Current Report Filing (8-k)

March 21 2017 - 4:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 21, 2017

Date of Report (Date of earliest event reported)

ADVANCED MICRO DEVICES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-07882

|

94-1692300

|

|

(State of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

|

One AMD Place

Sunnyvale, California 94085

(Address of principal executive offices) (Zip Code)

|

(408) 749-4000

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

Fifth Amendment to the Amended and Restated Loan and Security Agreement

On March 21, 2017, Advanced Micro Devices, Inc. (the “Company”), and its subsidiaries, AMD International Sales & Service, Ltd. (together with the Company, the “Borrowers”) and ATI Technologies ULC (together with the Borrowers, the “Loan Parties”) entered into a fifth amendment (the “Fifth Amendment”) to the amended and restated loan and security agreement dated April 14, 2015 (the “Amended and Restated Loan and Security Agreement”) with certain financial institutions party to thereto from time to time as lenders (the “Lenders”) and Bank of America, N.A., as agent for the Lenders (the “Agent”).

The Fifth Amendment amends the Amended and Restated Loan Agreement as amended by the first amendment dated as of June 10, 2015, the second amendment dated as of April 29, 2016, the third amendment dated as of June 21, 2016, and the fourth amendment dated as of September 7, 2016.

The Fifth Amendment amends the Amended and Restated Loan and Security Agreement to, among other things:

|

|

|

|

•

|

extending the total senior secured asset based line of credit (the “Secured Revolving Line of Credit”) maturity date from April 14, 2020 to March 21, 2022.

|

|

|

|

|

•

|

reducing the Applicable Margin, which is applicable to both loans and letters of credit issued under the Secured Revolving Line of Credit as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applicable Margin Prior to Fifth Amendment

|

|

Applicable Margin Effective as of the Fifth Amendment

|

|

Level

|

|

Average

Availability for

Last Fiscal Month

|

|

Base Rate

Revolver Loans:

Applicable Margin

|

|

LIBOR

Revolver Loans:

Applicable Margin

|

|

Base Rate

Revolver Loans:

Applicable Margin

|

|

LIBOR

Revolver Loans:

Applicable Margin

|

|

I

|

|

≥

66.66% of the Revolver Commitment

|

|

0.50%

|

|

1.50%

|

|

0.25%

|

|

1.25%

|

|

II

|

|

≥

33.33% of the Revolver Commitment < 66.66%

|

|

0.75%

|

|

1.75%

|

|

0.50%

|

|

1.50%

|

|

III

|

|

< 33.33% of the Revolver Commitment

|

|

1.00%

|

|

2.00%

|

|

0.75%

|

|

1.75%

|

|

|

|

|

•

|

reducing the unused commitment fee applicable to the Secured Revolving Line of Credit from 0.375% to 0.25%.

|

|

|

|

|

•

|

lowering the minimum threshold of Availability required to be maintained by the Obligors in order to avoid cash dominion, from the greater of (ii) 15% of the total commitment amount and (i) $75 million to (a) 10% of the total commitment amount and (b) $50 million

|

|

|

|

|

•

|

improving the borrowing base reporting requirement threshold from $25 million borrowing outstanding on the Secured Revolving Line of Credit to the greater of (i) $75 million and (ii) 20% of the borrowing base, resulting in less frequent borrowing base reporting by the Company.

|

|

|

|

|

•

|

amending maximum dollar limits related to supply chain finance arrangements from amounts that qualify as Qualified Factoring Arrangements under the Amended and Restated Loan and Security Agreement from $220 million in aggregate to $220 million in aggregate during the first and fourth fiscal quarters of the Borrowers and $300 million in aggregate during the second and third fiscal quarters of the Borrowers.

|

|

|

|

|

•

|

reducing the amount of the Secured Revolving Line of Credit that will be available for issuance for letters of credit from $75 million to $45 million.

|

The description of the Fifth Amendment and the Secured Revolving Line of Credit is qualified in its entirety by reference to the entire text of the Fifth Amendment, filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference. Capitalized terms not defined herein shall have the meanings set forth in the Amended and Restated Loan and Security Agreement.

Item 2.03. Creation of a Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information required by this Item 2.03 relating to the Fifth Amendment to the Amended and Restated Loan Agreement is contained in Item 1.01 above and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Fifth Amendment to the Amended and Restated Loan and Security Agreement, dated as of March 21, 2017, by and among Advanced Micro Devices, Inc., a Delaware corporation, AMD International Sales & Service, Ltd., a Delaware corporation, ATI Technologies ULC, an Alberta unlimited liability corporation, the financial institutions party thereto from time to time as lenders and Bank of America, N.A., a national banking association, as agent for the lenders

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: March 21, 2017

|

|

ADVANCED MICRO DEVICES, INC.

|

|

|

By:

|

/s/ Devinder Kumar

|

|

|

Name:

|

Devinder Kumar

|

|

|

Title:

|

Senior Vice President, Chief Financial Officer and Treasurer

|

|

|

|

|

INDEX TO EXHIBITS

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Fifth Amendment to the Amended and Restated Loan and Security Agreement, dated as of March 21, 2017, by and among Advanced Micro Devices, Inc., a Delaware corporation, AMD International Sales & Service, Ltd., a Delaware corporation, ATI Technologies ULC, an Alberta unlimited liability corporation, the financial institutions party thereto from time to time as lenders and Bank of America, N.A., a national banking association, as agent for the lenders

|

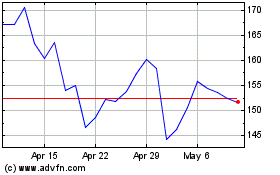

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

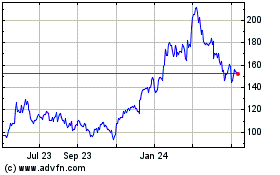

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024