Current Report Filing (8-k)

May 05 2017 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 5, 2017 (May 3, 2017)

Asbury Automotive Group, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

|

|

|

001-31262

|

|

01-0609375

|

|

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

2905 Premiere Parkway NW Suite 300

Duluth, GA

|

|

30097

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

|

(770) 418-8200

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Asbury Automotive Group, Inc. ("Asbury" or the "Company"), announced that Sean D. Goodman, age 51, has been appointed to serve as Senior Vice President and Chief Financial Officer of the Company, effective July 5, 2017. Mr. Goodman joins the Company from Unifi, Inc., a NYSE-listed multinational manufacturer and distributor of innovative textile solutions, where he served as Vice President, Chief Financial Officer and Chief Accounting Officer since January 2016. Prior to that, Mr. Goodman was the Senior Vice President and Chief Financial Officer of the Americas region for Landis+Gyr, Inc., a subsidiary of Toshiba Corporation, from April 2011 to January 2016. Mr. Goodman also served in various roles at The Home Depot, Inc. (“Home Depot”) from February 2006 to April 2011, including Director of Strategic Business Development and Director of Finance responsible for financial leadership of the Home Services Division, and Financial Planning and Analysis for Home Depot. Before joining Home Depot, he held various capital markets, finance, strategy, accounting and treasury positions with Morgan Stanley, Inc. in London, England and Deloitte & Touche LLP in New York. Mr. Goodman has a B.Bus.Sc. with honors in business strategy and corporate finance and an M.A. in accounting from University of Cape Town, and an M.B.A. from Harvard Business School. He is a certified public accountant.

Mr. Goodman will assume the role of principal financial officer on July 5, 2017, and Mr. Stax’s tenure as Interim Principal Financial Officer will end on such date. Mr. Stax, however, will continue to serve as Corporate Controller and Chief Accounting Officer of the Company as previously reported on a current report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission on January 25, 2017.

Mr. Goodman has entered into a letter agreement with the Company in connection with his appointment (the “Letter Agreement”). Pursuant to the terms thereof, Mr. Goodman will be entitled to receive an annual base salary of $600,000.00 and a one-time signing bonus in lieu of any relocation benefits in the amount of $150,000.00. The Company also will grant Mr. Goodman an award of restricted shares valued at $600,000 upon the commencement of his employment. The shares will vest ratably over 3 years. Mr. Goodman also will become eligible for a target annual cash bonus under the Company's annual cash incentive plan equal to 75% of his base salary pro-rated for 2017. Mr. Goodman also will receive a severance pay agreement providing base salary continuation for one year and a pro-rated bonus for the portion of the year he served in the event he is terminated without “cause” or resigns for “good reason” as provided therein.

Mr. Goodman will enter into the Company’s standard indemnification agreement. The indemnification agreement will be identical in all material respects to the Company’s form of Indemnification Agreement, filed with the SEC on April 30, 2010 as Exhibit 10.7 to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2010.

The foregoing description of the Letter Agreement is qualified in its entirety by reference to the Letter Agreement, a copy of which is attached hereto as

Exhibit 10.1

and is incorporated herein by reference. A copy of the press release issued by the Company announcing Mr. Goodman’s appointment as Senior Vice President and Chief Financial Officer is attached as

Exhibit 99.1

hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished as part of this report.

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

10.1

|

|

Letter Agreement between Asbury Automotive Group, Inc. and Sean Goodman, dated as of May 3, 2017.

|

|

|

|

|

|

|

|

99.1

|

|

Press Release dated May 5, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

ASBURY AUTOMOTIVE GROUP, INC.

|

|

|

|

|

|

|

Date: May 5, 2017

|

By:

|

|

/s/ George A. Villasana

|

|

|

Name:

|

|

George A. Villasana

|

|

|

Title:

|

|

Senior Vice President, General Counsel and Secretary

|

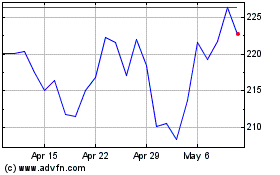

Asbury Automotive (NYSE:ABG)

Historical Stock Chart

From Mar 2024 to Apr 2024

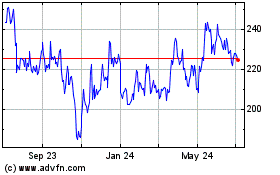

Asbury Automotive (NYSE:ABG)

Historical Stock Chart

From Apr 2023 to Apr 2024