Current Report Filing (8-k)

April 25 2017 - 3:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

April 25, 2017

(Date of earliest event reported)

LABORATORY CORPORATION OF

AMERICA HOLDINGS

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-11353

|

|

13-3757370

|

|

(State or other jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

358 South Main Street,

|

|

|

|

|

|

Burlington, North Carolina

|

|

27215

|

|

336-229-1127

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(Registrant’s telephone number including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

[ ]

|

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

[ ]

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether registrant is an emerging growth company as defined in Rule 405 of Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. [ ]

|

|

|

|

|

|

|

Item 2.05

|

|

Costs Associated with Exit or Disposal Activities

|

On April 25, 2017, Laboratory Corporation of America

®

Holdings (LabCorp

®

) announced that it is expanding its LaunchPad business process improvement initiative to include its Covance Drug Development segment (CDD). The application of the initiative to CDD will consist of two phases implemented over three years. The first phase is intended to better align CDD's resources with its near-term outlook, and, in connection with the implementation of the first phase, on April 24, 2017, the Company committed to carry out a reduction in workforce in 2017. The first phase is expected to generate pre-tax savings of approximately $20.0 million in 2017 and approximately $45.0 million on an annualized basis thereafter, with estimated total pre-tax charges of $30.0 million in 2017, primarily related to severance cost expected to be approximately $14.0 million and related facility closure costs expected to be approximately $16.0 million in 2017. The second phase will focus on long-term structural changes designed to create a more efficient business model for CDD. Additional details on the second phase will be provided later this year.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

LABORATORY CORPORATION OF AMERICA HOLDINGS

Registrant

|

|

|

|

|

|

|

|

By:

|

/s/ F. SAMUEL EBERTS III

|

|

|

|

F. Samuel Eberts III

|

|

|

|

Chief Legal Officer and Secretary

|

April 25, 2017

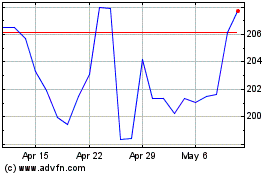

Laboratory Corporation o... (NYSE:LH)

Historical Stock Chart

From Mar 2024 to Apr 2024

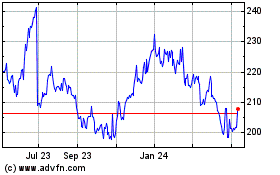

Laboratory Corporation o... (NYSE:LH)

Historical Stock Chart

From Apr 2023 to Apr 2024