertainties that could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including, but not limited to, risks and uncertainties related to economic, competitive, governmental and other factors outside of our control and market conditions for debt financings that may cause us to be unable to consummate the proposed redemption and the refinancing, and may also cause our business, industry, strategy, or actual results to differ materially.

Additional factors that could cause actual events or results to differ materially from the events or results described in the forward-looking statements can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K for the year ended September 30, 2016, as filed with the Securities and Exchange Commission. Consequently, all forward-looking statements in this release are qualified by the factors, risks and uncertainties contained therein. We assume no obligation to publicly update or revise any forward-looking statements.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SALLY BEAUTY HOLDINGS, INC.

|

|

|

|

|

June 6, 2017

|

By:

|

/s/ Matthew Haltom

|

|

|

|

Name: Matthew Haltom

|

|

|

|

Title: Senior Vice President, General Counsel & Secretary

|

5

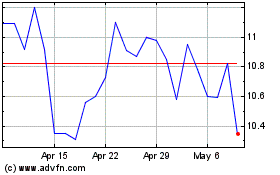

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

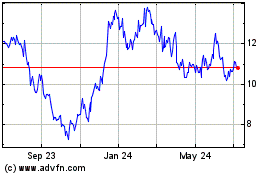

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Apr 2023 to Apr 2024