Current Report Filing (8-k)

May 09 2017 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): May 3,

2017

001-35922

(Commission file number)

PEDEVCO CORP.

(Exact name of registrant as specified in its charter)

|

Texas

|

|

22-3755993

|

|

(State or other jurisdiction of

incorporation

or organization)

|

|

(IRS Employer Identification

No.)

|

4125 Blackhawk Plaza Circle, Suite 201

Danville, California 94506

(Address of principal executive offices)

(855) 733-3826

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17

CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of

1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act.

☐

ITEM 3.01 NOTICE OF DELISTING OR FAILURE TO SATISFY A

CONTINUED LISTING RULE OR STANDARD; TRANSFER OF

LISTING.

On May 3, 2017, PEDEVCO Corp. (the

“

Company

”)

received notice from the NYSE MKT LLC (the

“

Exchange

”)

that, as a result of the Company’s one-for-ten reverse split

of its outstanding common stock that took effect on April 7, 2017,

the Company has regained compliance with Section 1003(f)(v) of the

NYSE MKT Company Guide (“

Company

Guide

”), which requires

the thirty day average closing price per share of the

Company’s common stock to be at or above $0.20 per

share.

The Exchange

previously notified the Company that it was out of compliance with

this continued listing standard on November 3, 2016, as reported by

the Company in a Current Report on Form 8-K filed with the

Securities and Exchange Commission (the “

SEC

”) on November 9, 2016.

In addition, on May 3, 2017, the Company received

notice from the Exchange that the Company is not in compliance with

Sections 1003(a)(i), (ii) and (iii) of the Company Guide since it

reported stockholders’ equity of less than $2,000,000 at

December 31, 2016 and has incurred net losses in its five most

recent fiscal years ended December 31, 2016. The Exchange

previously notified the Company that it was out of compliance with

the Exchange’s $6,000,000 minimum stockholders’ equity

standard under Section 1003(a)(iii) on December 27, 2016, as

reported by the Company in a Current Report on Form 8-K filed on

December 30, 2016. As previously reported by the Company in a

Current Report on Form 8-K filed on February 17, 2017, the Company

submitted a plan of compliance (“

Plan

”)

to the Exchange designed to regain compliance under Section

1003(a)(iii) of the Company Guide, which was accepted by the

Exchange on February 13, 2017, and which Plan, if achieved as

contemplated, would increase the Company’s

stockholders’ equity well-above the Exchange’s minimum

continued listing standards required under Sections 1003(a)(i),

(ii) and (iii) of the Company Guide. As such, no new or revised

Plan is required to be submitted by the Exchange at this time, and

the Company believes it is making progress consistent with the

Exchange-approved Plan.

Receipt of the letter does not have any immediate

effect upon the listing of the Company’s common stock,

provided that in order to maintain its listing on the Exchange, the

Company must continue to make progress consistent with the Plan

previously approved by the Exchange, and regain compliance with

Sections 1003(a)(i), (ii) and (iii) of the Company Guide by June

27, 2018. If the Company fails to do so, the Company will be

subject to delisting procedures as set forth in the Company Guide.

The Company may then appeal such a determination by the staff of

the Exchange in accordance with the provisions of the Company

Guide. There can be no assurance that the Company will be able to

achieve compliance with the Exchange’s continued listing

standards within the required time frame. Until the Company regains

compliance with the Exchange’s listing standards, a

“.

BC

” indicator will be affixed to the

Company’s trading symbol to denote non-compliance with

the Exchange’s continued listing standards; provided that as

disclosed in the Current Report on Form 8-K filed by the Company on

November 9, 2016, a “

.BC

” indicator is already affixed to the

Company’s trading symbol due to the fact that the Company was

not in compliance with Section 1003(f)(v) of the Company Guide

until notified on May 3, 2017 that it has now regained compliance

under such Section.

ITEM 7.01 REGULATION FD DISCLOSURE.

The

Company issued a press release on May 9, 2017, announcing that the

Company had received notice from the Exchange indicating that it

had regained compliance with the Exchange’s continued

“minimum stock price” listing standards, but does not

satisfy the continued listing standards of the Exchange with

respect to minimum stockholders’ equity. A copy of the press

release is furnished herewith as Exhibit 99.1 and is incorporated

by reference herein.

In

accordance with General Instruction B.2 of Form 8-K, the

information presented herein under Item 7.01 and set forth in the

attached Exhibit 99.1 is deemed to be “furnished” and

shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of that section, nor shall such

information and Exhibit be deemed incorporated by reference into

any filing under the Securities Act of 1933 or the Securities

Exchange Act of 1934, each as amended.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

Press

Release dated May 9, 2017

|

Forward-Looking Statements

Some of

the statements contained in this report discuss future

expectations, contain projections of results of operations or

financial condition, or state other “

forward-looking

”

information. The words “

believe,

”

“

intend,

”

“

plan,

”

“

expect,

”

“

anticipate,

”

“

estimate,

”

“

project,

”

“

goal

”

and similar expressions identify such a statement was made,

although not all forward-looking statements contain such

identifying words. These statements are subject to known and

unknown risks, uncertainties, and other factors that could cause

the actual results to differ materially from those contemplated by

the statements. The forward-looking information is based on various

factors and is derived using numerous assumptions. Factors that

might cause or contribute to such a discrepancy include, but are

not limited to, the risks discussed in this and our other SEC

filings. We do not promise to or take any responsibility to update

forward-looking information to reflect actual results or changes in

assumptions or other factors that could affect those statements

except as required by law. Future events and actual results could

differ materially from those expressed in, contemplated by, or

underlying such forward-looking statements.

PEDEVCO’s

forward-looking statements are based on assumptions that PEDEVCO

believes to be reasonable but that may not prove to be accurate.

PEDEVCO cannot guarantee future results, level of activity,

performance or achievements. Moreover, PEDEVCO does not assume

responsibility for the accuracy and completeness of any of these

forward-looking statements. PEDEVCO assumes no obligation to update

or revise any forward-looking statements as a result of new

information, future events or otherwise, except as may be required

by law. Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date

hereof.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

|

PEDEVCO

CORP.

|

|

|

|

|

|

|

|

Date:

May 9, 2017

|

By:

|

/s/

Michael L.

Peterson

|

|

|

|

|

Michael

L. Peterson

|

|

|

|

|

President

and

Chief Executive

Officer

|

|

EXHIBIT INDEX

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

|

|

Press Release dated

May 9, 2017

|

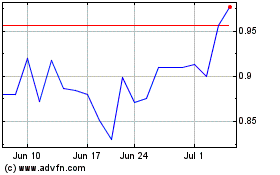

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024