Current Report Filing (8-k)

May 23 2017 - 1:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 23, 2017

(May 17, 2017)

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of Registrant as specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

Luxembourg

|

|

001-34354

|

|

98-0554932

|

|

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

40, avenue Monterey

L-2163 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices including zip code)

+352 2469 7900

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

Emerging growth company

o

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 17, 2017, Altisource Portfolio Solutions S.A. (the “Company”) held its 2017 annual meeting of shareholders (the “Annual Meeting”) followed by an extraordinary meeting of shareholders (the “Extraordinary Meeting”). A quorum was present for each of the meetings.

The final results for each matter submitted to a vote of shareholders at the Annual Meeting were as follows:

|

|

|

|

(i)

|

The following Directors were elected for a one (1) year term and/or until their successors are duly elected and qualified by the following vote:

|

|

|

|

|

|

|

|

|

|

Name

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

Orin S. Kramer

|

16,112,270

|

51,540

|

4,886

|

1,286,314

|

|

W. Michael Linn

|

15,974,958

|

188,859

|

4,879

|

1,286,314

|

|

Roland Müller-Ineichen

|

16,145,461

|

18,349

|

4,886

|

1,286,314

|

|

William B. Shepro

|

16,149,238

|

14,572

|

4,886

|

1,286,314

|

|

Timo Vättö

|

16,143,277

|

20,033

|

5,386

|

1,286,314

|

|

Joseph L. Morettini

|

16,147,788

|

16,022

|

4,886

|

1,286,314

|

|

|

|

|

(ii)

|

The appointment of

Mayer Hoffman McCann P.C. as the Company’s independent registered certified public accounting firm for the year ending December 31, 2017 and the appointment of Atwell S.à r.l. as the Company’s certified auditor (

Réviseur d’Entreprises

) for the same period

were approved by the following vote:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

17,426,246

|

16,710

|

12,054

|

N/A

|

|

|

|

|

(iii)

|

T

he appointment of Michelle D. Esterman, Chief Financial Officer of the Company, as the supervisory auditor (

Commissaire aux Comptes

)

to report on the Company’s unconsolidated annual accounts prepared in accordance with accounting principles generally accepted in Luxembourg (the “Luxembourg Annual Accounts”) for the years ending December 31, 2017 through December 31, 2022, or until her successor is duly elected and qualified, and the ratification of her appointment by the Board of Directors as the supervisory auditor to report on the Luxembourg Annual Accounts for the years ended December 31, 2009 through December 31, 2016

were approved by the following vote:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

17,419,072

|

23,943

|

11,995

|

N/A

|

|

|

|

|

(iv)

|

The

Luxembourg Annual Accounts for the year ended December 31, 2016 and the Company’s consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States including a footnote reconciliation of equity and net income to International Financial Reporting Standards (together with the Luxembourg Annual Accounts, the “Luxembourg Statutory Accounts”) as of and for the year ended December 31, 2016

were approved by the following vote:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

17,223,846

|

17,870

|

213,294

|

N/A

|

|

|

|

|

(v)

|

The receipt and approval of the Directors’ reports for the Luxembourg Statutory Accounts for the year ended December 31, 2016 and the receipt of the reports of the supervisory auditor (

Commissaire aux Comptes

) for the Luxembourg Annual Accounts for the years ended December 31, 2009 through December 31, 2016 were approved by the following vote:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

17,220,603

|

21,676

|

212,731

|

N/A

|

|

|

|

|

(vi)

|

The allocation of the results in the Luxembourg Annual Accounts for the year ended December 31, 2016 was approved by the following vote:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

17,222,006

|

21,189

|

211,815

|

N/A

|

|

|

|

|

(vii)

|

The discharge of

each of the Directors of the Company for the performance of their mandates for the year ended December 31, 2016 and the discharge of the supervisory auditor (

Commissaire aux Comptes

) for the performance of her mandate for the years ended December 31, 2009 through December 31, 2016

were approved by the following vote:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

16,144,850

|

15,569

|

8,277

|

1,286,314

|

|

|

|

|

(viii)

|

The renewal of

the Company’s share repurchase program whereby the Company is authorized to repurchase shares of its common stock within certain limits

was approved by the following vote:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

14,983,429

|

1,180,421

|

4,846

|

1,286,314

|

|

|

|

|

(ix)

|

The compensation of the Company’s

named executive officers as disclosed in the Company’s joint proxy statement (“Say-on-Pay”)

was approved

on an advisory (non-binding) basis

by the following vote:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

Broker Non-Votes

|

|

16,092,544

|

72,071

|

4,081

|

1,286,314

|

|

|

|

|

(x)

|

A frequency of every “one year” for future shareholder advisory votes on executive compensation (“Say-on-Frequency”)

was approved

on an advisory (non-binding) basis

by the following vote:

|

|

|

|

|

|

|

|

|

|

One Year

|

Two Years

|

Three Years

|

Abstentions

|

Broker Non-Votes

|

|

15,732,645

|

1,035

|

285,537

|

149,479

|

1,286,314

|

The final results for each matter submitted to a vote of shareholders at the Extraordinary Meeting were as follows. The Company did not receive any broker non-votes with respect to any of the proposals presented.

|

|

|

|

(i)

|

The amendment of

the Company’s Articles of Incorporation to renew and extend the authorization of the Board of Directors to issue shares of the Company’s common stock, within the limits of the Company’s authorized share capital of one hundred million dollars ($100,000,000) and, in connection with any such issuance, to limit or cancel the preferential subscription rights of shareholders, each for a period of five (5) years, as set forth in the proposed Amended and Restated Articles of Incorporation and the receipt of the report issued by the Board of Directors pursuant to article 32-3 (5) of the Luxembourg Law of 10 August 1915 on commercial companies, as amended (the “Luxembourg Company Law”) were

approved by the following vote:

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

|

12,138,887

|

1,302,308

|

4,364

|

|

|

|

|

(ii)

|

The amendment of the Company’s Articles of Incorporation to effectuate recent changes in the Luxembourg Company Law

and to make certain other administrative changes, w

as approved by the following vote:

|

|

|

|

|

|

|

|

For

|

Against

|

Abstentions

|

|

13,157,881

|

282,106

|

5,572

|

Each of the foregoing proposals for the Annual Meeting and for the Extraordinary Meeting is more fully described in the joint proxy statement filed by the Company with the Securities and Exchange Commission on April 6, 2017.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date:

May 23, 2017

|

|

|

|

|

|

|

|

|

Altisource Portfolio Solutions S.A.

|

|

|

|

|

|

|

|

By:

|

/s/ Kevin J. Wilcox

|

|

|

|

Name:

|

Kevin J. Wilcox

|

|

|

|

Title:

|

Chief Administration and Risk Officer

|

|

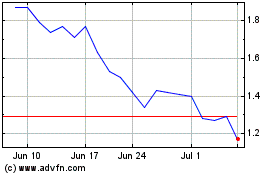

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

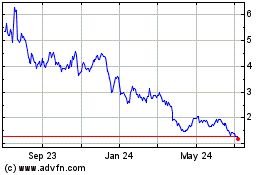

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Apr 2023 to Apr 2024