Current Report Filing (8-k)

March 09 2017 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

March 9, 2017 (March 3, 2017)

Avis Budget Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-10308

|

|

06-0918165

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification Number)

|

|

|

|

|

|

|

|

6 Sylvan Way

Parsippany, NJ

|

07054

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

|

|

|

|

|

(973) 496-4700

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

Item 1.01

|

|

Entry into a Material Definitive Agreement.

|

On March 3, 2017, Avis Budget Holdings, LLC and Avis Budget Car Rental, LLC entered into a First Amendment to the Fourth Amended and Restated Credit Agreement, dated as of October 7, 2016, among Avis Budget Holdings, LLC, Avis Budget Car Rental, LLC, Avis Budget Group, Inc., JPMorgan Chase Bank, N.A. as administrative agent, the other lenders from time to time parties thereto, and the subsidiary borrowers from time to time parties thereto. The amendment provides for, among other things, an additional $188 million of term loans issued at closing, a three-year extension of the maturity date of a portion of its existing term loans issued thereunder, a reduction of the term loan interest rate, and removal of the minimum rate applicable to the term loans. Following completion of this transaction, the Company has $1.15 billion of term loans outstanding, all of which matures in March 2022.

The foregoing description of the amendment is a summary and is qualified in its entirety by the terms and provisions of the First Amendment, a copy of which is attached hereto as

Exhibit 10.1

and is incorporated herein by reference.

Certain of the lenders party to the credit agreement, and their respective affiliates, have performed, and may in the future perform, various commercial banking, investment banking and other financial advisory services for Avis Budget Group, Inc., Avis Budget Car Rental, LLC and their subsidiaries for which they have received, and will receive, customary fees and expenses.

|

|

|

|

|

|

|

Item 2.03

|

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information described above under Item 1.01 of this report is incorporated into this Item 2.03 by reference.

|

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

(d) Exhibits.

The following exhibits are filed as part of this report:

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

First Amendment, dated as of March 3, 2017, to the Fourth Amended and Restated Credit Agreement dated as of October 7, 2016, among Avis Budget Holdings, LLC, Avis Budget Car Rental, LLC, Avis Budget Group, Inc., the subsidiary borrowers from time to time parties thereto, JPMorgan Chase Bank, N.A., as administrative agent, and the several lenders from time to time parties thereto.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

|

|

|

|

|

|

|

|

AVIS BUDGET GROUP, INC.

|

|

|

By:

|

/s/ Bryon L. Koepke

|

|

|

|

Name:

|

Bryon L. Koepke

|

|

|

|

Title:

|

Senior Vice President and Chief Securities Counsel

|

|

Date: March 9, 2017

AVIS BUDGET GROUP, INC.

CURRENT REPORT ON FORM 8-K

Report Dated

March 9, 2017 (March 3, 2017)

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

First Amendment, dated as of March 3, 2017, to the Fourth Amended and Restated Credit Agreement dated as of October 7, 2016, among Avis Budget Holdings, LLC, Avis Budget Car Rental, LLC, Avis Budget Group, Inc., the subsidiary borrowers from time to time parties thereto, JPMorgan Chase Bank, N.A., as administrative agent, and the several lenders from time to time parties thereto.

|

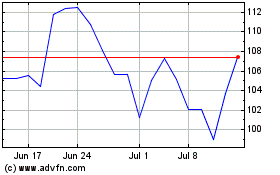

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

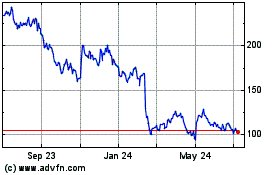

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Apr 2023 to Apr 2024