Current Report Filing (8-k)

June 05 2017 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 2, 2017

Commission file number 001-11625

Pentair plc

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Ireland

|

|

98-1141328

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(I.R.S. Employer

Identification number)

|

43 London Wall, London, EC2M 5TF United Kingdom

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: 44-207-347-8925

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(b) Dennis J. Cassidy, Jr. (the “Executive”) resigned his position as an officer of Pentair plc (the “Company”) on

June 2, 2017.

(e) Effective on May 2, 2017, Pentair Management Company (“PMC”), a wholly-owned subsidiary of the

Company, and the Executive, entered into a Confidential Separation Agreement (the “Agreement”) pursuant to which the Executive’s employment with the Company ceased on May 1, 2017 (the “Separation Date”). Pursuant to the

Agreement, PMC agreed to make separation payments to the Executive of (i) $485,000 within 20 days following the Executive’s execution of the release of claims described below and (ii) provided that the Executive is in compliance with

the obligations, including the

non-solicitation

and

non-competition

covenants described below, at all times through February 1, 2018, $1,164,000 on or before

February 1, 2018. The Agreement also provides that PMC will make an additional payment of $31,036, which the Executive may use toward the cost of future health insurance premiums or for other purposes, at the same time the first separation

payment is made. The Executive will receive a prorated cash bonus for 2017 which will be payable in March 2018 pursuant to the Pentair Management Incentive Plan. Under the Agreement, PMC will pay for outplacement services up to a Company determined

maximum, provided that in lieu of outplacement services, the Executive may elect to receive a payment of $45,000. In addition, PMC agrees to treat the Executive’s unearned restricted stock units, performance units and stock options in

accordance with the existing equity plans of the Company under which they were granted.

In exchange for the benefits above, the Executive

agreed to release PMC and all of its affiliated entities and persons from all claims arising out of the Executive’s employment or separation of employment with PMC. The Executive also agrees for a 24-month period after the Separation Date that

the Executive will not (i) become employed by, consult with, obtain an ownership interest in, render services to, or have any competitive involvement with, any entity or person that competes with the business of the Company and its affiliates,

(ii) solicit or accept competitive business from any customer of the Company and its affiliates or (iii) solicit any employee of the Company and its affiliates.

The foregoing description of the Agreement is qualified in its entirety by reference to the full copy of the Agreement, a copy of which is

filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

|

ITEM 9.01

|

Financial Statements and Exhibits.

|

a) Not applicable.

b) Not applicable.

c) Not applicable.

d)

Exhibits

. The following exhibit is being filed herewith:

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

10.1

|

|

Confidential Separation Agreement, dated as of May 2, 2017, between Pentair Management Company and Dennis J. Cassidy, Jr.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized, on June 2, 2017.

|

|

|

|

|

PENTAIR PLC

|

|

Registrant

|

|

|

|

|

By:

|

|

/s/ Angela D. Jilek

|

|

|

|

Angela D. Jilek

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

PENTAIR PLC

Exhibit Index to Current Report on Form 8-K

Dated May 2, 2017

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

10.1

|

|

Confidential Separation Agreement, dated as of May 2, 2017, between Pentair Management Company and Dennis J. Cassidy, Jr.

|

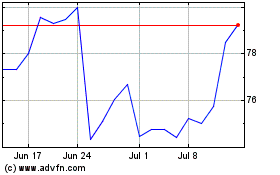

Pentair (NYSE:PNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pentair (NYSE:PNR)

Historical Stock Chart

From Apr 2023 to Apr 2024