Current Report Filing (8-k)

March 02 2017 - 10:43AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 24, 2017

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

OHIO

|

1-2299

|

34-0117420

|

|

(State or other jurisdiction of

|

(Commission File

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Number)

|

Identification No.)

|

One Applied Plaza, Cleveland, Ohio 44115

(Address of Principal Executive Officers) (Zip Code)

Registrant's Telephone Number, Including Area Code: (216) 426-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

r

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

r

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

r

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

r

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 5.04 Temporary Suspension of Trading Under Registrant's Employee Benefit Plans.

On February 24, 2017, Applied Industrial Technologies, Inc. (the “Company”) received a notice required by Section 101(i)(2)(E) of the Employee Retirement Income Security Act of 1974, as amended, regarding a blackout period for all investment options, including the company stock fund, under the Applied Industrial Technologies, Inc. Retirement Savings Plan (the “Plan”) beginning March 3, 2017. The Company provided a notice to its directors and executive officers informing them of the blackout period and the trading restrictions that apply to the Company’s directors and executive officers during the blackout period. This notice was required pursuant to Section 306 of the Sarbanes-Oxley Act of 2002 and the Securities and Exchange Commission’s Regulation BTR, which prohibits trading in Company equity securities by directors and executive officers during blackout periods.

The blackout period is required to facilitate the transfer of custody and record keeping responsibilities from Wells Fargo to Principal Financial Group. The blackout period is expected to begin on March 3, 2017 and is expected to end during the week of March 19, 2017. During the blackout period, participants in the Plan will be unable to direct investment transfers and/or take actions with respect to Plan loans, withdrawals or distributions from the portion of the participants’ accounts.

During the blackout period and for a period of two years after the end date thereof, directors and officers may obtain, without charge, information regarding the blackout period, including the actual beginning and end dates of the blackout period, by contacting

Gregory Krupa, Human Resources Manager, of Applied Industrial Technologies, Inc., One Applied Plaza, Cleveland, Ohio 44115 or by phone at (216) 426-4000.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

By:

/s/ Fred D. Bauer

|

|

|

Fred D. Bauer, Vice President-General Counsel & Secretary

|

|

|

|

Date: March 2, 2017

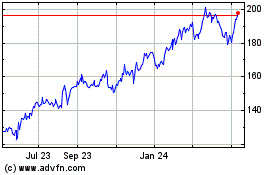

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

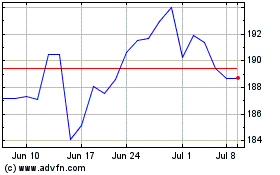

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Apr 2023 to Apr 2024