Current Report Filing (8-k)

April 14 2017 - 5:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

April 7, 2017

Date of

Report (Date of earliest event reported)

Friendable, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-52917

|

98-0546715

|

|

(State

or other jurisdiction

|

(Commission

|

(IRS

Employer

|

|

of

incorporation)

|

File

Number)

|

Identification

No.)

|

1821 S Bascom Ave., Suite 353, Campbell, California

95008

(Address

of principal executive offices) (Zip Code)

(855) 473-7473

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On

April 7, 2017, Friendable, Inc. (the “

Company

”) entered into a

Settlement Agreement with Joseph Canouse (the “

Agreement

”). The Company and Mr.

Canouse had been in a dispute regarding what amount, if any, was

owed pursuant to a consulting agreement between the parties signed

in April 2014. In December 2016, Mr. Canouse obtained a judgment in

state court in Georgia and the right to garnish the Company’s

bank accounts. Pursuant to the Settlement Agreement, the Company

agreed to issue an 8% Convertible Note in the principal amount of

$82,931.27 (the “

Note

”). The Note was issued to an

entity controlled by Mr. Canouse.

Although the Note

is dated Mach 30, 2017, it was issued on April 7, 2017.

In

return for the issuance of the Note, Mr. Canouse will file a

Consent Motion to Withdraw Judgment, dismiss all garnishments, and

cease all collection activities.

Interest

accrues daily on the outstanding principal amount of the Note at a

rate per annum equal to 8% on the basis of a 365-day year. The

principal amount of the Note and interest are payable on September

30, 2017. The Note is convertible into common stock, subject to

Rule 144, at any time after the issue date at the lower of (i) the

closing sale price of the common stock on the on the trading day

immediately preceding the closing date, and (ii) 50% of the lowest

sale price for the common stock during the twenty-five (25)

consecutive trading days immediately preceding the conversion date

or the closing bid price, whichever is lower, provided, however, if

the Company’s share price at any time loses the bid (ex:

0.0001 on the ask with zero market makers on the bid on level 2),

then the conversion price may, in the Holder’s sole and

absolute discretion, be reduced to a fixed conversion price of

0.00001 (if lower than the conversion price otherwise). Mr. Canouse

does not have the right to convert the Note, to the extent that he

would beneficially own in excess of 4.9% of our outstanding common

stock. The Company shall have the right, exercisable on not less

than five (5) trading days’ prior written notice to

the

Canouse entity

, to prepay the

outstanding balance on the Note for (i) 135% of all unpaid

principal and interest if paid within 90 days of the issue date and

(ii) 150% of all unpaid principal and interest starting on the 91st

day following the issue date. In the event of default, the amount

of principal and interest not paid when due bear default interest

at the rate of 24% per annum and the Note becomes immediately due

and payable.

The

Note is a long-term debt obligation that is material to the

Company. The Note also contains certain representations,

warranties, covenants and events of default including if the

Company is delinquent in its periodic report filings with the SEC,

and increases in the amount of the principal and interest rates

under the Notes in the event of such defaults.

The

foregoing description of the terms of the Agreement and the Note,

does not purport to be complete and is qualified in its entirety by

the complete text of the documents attached as, respectively,

Exhibits 10.1 and 4.1 to this Current Report on Form

8-K.

Item 2.03 Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of a

Registrant

The information set forth in Item 1.01 of this Current Report on

Form 8-K is incorporated by reference into this Item

2.03.

Item 3.02 Unregistered Sales of Equity Securities

The information set forth in Item 1.01 of this Current Report on

Form 8-K is incorporated by reference into this Item

3.02.

The

issuance of the securities whose information is set forth in Item

1.01 of this Current Report on Form 8-K were not registered under

the Securities Act of 1933, as amended (the “Securities

Act”), but qualified for exemption under Section 4(a)(2) of

the Securities Act. The securities were exempt from registration

under Section 4(a)(2) of the Securities Act because the issuance of

such securities by the Company did not involve a “public

offering,” as defined in Section 4(a)(2) of the Securities

Act, due to the insubstantial number of persons involved in the

transaction, size of the offering, manner of the offering and

number of securities offered. The Company did not undertake an

offering in which it sold a high number of securities to a high

number of investors. In addition, these investors had the necessary

investment intent as required by Section 4(a)(2) of the Securities

Act since they agreed to, and will receive, share certificates

bearing a legend stating that such securities are restricted

pursuant to Rule 144 of the Securities Act. This restriction

ensures that these securities would not be immediately

redistributed into the market and therefore not be part of a

“public offering.” Based on an analysis of the above

factors, we have met the requirements to qualify for exemption

under Section 4(a)(2) of the Securities Act.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Friendable, Inc.

|

|

|

|

|

|

|

|

Date:

April 14, 2017

|

By:

|

/s/ Robert Rositano

|

|

|

|

Robert

Rositano

|

|

|

|

CEO

|

|

|

|

|

|

|

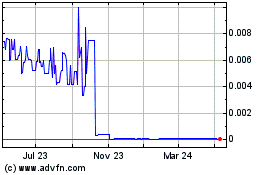

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

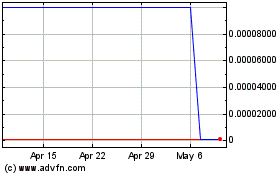

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Apr 2023 to Apr 2024