Current Report Filing (8-k)

May 08 2017 - 5:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 2, 2017

__________________________________________________________________

CELADON GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-34533

|

13-3361050

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

9503 East 33

rd

Street

One Celadon Drive, Indianapolis, IN

|

46235

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(317) 972-7000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

|

[ ]

|

Emerging growth company

|

|

[ ]

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

Item 3.01

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

(a) On May 2, 2017, Celadon Group, Inc., a Delaware corporation (the “Company”), received from the New York Stock Exchange (the “NYSE”) a notice of failure to satisfy a continued listing rule or standard and related monitoring. This notice informed the Company that, as a result of the Company’s disclosure via Form 8-K filed May 1, 2017 regarding non-reliance and withdrawal of auditor reports on the previously completed June 30, 2016 Form 10-K and the interim reviews related to the Company’s Form 10-Qs for the three month periods ended September 30, 2016 and December 31, 2016, respectively, the NYSE has determined that the Company has failed to timely file these forms with the Securities and Exchange Commission. Accordingly, the Company is subject to the procedures specified in Section 802.01E of the NYSE Listed Company Manual. The Company’s management has discussed the notice with the NYSE.

The Audit Committee of the Company's Board of Directors is reviewing this development. The Audit Committee is comprised of all independent directors of the Company, and will be assisted by an independent law firm and a leading, international auditing, tax, and advisory firm.

|

Item 7.01

|

Regulation FD Disclosure.

|

On May 8, 2017, the Company issued a press release discussing the items noted above. A copy of the press release is attached to this report as Exhibit 99.1.

Item 9.01

Financial Statements and Exhibits.

|

(d)

|

Exhibits.

|

|

|

|

|

|

|

|

|

|

EXHIBIT

|

|

|

|

|

NUMBER

|

|

EXHIBIT DESCRIPTION

|

|

|

|

|

Press Release dated May 8, 2017 Regarding NYSE Status.

|

The information contained in Item 7.01 and Exhibit 99.1 of Item 9.01 of this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The information contained in Item 3.01, Item 7.01, and Exhibit 99.1 of this report contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements may be identified by their use of terms or phrases, including “expects,” “expected,” “will,” “would be,” “intends,” “believes,” and similar terms and phrases. Forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. In this report, statements relating to the Audit Committee’s review, the anticipated correction of the Filing Delinquency, the timing of correcting the Filing Delinquency, the Company’s belief that it will continue to be listed on the NYSE, anticipated grace periods, and anticipated NYSE actions with respect to the Filing Delinquency and the listing of the Company’s common stock, among others, are forward-looking statements. Actual results may differ from those set forth in the forward-looking statements. It is possible that the Company will have to record different financial statement entries. Carrying values of the affected assets, including minority interest in joint venture, could be subject to change. If that occurs, restated financial statements could be required. There can be no assurance that the re-issued statements will not differ materially from those discussed in this press release or as previously filed, or that additional adjustments will not be identified. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, the risk that additional information may arise from the Company’s and its Audit Committee’s review, and subsequent accounting or related review or analysis, the risk that the process of preparing, auditing, and reviewing restated financial statements, if any, or other subsequent events would require the Company to make additional adjustments, the time and effort required to complete the reissuance of its financial statements, the Company’s ability to timely file amended periodic reports reflecting restated financial statements, if required, the ramifications of the Company’s potential inability to timely file any required reports, including potential delisting of its common stock on the NYSE, potential claims and proceedings relating to any of these matters, and negative tax or other implications for the Company resulting from any accounting adjustments, as well as other risks described more fully in the Company's filings with the SEC. Readers should review and consider factors that could impact results as provided in various disclosures by the Company in its press releases, stockholder reports, and filings with the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

CELADON GROUP, INC.

|

|

|

|

|

|

|

|

|

|

Date: May 8,

2017

|

By:

|

/s/ Bobby Peavler

|

|

|

|

Bobby Peavler

Executive Vice President, Chief Financial Officer, and Treasurer

|

EXHIBIT INDEX

|

EXHIBIT

NUMBER

|

|

EXHIBIT DESCRIPTION

|

|

|

|

Press Release dated May 8, 2017 Regarding NYSE Status.

|

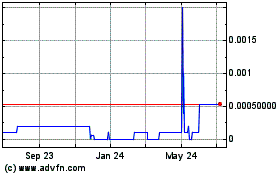

Celadon (CE) (USOTC:CGIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Celadon (CE) (USOTC:CGIP)

Historical Stock Chart

From Apr 2023 to Apr 2024