Current Report Filing (8-k)

May 15 2017 - 5:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 12, 2017

CYTOMX THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37587

|

|

27-3521219

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

151 Oyster Point Blvd.

Suite 400

South San

Francisco, CA 94080

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (650)

515-3185

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☒

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On May 12, 2017, Robert C. Goeltz II, Chief Financial Officer of CytomX Therapeutics,

Inc. (the “Company”) and the Company agreed on the terms of his resignation from his position, effective May 15, 2017, as Mr. Goeltz has decided to leave the company to pursue new opportunities. On May 15, 2017, the Company

entered into a Separation Agreement with Mr. Goeltz (the “Separation Agreement”) that provides (1) a cash payment equal to twelve months of his base salary, (2) up to twelve months of reimbursement for continuation

healthcare, (3) a cash payment equal to his 2017 target bonus

pro-rated

to May 15, 2017 and (4) the extension of the exercise period for Mr. Goeltz’s options to January 31,

2019. The Separation Agreement also includes a general release of claims against the Company.

The foregoing descriptions of the Separation Agreement

are qualified in their entirety by reference to the full text of the Separation Agreement which will be filed as an exhibit to the Company’s Quarterly Report on Form

10-Q

for the three months ending

June 30, 2017.

On May 15, 2017, the Board of Directors (the “Board”) of the Company promoted Debanjan Ray to serve as Chief Financial

Officer of the Company, effective that day. In this role, Mr. Ray will also be the Company’s Principal Financial and Accounting Officer. He will also serve as the Head of Corporate Development. Mr. Ray, 39, has served as Senior Vice

President of Corporate Development and Strategy of the Company since August 2015. Prior to that, Mr. Ray served as Vice President, Business Development and Alliance Management at the Company since July 2013. Mr. Ray joined the Company in

2011 as Senior Director of Business Development. Prior to joining the Company, Mr. Ray held positions as the vice president of business development at Itero Biopharmaceuticals. Prior to Itero, Mr. Ray was as associate director of business

development at Portola Pharmaceuticals and an associate in the life sciences venture practice at J.P. Morgan Partners. He also served as a business analyst in the healthcare practice at McKinsey & Company. Mr. Ray holds a dual B.S. in

chemical engineering and biology from the Massachusetts Institute of Technology and an M.B.A. from The Wharton School, University of Pennsylvania.

In

connection with Mr. Ray’s promotion, the Board also approved, effective May 15, 2017, an increase in his (1) annual base salary to $375,000 and (2) discretionary annual bonus target to 40% of his base salary, with the

payment amount based upon performance as determined by the Company. On May 13, 2017, Mr. Ray also received an option under the Company’s 2015 Equity Incentive Plan to purchase 30,000 shares of the Company’s common stock with an

exercise price of $14.62, the closing price of the Company’s common stock on May 12, 2017, which will vest monthly in 48 substantially equal monthly installments starting on May 15, 2017, in each case, subject to Mr. Ray’s

continued service to the Company through each applicable vesting date.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: May 15, 2017

|

|

|

|

CYTOMX THERAPEUTICS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Cynthia J. Ladd

|

|

|

|

|

|

|

|

Cynthia J. Ladd

|

|

|

|

|

|

|

|

Senior Vice President and General Counsel

|

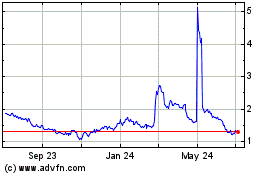

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

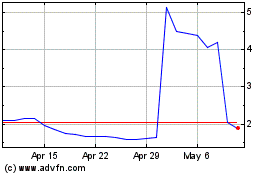

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Apr 2023 to Apr 2024